United Kingdom Plant Protein Market Size, Share, and COVID-19 Impact Analysis, By Protein Type (Hemp Protein, Pea Protein, Potato Protein, Rice Protein, Soy Protein, Wheat Protein, and Others), By End User (Animal Feed, Food & Beverages, Personal Care & Cosmetics, and Supplements), and United Kingdom Plant Protein Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesUnited Kingdom Plant Protein Market Insights Forecasts to 2033

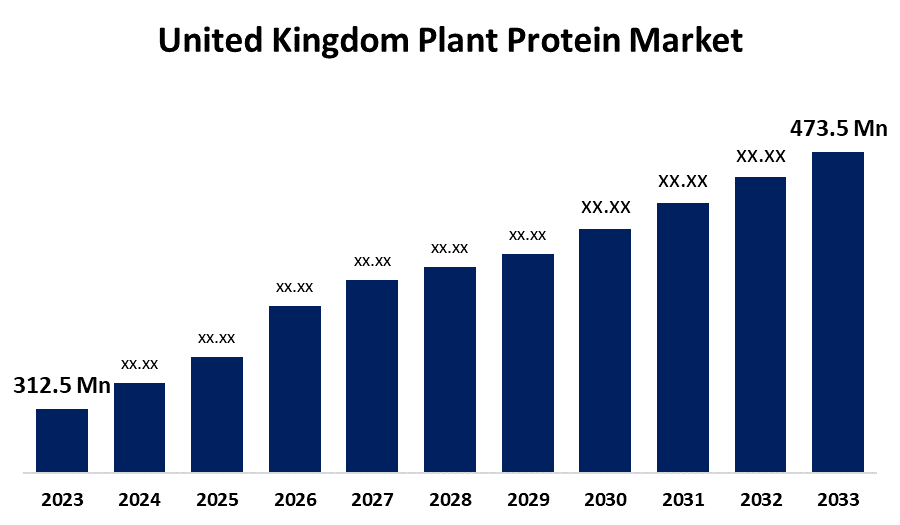

- The U.K. Plant Protein Market Size was valued at USD 312.5 Million in 2023.

- The U.K. Plant Protein Market Size is Growing at a CAGR of 4.24% from 2023 to 2033

- The U.K. Plant Protein Market Size is Expected to reach USD 473.5 Million by 2033

Get more details on this report -

The United Kingdom Plant Protein Market Size is anticipated to Exceed USD 473.5 Million by 2033, Growing at a CAGR of 4.24% from 2023 to 2033. The increased environmental awareness, ethical concerns, and advancement in food technology are driving the growth of the plant protein market in the UK.

Market Overview

The plant protein market refers to the industry for protein derived from plant sources, including soy, wheat, pea, and rice, used in food, beverages, supplements, and other applications, driven by consumer need for plant-based alternatives. Plant proteins are important alternatives for vegetarians that are popularly used among vegans and patients suffering from obesity and cardiovascular diseases. Consumer preference for alternative sources of protein and increasing priority of plant-based over animal-based products are driving the market for plant protein. Furthermore, consumer inclination towards health consciousness, vegan trend adoption, and cases of lactose intolerance drive the plant protein market. The increasing investment in R&D and expansion of production capacity by the key companies contributing to market expansion. In addition, the growing demand for convenient, healthy, and highly nutritious products is offering market growth opportunity for plant protein.

Report Coverage

This research report categorizes the market for the UK plant protein market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom plant protein market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK plant protein market.

United Kingdom Plant Protein Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 312.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.24% |

| 2033 Value Projection: | USD 473.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Protein Type, By End User |

| Companies covered:: | A. Costantino & C. SpA, Archer Daniels Midland Company, Cargill Incorporated, Ingredion Incorporated, International Flavors & Fragrances Inc., Kerry Group PLC, Lantmännen, Roquette Frère, Tereos SCA, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The increased environmental awareness leads to a changing preference for plant-based protein sources owing to lower environmental impact, which is driving the plant protein market. The concerns regarding the nutritional value and health risk of highly processed plant-based products is driving the market demand. Further, the food technology advancement, including innovative techniques such as precision fermentation, 3D printing, and high-pressure processing, is responsible for promoting the market growth.

Restraining Factors

The country’s unfavorable environment and concomitant harvesting issues are restricting plant production, which may ultimately hamper the plant protein market.

Market Segmentation

The United Kingdom plant protein market share is classified into protein type and end user.

- The pea protein segment dominates the UK plant protein market in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom plant protein market is segmented by protein type into hemp protein, pea protein, potato protein, rice protein, soy protein, wheat protein, and others. Among these, the pea protein segment dominates the UK plant protein market in 2023 and is expected to grow at a significant CAGR during the projected period. Pea protein is increasingly used as a meat substitute and dairy alternative to functional foods. The surging need for nutritious and functional food options that are minimally processed, along with rising health concerns, is driving the plant protein market.

- The food & beverages segment dominates the market with the largest revenue share in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom plant protein market is segmented by end user into animal feed, food & beverages, personal care & cosmetics, and supplements. Among these, the food & beverages segment dominates the market with the largest revenue share in 2023 and is expected to grow at a significant CAGR during the projected period. Protein provides food with structure and texture and enables water retention. The increasing need for meat and dairy alternatives with the growing veganism in the country is driving the plant protein market in the food & beverages segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. plant protein market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Costantino & C. SpA

- Archer Daniels Midland Company

- Cargill Incorporated

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Kerry Group PLC

- Lantmännen

- Roquette Frère

- Tereos SCA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2022, Roquette, a global leader in plant-based ingredients and a pioneer of plant proteins, announced the launch of two rice proteins, a bold move that adds a new botanical origin to its current portfolio. With NUTRALYS® rice protein, Roquette offers consumers a familiar, safe and nutritious alternative protein with premium quality and high standards of production.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Plant Protein Market based on the below-mentioned segments:

UK Plant Protein Market, By Protein Type

- Hemp Protein

- Pea Protein

- Potato Protein

- Rice Protein

- Soy Protein

- Wheat Protein

- Others

UK Plant Protein Market, By End User

- Animal Feed

- Food & Beverages

- Personal Care & Cosmetics

- Supplements

Need help to buy this report?