United Kingdom Plastic Bottles Market Size, Share, and COVID-19 Impact Analysis, By Material (Polyethylene Terephthalate (PET), High-Density Polyethylene (HDPE), and Polypropylene (PP)), By Closure Type (Screw Caps, Snap Caps, Sport Caps, and Push-Pull Caps), By Wall Thickness (Thin-Walled Bottles, Medium-Walled Bottles, and Thick-Walled Bottles), By Application (Beverages, Cosmetics & Personal Care, Pharmaceuticals, and Food), and United Kingdom Plastic Bottles Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited Kingdom Plastic Bottles Market Insights Forecasts to 2033

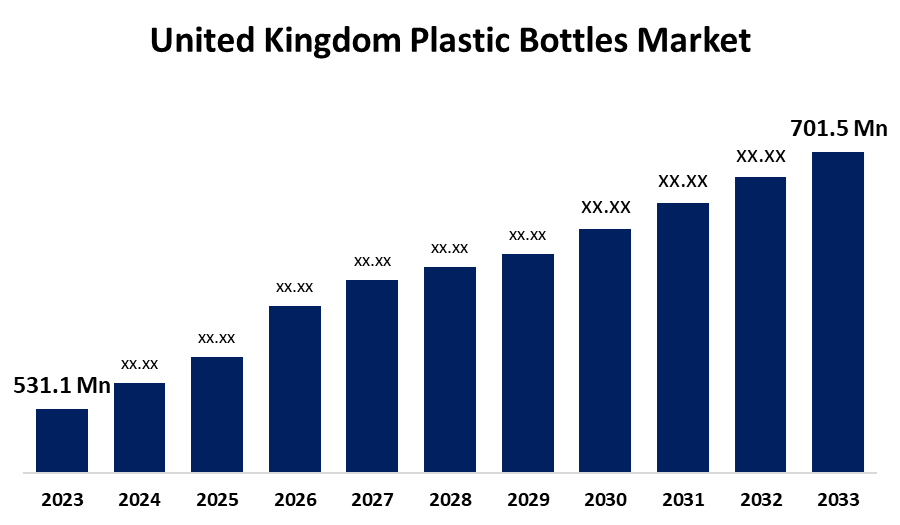

- The U.K. Plastic Bottles Market Size was valued at USD 531.1 Million in 2023.

- The U.K. Plastic Bottles Market is growing at a CAGR of 2.82% from 2023 to 2033

- The U.K. Plastic Bottles Market Size is expected to reach USD 701.5 Million by 2033

Get more details on this report -

The United Kingdom Plastic Bottles Market is anticipated to exceed USD 701.5 Million by 2033, growing at a CAGR of 2.82% from 2023 to 2033. The growing adoption of lightweight packaging methods and demand from the beverage sector are driving the growth of the plastic bottles market in the UK.

Market Overview

Plastic bottles market refers to the manufacturing, distribution, and consumption of plastic bottles, primarily for packaging beverages, food, and other products, with PET (polyethylene terephthalate) bottles dominating the market. Plastic bottles are bottles constructed from high-density or low-density plastic. They are typically used to store liquids such as water, soft drinks, motor oil, cooking oil, medicine, shampoo, or milk. Manufacturers are inclined towards the use of plastic bottles due to cost-effectiveness and minimum loss of raw material during the manufacturing process. Further, plastic bottles are demandable due to the preference for high-quality drinking water by consumers due to concerns over tainted tap water and the inherent convenience of portability. The upsurging innovation of different formats of bottled water is promoting market growth opportunities.

Report Coverage

This research report categorizes the market for the UK plastic bottles market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom plastic bottles market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK plastic bottles market.

United Kingdom Plastic Bottles Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 531.1 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.82% |

| 2033 Value Projection: | USD 701.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Material, By Closure Type and COVID-19 Impact Analysis |

| Companies covered:: | Amcor Group Gmbh, Berry Global Inc., Aptar Group Inc., Coda Plastics Ltd., Berlin Packaging UK, Esterform Packaging Ltd., Cambrian Packaging, Fernhill Packaging Ltd., Robinson plc, Measom Freer & Co Ltd., and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The adoption of plastic bottles as a lightweight packaging method owing to sustainability concerns and advancements in manufacturing, with companies reducing plastic usage while maintaining functionality and durability is fueling the plastic bottle market growth. The beverage sector’s demand for plastic bottles driven by increasing consumer preference for packaged beverages and the convenience of plastic bottles is propelling the market. The popularity of bottled water and its use in pharmaceuticals, cosmetics, and household products is also responsible for bolstering the market growth.

Restraining Factors

The environmental concerns about the use of plastics are challenging the plastic bottle market. Further, the regulatory norms and availability of other alternative packaging options are hindering the market growth.

Market Segmentation

The United Kingdom plastic bottles market share is classified into material, closure type, wall thickness, and application.

- The polyethylene terephthalate (PET) segment dominated the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom plastic bottles market is segmented by material into polyethylene terephthalate (PET), high-density polyethylene (HDPE), and polypropylene (PP). Among these, the polyethylene terephthalate (PET) segment dominated the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period. Polyethylene terephthalate (PET) is commonly used recyclable plastic, especially for beverages such as water and soft drinks. The lightweight, shatter-resistant, and recyclable properties of polyethylene terephthalate drive the market growth.

- The screw caps segment dominates the UK plastic bottles market with the largest share in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom plastic bottles market is segmented by closure type into screw caps, snap caps, sport caps, and push-pull caps. Among these, the screw caps segment dominates the UK plastic bottles market with the largest share in 2023 and is expected to grow at a significant CAGR during the projected period. Screw caps provide high dimensional stability and easy grip outer edge. The versatility and cost-effectiveness of crew caps which make them suitable for various applications is propelling the market growth.

- The thin-walled bottles segment accounted for the largest share of the UK plastic bottles market in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom plastic bottles market is segmented by wall thickness into thin-walled bottles, medium-walled bottles, and thick-walled bottles. Among these, the thin-walled bottles segment accounted for the largest share of the UK plastic bottles market in 2023 and is expected to grow at a significant CAGR during the projected period. Thin-walled bottles involve the use of polyethylene terephthalate (PET), polypropylene (PP), and other lightweight polymers. The extensive use of thin-walled bottles in the beverage sector is propelling the market.

- The beverages segment accounted for the largest share of the UK plastic bottles market in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom plastic bottles market is segmented by application into beverages, cosmetics & personal care, pharmaceuticals, and food. Among these, the beverages segment accounted for the largest share of the UK plastic bottles market in 2023 and is expected to grow at a significant CAGR during the projected period. Plastic bottles are used in the beverage sector for packaged water, juices, flavored water, functional water, carbonated drinks, and others. The rising demand for packaged beverages is driving the market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. plastic bottles market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amcor Group Gmbh

- Berry Global Inc.

- Aptar Group Inc.

- Coda Plastics Ltd.

- Berlin Packaging UK

- Esterform Packaging Ltd.

- Cambrian Packaging

- Fernhill Packaging Ltd.

- Robinson plc

- Measom Freer & Co Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, British cosmetics retailer Lush, in partnership with supplier Spectra Packaging, announced the global rollout of its certified-recycled Prevented Ocean Plastic bottles.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Plastic Bottles Market based on the below-mentioned segments:

UK Plastic Bottles Market, By Material

- Polyethylene Terephthalate (PET)

- High-Density Polyethylene (HDPE)

- Polypropylene (PP)

UK Plastic Bottles Market, By Closure Type

- Screw Caps

- Snap Caps

- Sport Caps

- Push-Pull Caps

UK Plastic Bottles Market, By Wall Thickness

- Thin-Walled Bottles

- Medium-Walled Bottles

- Thick-Walled Bottles

UK Plastic Bottles Market, By Application

- Beverages

- Cosmetics & Personal Care

- Pharmaceuticals

- Food

Need help to buy this report?