United Kingdom Plastic Packaging Market Size, Share, and COVID-19 Impact Analysis, By Material (Polyethylene (PE), Polyethylene Terephthalate (PET), Polypropylene (PP), Polystyrene (PS), Expanded Polystyrene (EPS), Polyvinyl Chloride (PVC), Bio-Based Plastics, and Others), By Product (Rigid and Flexible), By Technology (Injection Molding, Extrusion, Blow Molding, Thermoforming, and Others), By Application (Food & Beverages, Industrial Packaging, Pharmaceuticals, Personal & Household Care, and Others), and United Kingdom Plastic Packaging Market Insights, Industry Trend, Forecasts to 2033

Industry: Advanced MaterialsUnited Kingdom Plastic Packaging Market Insights Forecasts to 2033

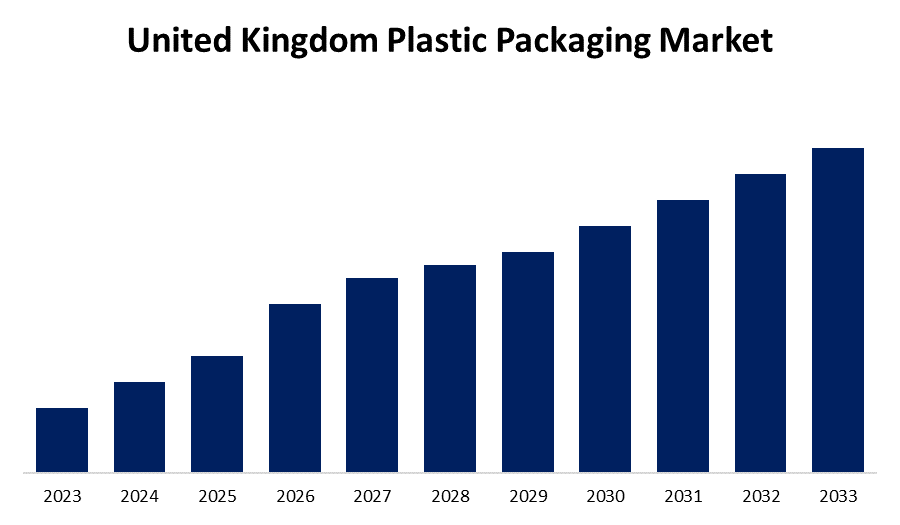

- The Market is growing at a CAGR of 2.50% from 2023 to 2033

- The U.K. Plastic Packaging Market Size is expected to Hold a Significant Share by 2033

Get more details on this report -

The United Kingdom Plastic Packaging Market is anticipated to hold a significant share by 2033, Growing at a CAGR of 2.50% from 2023 to 2033. The growing adoption of lightweight packaging methods and highly eco-friendly packaging & recycled plastics are driving the growth of the plastic packaging market in the UK.

Market Overview

Plastic packaging is a component of the complex supply chain from the point of manufacture to the point of consumption. Its main goal is to protect and guarantee the product’s safe and secure delivery to the final user (either the product's maker or the customer) in a pristine and undamaged state. Its function in a circular economy is to assist in eliminating product waste and maintain a product's value for as long as necessary. Plastic packaging makes up the majority of the packaging industry in the UK. Furthermore, it is anticipated that the UK market for plastic packaging would provide a sizable amount of revenue due to its extensive manufacturing capabilities. In the United Kingdom, plastics are also in demand as a result of the expansion of the flexible packaging sector. As plastic bottles become more widely available in markets where other materials have historically been utilized, their quality keeps becoming better.

Report Coverage

This research report categorizes the market for the UK plastic packaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom plastic packaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK plastic packaging market.

United Kingdom Plastic Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.50% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Material, By Product, By Technology, By Application |

| Companies covered:: | Amcor PLC, Berry Global, Coveris Holding, Constantia Flexibles, Polystar Plastics Ltd, Coda Plastics Limited, Sealed Air Corporation, Charpak Ltd, Sonoco Products Company, Wipak UK Ltd, National Flexible, Clifton Packaging Group Limited, Tyler Packaging Limited (Macfarlane Group PLC), and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

Plastic is a preferred material substitution over glass or metal in major industries like food and beverage, household & personal care, and industrial as it can be used to package in both rigid and flexible, lightweight, and transparent ways. The adoption of lightweight packaging as a result of a growing emphasis on sustainable packaging is expected to drive the market. Manufacturers of plastic packaging products employ a variety of raw materials, such as virgin plastics, recycled plastics, and biobased plastics. Due to their sustainability, biobased and recycled plastics have become much more popular which is driving the market growth.

Restraining Factors

The increased price of raw material (plastic resin) and government regulations & environmental concerns are restraining the UK plastic packaging market.

Market Segmentation

The United Kingdom Plastic Packaging Market share is classified into material, product, technology, and application.

- The polyethylene terephthalate (PET) material segment held the largest market share in 2023.

The United Kingdom plastic packaging market is segmented by material into polyethylene (PE), polyethylene terephthalate (PET), polypropylene (PP), polystyrene (PS), expanded polystyrene (EPS), polyvinyl chloride (PVC), bio-based plastics, and others. Among these, the polyethylene terephthalate (PET) material segment held the largest market share in 2023. PET is widely used to package a wide range of drinks, such as juices, soft drinks, water, vegetable oils, energy drinks, and other food items like dried and fresh fruits, nuts, and snacks. The capacity of polyethylene terephthalate to preserve product freshness and integrity is driving the market demand.

- The rigid segment dominated the UK plastic packaging market with the largest market share during the forecast period.

The United Kingdom plastic packaging market is segmented by product into rigid and flexible. Among these, the rigid segment dominated the UK plastic packaging market with the largest market share in 2023. Pallets, intermediate bulk containers, and other industrial packaging products can be reused, which is expected to encourage the development of rigid plastic products. Rigid packaging's strong barrier against light, moisture, and oxygen is responsible for propelling the market

- The extrusion segment accounted for the largest revenue share of the UK plastic packaging market in 2023.

Based on the technology, the U.K. plastic packaging market is divided into injection molding, extrusion, blow molding, thermoforming, and others. Among these, the extrusion segment accounted for the largest revenue share of the UK plastic packaging market in 2023. The cheaper cost and sustainability of rigid equivalent are drive the market growth. The rapid increase in investment in the manufacturing sector and technological advancements are anticipated to create lucrative market opportunity.

- The food & beverages segment dominates the market with the largest revenue share of the UK plastic packaging market in 2023.

Based on the application, the U.K. plastic packaging market is divided into food & beverages, industrial packaging, pharmaceuticals, personal & household care, and others. Among these, the food & beverages segment dominates the market with the largest revenue share of the UK plastic packaging market in 2023. There is a rising alcohol and non-alcoholic beverage consumption, particularly among youth in the region. The shifting consumer tastes and lifestyles are responsible for driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. plastic packaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amcor PLC

- Berry Global

- Coveris Holding

- Constantia Flexibles

- Polystar Plastics Ltd

- Coda Plastics Limited

- Sealed Air Corporation

- Charpak Ltd

- Sonoco Products Company

- Wipak UK Ltd

- National Flexible

- Clifton Packaging Group Limited

- Tyler Packaging Limited (Macfarlane Group PLC)

- Others

Recent Developments

- In September 2022, Coca Cola Great Britain (CCGB) is extending the rollout of its attached caps to 500ml bottles, as part of a packaging development across its entire portfolio which will help improve recycling rates and prevent waste. The new design enables the cap to stay connected to the bottle after opening, making it easier to recycle the entire package and ensure no cap gets left behind.

- In May 2022, FlexCollect, the UK’s largest collaborative project to support the collection and recycling of flexible plastic packaging, launched with UK Research and Innovation (UKRI) support.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Plastic Packaging Market based on the below-mentioned segments:

UK Plastic Packaging Market, By Material

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polystyrene (PS)

- Expanded Polystyrene (EPS)

- Polyvinyl Chloride (PVC)

- Bio-Based Plastics

- Others

UK Plastic Packaging Market, By Product

- Rigid

- Flexible

UK Plastic Packaging Market, By Technology

- Injection Molding

- Extrusion

- Blow Molding

- Thermoforming

- Others

UK Plastic Packaging Market, By Application

- Food & Beverages

- Industrial Packaging

- Pharmaceuticals

- Personal & Household Care

- Others

Need help to buy this report?