United Kingdom Pouch Packaging Market Size, Share, and COVID-19 Impact Analysis, By Product (Flat and Stand-up), By End-User Industry (Food, Beverage, Medical & Pharmaceutical, Personal Care & Household Care, and Others), and United Kingdom Pouch Packaging Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited Kingdom Pouch Packaging Market Insights Forecasts to 2033

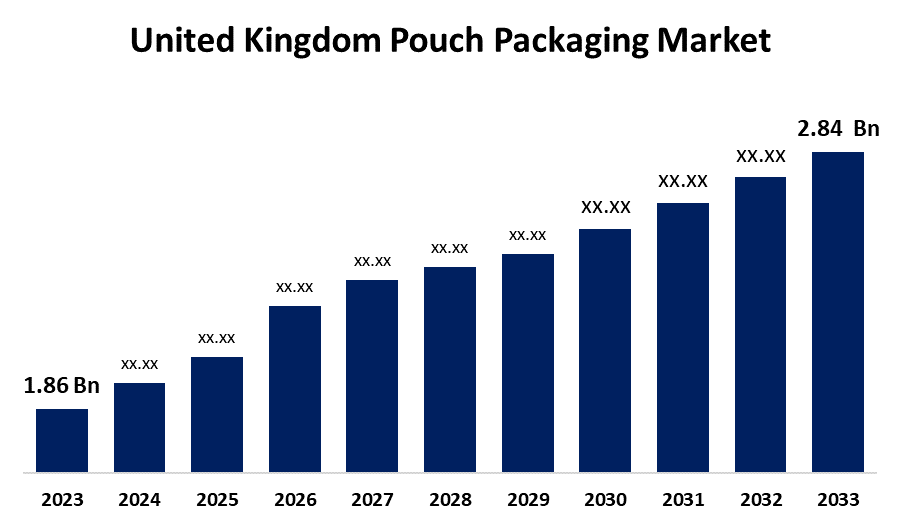

- The U.K. Pouch Packaging Market Size was valued at USD 1.86 Billion in 2023.

- The U.K. Pouch Packaging Market is growing at a CAGR of 4.32% from 2023 to 2033

- The U.K. Pouch Packaging Market Size is expected to reach USD 2.84 Billion by 2033

Get more details on this report -

The United Kingdom Pouch Packaging Market Size is Anticipated to Exceed USD 2.84 Billion by 2033, Growing at a CAGR of 4.32% from 2023 to 2033. The growing demand from food & beverage industry are driving the growth of the UK pouch packaging market.

Market Overview

Pouch packaging market refers to the production, distribution, and consumption of flexible pouches used for packaging various products such as food, beverages, and other goods. Pouch packaging is flexible product packaging made from barrier film or foil with optional spouts and caps. The barrier film material ensures that the products inside do not get exposed to air, moisture, light, and other outside elements. There is a growing need for pouch packaging in diverse sectors including food & beverage, healthcare, and personal care. The rising consumer inclination towards convenient, lightweight, and portable packaging solutions as well as environmental concerns surging the need for sustainable and eco-friendly pouches are also responsible for propelling the pouch packaging market demand. Additionally, technological advancements and the development of innovative pouch designs and materials are creating lucrative market opportunities.

Report Coverage

This research report categorizes the market for the UK pouch packaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom pouch packaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK pouch packaging market.

United Kingdom Pouch Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.86 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.32% |

| 2033 Value Projection: | USD 2.84 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Product, By End-User Industry and COVID-19 Impact Analysis |

| Companies covered:: | Amcor PLC, Mondi PLC, Sonoco Products Company, ProAmpac LLC, Constantia Flexibles GmbH, Surepak Innovative Packaging Solutions, ePac Holdings LLC, CS Flexible Pouches (Asteria Group), Elliot Packaging, and Others key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The increasing use of pouch packaging for food & beverage products owing to their malleability and low weight is driving the pouch packaging market. The innovations in food processing along with the shifting lifestyles are driving preference for pouch packaging, thereby propelling the market demand. In addition, the inclination towards sustainable packaging solutions along with the regulatory pressure leads preference for pouch packaging format by key market players, escalating the market growth.

Restraining Factors

The recycling and environmental concerns associated with pouch packaging are challenging the market growth. The increased cost of raw materials and alternative packaging solutions is restraining the market.

Market Segmentation

The United Kingdom pouch packaging market share is classified into product and end-user industry.

- The stand-up segment dominated the market with a significant market share in 2023 and is expected to grow at the fastest CAGR during the projected period.

The United Kingdom pouch packaging market is segmented by product into flat and stand-up. Among these, the stand-up segment dominated the market with a significant market share in 2023 and is expected to grow at the fastest CAGR during the projected period. Stand up pouch packaging is a flexible packaging category that is primarily used for food, pet food, and nutritional supplements. The widespread use of stand-up pouch packaging in the food & beverage sector owing to their durability and enhanced stability of products is propelling the market.

- The beverage segment dominated the market with a substantial market share in 2023 and is expected to grow at the fastest CAGR during the projected period.

The United Kingdom pouch packaging market is segmented by end-user industry into food, beverage, medical & pharmaceutical, personal care & household care, and others. Among these, the beverage segment dominated the market with a substantial market share in 2023 and is expected to grow at the fastest CAGR during the projected period. Pouch packaging is used for beverages, especially uncarbonated drinks, and for juices, sports, as well as children’s beverages. The use of pouch packaging owing to its malleability and low weight is driving the market in the beverage segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. pouch packaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amcor PLC

- Mondi PLC

- Sonoco Products Company

- ProAmpac LLC

- Constantia Flexibles GmbH

- Surepak Innovative Packaging Solutions

- ePac Holdings LLC

- CS Flexible Pouches (Asteria Group)

- Elliot Packaging

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, Rose Marketing has collaborated with Perfetti Van Melle on the launch of Chupa Chups Slush Pouches, in Cola and Strawberry varieties. The range, which is co-branded with Eezy Freezzy is ambient, meaning shoppers can buy and freeze them as and when needed, and each flavour has a £1.25 RRP.

- In March 2024, Pouch-served drink manufacturer Capri-Sun is launching its first ever fully recyclable pouches for its 200ml single-serve packs of Orange and Blackcurrant & Apple flavors.

- In January 2024, ProAmpac, a leader in flexible packaging and material science, announced the launch of ProActive Intelligence Moisture Protect (MP-1000), a patent-pending breakthrough moisture-adsorbing technology that eliminates the need for desiccant packets.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Pouch Packaging Market based on the below-mentioned segments:

UK Pouch Packaging Market, By Product

- Flat

- Stand-up

UK Pouch Packaging Market, By End-User Industry

- Food

- Beverage

- Medical & Pharmaceutical

- Personal Care & Household Care

- Others

Need help to buy this report?