United Kingdom Poultry Feed Market Size, Share, and COVID-19 Impact Analysis, By Livestock (Layers, Broilers, Turkey, and Others), By Feed Type (Complete Feed, Concentrates, and Premix), and United Kingdom Poultry Feed Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesUnited Kingdom Poultry Feed Market Insights Forecasts to 2033

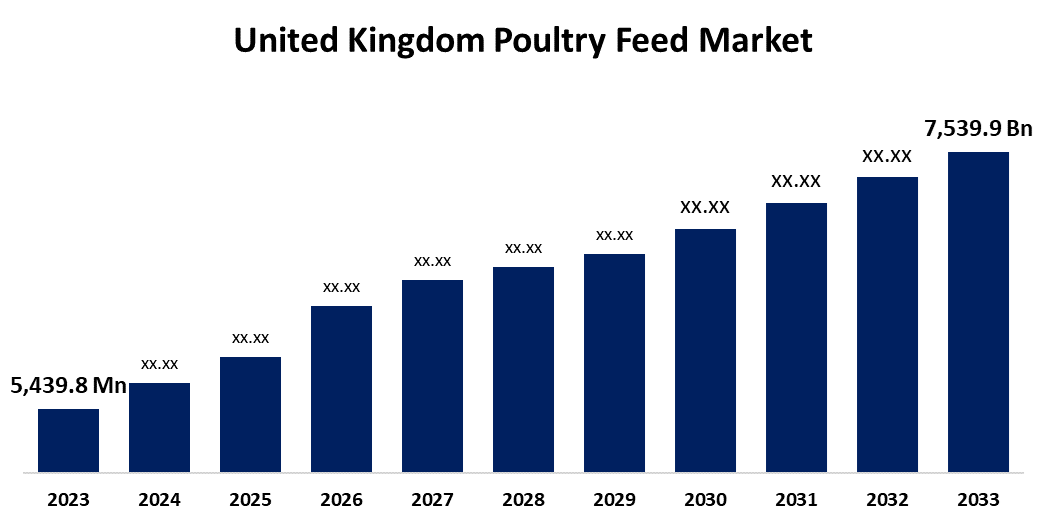

- The U.K. Poultry Feed Market Size was valued at USD 5,439.8 Million in 2023.

- The Market is Growing at a CAGR of 3.32% from 2023 to 2033

- The UK Poultry Feed Market Size is Expected to Reach USD 7,539.9 Million by 2033

Get more details on this report -

The U.K. Poultry Feed Market Size is Anticipated to Reach USD 7,539.9 Million by 2033, growing at a CAGR of 3.32% from 2023 to 2033.

Market Overview

The food created for farm poultry, such as chickens, ducks, geese, and other poultry animals, is known as poultry feed. It includes essential components needed to offer a diet rich in nutrients. The primary purpose of poultry feed is to meet the nutritional needs of agricultural animals. The market is anticipated to increase in the approaching years due to rising product demand brought on by the prevalence of nutritional inadequacies and abnormalities of the digestive tract in poultry animals. The market is growing as a result of the UK's favorable agricultural policies, grants, and subsidies, which promote vast and sophisticated farming. Furthermore, the growing emphasis on sustainable agricultural methods in the UK is supporting the market for organic, non-GMO, and ecologically friendly chicken feeds. Furthermore, the UK poultry feed sector is shifting toward sustainable production in an attempt to reduce carbon emissions and improve animal welfare. The UK government's goal of being net-zero by 2050 is being attained by efforts to improve feed made from local resources and lessen dependency on imported feed.

Report Coverage

This research report categorizes the market for the UK poultry feed market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom poultry feed market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.K. poultry feed market.

United Kingdom Poultry Feed Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5,439.8 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.32% |

| 2033 Value Projection: | USD 7,539.9 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Livestock, By Feed Type and COVID-19 Impact Analysis |

| Companies covered:: | Alltech Inc., ABN, Midland Feeds, ForFarmers, Duffields, BASF SE and otrhers key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The UK poultry feed industry is expected to develop due to a number of factors, including rising animal protein preferences, the expansion of the egg and poultry industries worldwide, population growth, increased health consciousness regarding protein consumption, and the per capita consumption of meat. Due to growing health concerns, which are fueling commercial animal production, meat products are rapidly gaining appeal in the UK. Additionally, the poultry industry (which includes IPUs) has experienced the biggest production gain in UK, rising 3.9%, primarily due to an increase in intensive poultry unit production. This growth in poultry production is propelling the UK poultry feed market due to the rising need for premium feed to sustain the growing number of chickens. Furthermore, in the UK, 60.9 million individuals, or around 95 percent of the population, consume chicken at least two times per week. The UK poultry feed market is driven by this high rate of consumption because production must be supported by a consistent and significant supply of high-quality poultry feed to meet the demand for chicken meat.

Restraining Factors

The high cost and limited supply of raw materials are two of the main factors limiting the UK automotive coolant industry. Ethylene or propylene glycol makes up the majority of coolants, coupled with a number of performance-enhancing additives. The total cost of producing coolants can be greatly impacted by changes in the price of these raw materials, which are influenced by variables including the price of crude oil, supply chain interruptions, and geopolitical unrest.

Market Segmentation

The UK poultry feed market share is classified into livestock and feed type.

- The broilers segment is expected to hold the greatest market share through the forecast period.

The U.K. poultry feed market is segmented by livestock into layers, broilers, turkey, and others. Among these, the broilers segment is expected to hold the greatest market share through the forecast period. The broilers are chickens or other birds that are grown exclusively to produce meat. Their genes enable them to grow faster than native layers and hens. The purpose of broiler feeds is to give them more energy so they can acquire weight.

- The complete feed segment is anticipated to hold a significant share of the United Kingdom poultry feed market during the forecast period.

Based on the feed type, the UK poultry feed market is divided into complete feed, concentrates, and premix. Among these, the complete feed segment is anticipated to hold a significant share of the United Kingdom poultry feed market during the forecast period. The main factor driving the dominance of the complete feed segment is the low cost and beneficial effects of providing poultry birds with complete nutrition through the usage of complete feed.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. poultry feed market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Alltech Inc.

- ABN

- Midland Feeds

- ForFarmers

- Duffields

- BASF SE

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2022, 2Agriculture and ForFarmers United Kingdom (ForFarmers UK) decided to combine their companies into a joint venture in order to reach a larger clientele. The joint venture's feed portfolio was balanced across species, and it was anticipated that the combined sales volume would exceed 3 million tons of compound feed annually.

Market Segment

This study forecasts revenue at the UK, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Poultry Feed Market based on the below-mentioned segments:

United Kingdom Poultry Feed Market, By Livestock

- Layers

- Broilers

- Turkey

- Others

United Kingdom Poultry Feed Market, By Feed Type

- Complete Feed

- Concentrates

- Premix

Need help to buy this report?