United Kingdom Power Market Size, Share, and COVID-19 Impact Analysis, By Source (Non-Renewable and Renewable), By End-Use (Industrial, Commercial, and Residential), and UK Power Market Insights, Industry Trend, Forecasts to 2033

Industry: Energy & PowerUnited Kingdom Power Market Insights Forecasts to 2033

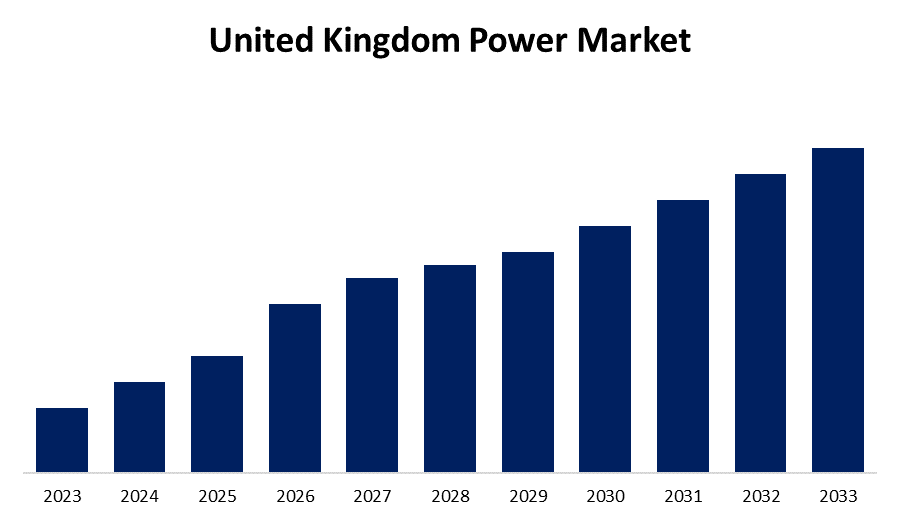

- The Market is growing at a CAGR of 8.13% from 2023 to 2033

- The U.K. Power Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The United Kingdom Power Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 8.13% from 2023 to 2033.

Market Overview

The power market covers a wide range of energy types such as fossil fuels, renewable sources, and nuclear power. The energy industry is vital to the worldwide economy since energy is necessary for transportation, manufacturing, heating, and power production. The market is extremely intricate and always changing, impacted by government policies, technological progress, and environmental issues that influence supply and demand. The majority of the electricity used in the UK is produced within the country. In the year 2023, solar power and wind power accounted for 41% of electricity generation, fossil fuels accounted for 36%, and nuclear energy accounted for 14%. Electricity is conveyed from power plants through transmission grids. Electricity substations transfer high-voltage electricity from transmission networks into lower-voltage electricity on distribution networks to supply households. In the UK, the majority of electricity has historically been produced through the combustion of fossil fuels like coal and gas. However, there is a growing shift towards utilizing renewable energy sources like wind and solar, along with nuclear power and imported electricity from other nations. The National Grid oversees the electricity and gas supplies in Great Britain. It runs the networks that transport energy nationwide, overseeing supply and demand to ensure users receive a secure and dependable energy supply.

Report Coverage

This research report categorizes the market for the U.K. power market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the UK power market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK power market.

United Kingdom Power Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.13% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Source, By End-Use |

| Companies covered:: | Electricite de France SA, Ecotricity Group Ltd, Engie SA, Vestas Wind Systems AS, Siemens Gamesa Renewable Energy SA, Uniper SE, Lightsource bp Renewable Energy Investments Limited, Good Energy Group PLC, E. ON UK PLC, Renewable Energy Systems Ltd, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

Renewable power generation in the United Kingdom is mainly propelled by wind, solar, and bioenergy sources, making up approximately 42% of the overall electricity generation mix, up from 36% in 2019.In 2020, there was a 15.1 TWh increase in non-hydro renewable power generation, showing a 13% year-on-year growth. Wind energy, including 2.9 TWh of onshore wind and 8.7 TWh of offshore wind, made up roughly 11.6 TWh out of a total of 15.1 TWh. The Digest of United Kingdom Energy Statistics 2021 stated that the total installed capacity of non-hydro renewable power grew to 45.9 GW in 2020, up from 45.0 GW in 2019. More substantial growth is anticipated in the forecast period. In addition, the United Kingdom has the goal of producing all electricity from renewable sources by 2035. Increasing investments and upcoming non-hydro renewable energy projects are anticipated to help achieve the goal.

Restraining Factors

The UK power market growth is likely to be hampered by high initial investment costs, lengthy investment return periods on projects, and limited natural resources in the forecast period.

Market Segmentation

The United Kingdom's power market share is classified into source and end-use.

- The non-renewable segment is expected to hold the largest market share through the forecast period.

The U.K. power market is segmented by source into non-renewable and renewable. Among these, the non-renewable segment is expected to hold the largest market share through the forecast period. The fast industrialization and urbanization rely greatly on non-renewable energy sources because they are easily accessible and there is not enough investment in renewable infrastructure.

- The industrial segment dominates the market with the largest market share over the predicted period.

The UK power market is segmented by end-use into industrial, commercial, and residential. Among these, the industrial segment dominates the market with the largest market share over the predicted period. Industrial activities naturally consume a significant amount of energy, needing a constant and substantial power supply for their manufacturing, processing, and production processes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom power market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Electricite de France SA

- Ecotricity Group Ltd

- Engie SA

- Vestas Wind Systems AS

- Siemens Gamesa Renewable Energy SA

- Uniper SE

- Lightsource bp Renewable Energy Investments Limited

- Good Energy Group PLC

- E. ON UK PLC

- Renewable Energy Systems Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-added resellers (VARs)

Recent Developments

- In January 2022, The UK government revealed funding of GBP 100 million (USD 134 million) to assist the Sizewell C nuclear power project in Suffolk. The funds will support ongoing project development and seek additional funding from private investors while obtaining necessary approvals.

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Power Market based on the below-mentioned segments:

United Kingdom Power Market, By Source

- Non-Renewable

- Renewable

United Kingdom Power Market, By End-Use

- Industrial

- Commercial

- Residential

Need help to buy this report?