United Kingdom Prepaid Cards Market Size, Share, and COVID-19 Impact Analysis, By Card Type (Open Closed Loop Prepaid Card and Open Loop Prepaid Card), By End User (Retail Establishments, Corporate, and Government/Public Sector), and by United Kingdom Prepaid Cards Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialUnited Kingdom Prepaid Cards Market Insights Forecasts to 2033

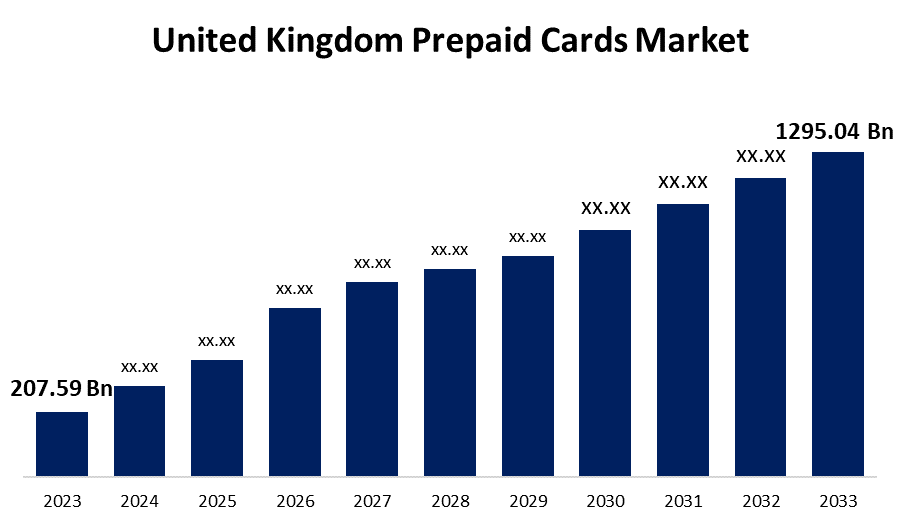

- The United Kingdom Prepaid Cards Market Size was valued at USD 207.59 Billion in 2023.

- The Market is growing at a CAGR of 20.09% from 2023 to 2033

- The United Kingdom Prepaid Cards Market Size is expected to reach USD 1295.04 Billion by 2033

Get more details on this report -

The United Kingdom Prepaid Cards Market is anticipated to exceed USD 1295.04 Billion by 2033, growing at a CAGR of 20.09% from 2023 to 2033.

Market Overview

Prepaid cards serve as a financial instrument that facilitates efficient money management for their customers. Usually, banks, payment service providers, or other financial organizations issue them. Prepaid cards are a popular option for people who wish to manage their spending or for people who might not have access to standard banking services because of this characteristic. The rise in demand for fast and secure payment solutions has resulted in significant growth in the UK prepaid card industry over the last few years. Prepaid cards are a type of payment card that allows customers to deposit money onto the card in advance. They are also known as cards that store value. These cards are commonly used for a variety of purposes including everyday purchases, trips, gift-giving, and financial planning. They offer a powerful alternative to conventional banking services. Convenience, security, and the growing acceptance of digital payment options have all contributed to the UK prepaid card market's strong recent development. There is fierce rivalry in the industry from a variety of participants, such as fintech firms, payment service providers, and well-established financial institutions. Prepaid card sales in the UK are anticipated to climb in the upcoming years due to the growing desire for alternative payment methods.

Report Coverage

This research report categorizes the market for the United Kingdom prepaid cards market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom prepaid cards market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom prepaid cards market.

United Kingdom Prepaid Cards Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 207.59 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 20.09% |

| 2033 Value Projection: | USD 1295.04 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Card Type, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Cashplus Bank, Caxton FX Ltd., Soldo, Cash Plus, Caxton, Centtrip, Revolut, Spree Cards and others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Users of prepaid cards have the freedom to handle their money without depending on regular banking services. They offer simple money loading and reloading, making financial access convenient. The continued transition to electronic payment methods has made conditions for prepaid cards more advantageous. Customers are adopting these cards at a rate that encourages them because of how convenient and secure they are. Since prepaid cards give people without bank accounts access to payment options, they are essential in advancing financial inclusion. They make it easier to participate in the digital economy and provide a competitive substitute for cash transactions. Prepaid cards play a crucial role in giving the underbanked and unbanked access to finance. Because they don't need a conventional bank account, a wider range of people can use them.

Restraining Factors

Regulations about consumer protection and anti-money laundering are among the many that regulate the prepaid card sector. For market participants, adhering to these restrictions might present difficulties. Concerns about the dependability and security of prepaid cards might exist among certain customers.

Market Segmentation

The United Kingdom prepaid cards market share is classified into card type and end user.

- The closed-loop prepaid card segment is expected to hold the largest market share through the forecast period.

The United Kingdom prepaid cards market is segmented by card type into open closed-loop prepaid cards and open-loop prepaid cards. Among these, the closed-loop prepaid card segment is expected to hold the largest market share through the forecast period. The reason for this was ascribed to their affiliation with particular establishments or companies, offering exclusive discounts, promos, and benefits for brand loyalty that draw clients seeking exceptional and customized experiences.

- The corporate segment dominates the market with the largest market share over the predicted period.

The United Kingdom prepaid cards market is segmented by end-users into retail establishments, corporate, and government/public sector. Among these, the corporate segment dominates the market with the largest market share over the predicted period. Corporate prepaid cards let businesses pay employees on time, control spending when traveling, and safely and economically complete procurement transactions. They also simplify financial operations, cut down on administrative costs, and improve financial control for employers. Within the competitive landscape of the UK corporate prepaid card market, these cards offer corporate clients customizable spending limits, expense tracking capabilities, and real-time reporting features that optimize corporate spending, improve cash flow management, and enhance operational efficiencies. Corporate prepaid cards give corporate clients a safe, scalable payment option that supports operational excellence, corporate sustainability goals, and strategic business objectives in the rapidly changing digital economy. They also assist in compliance with financial reporting standards, regulatory requirements, and corporate governance policies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom prepaid cards market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cashplus Bank

- Caxton FX Ltd.

- Soldo

- Cash Plus

- Caxton

- Centtrip

- Revolut

- Spree Cards

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-added resellers (VARs)

Recent Developments

- In July 2021, A firm called Soldo has raised USD 180 million in funding. Soldo provides prepaid business cards to its employees that are connected to an automatic spending management system. Currently, Soldo serves 26,000 clients across 30 countries, including small and medium-sized enterprises, midmarket corporations, and massive multinational corporations.

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Prepaid Cards Market based on the below-mentioned segments:

United Kingdom Prepaid Cards Market, By Card Type

- Open Closed Loop Prepaid Card

- Open Loop Prepaid Card

United Kingdom Prepaid Cards Market, By End User

- Retail Establishments

- Corporate

- Government/Public Sector

Need help to buy this report?