United Kingdom Probiotics Market Size, Share, and COVID-19 Impact Analysis, By Types (Functional Food & Beverages, Dietary Supplements, and Animal Feed), By Distribution Channel (Supermarkets/Hypermarkets, Health Stores/Pharmacies, Online Retail Stores, and Others), and United Kingdom Probiotics Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited Kingdom Probiotics Market Insights Forecasts to 2033

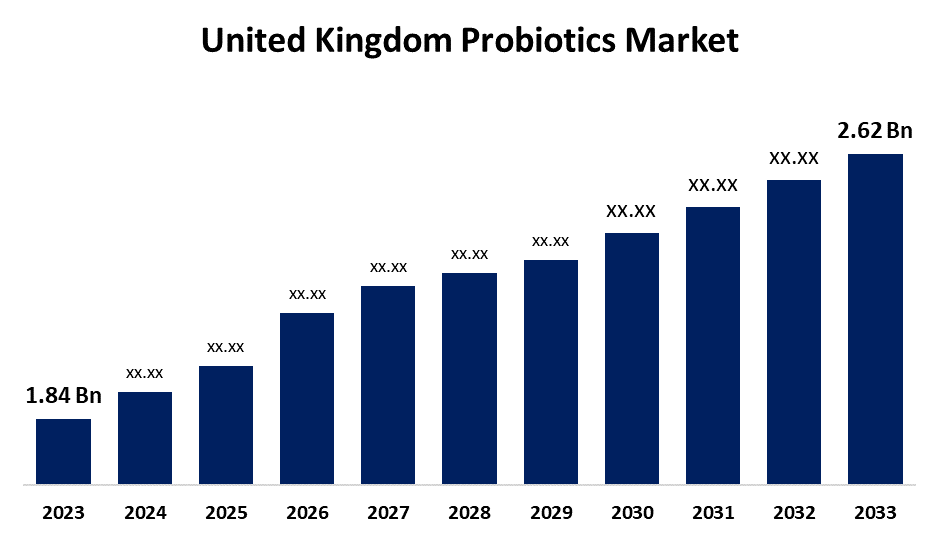

- The U.K. Probiotics Market Size was valued at USD 1.84 Billion in 2023.

- The Market Size is growing at a CAGR of 3.6% from 2023 to 2033

- The U.K. Probiotics Market Size is expected to reach USD 2.62 Billion by 2033

Get more details on this report -

The United Kingdom Probiotics Market is anticipated to exceed USD 2.62 Billion by 2033, growing at a CAGR of 3.6% from 2023 to 2033. The growing importance of gut health and awareness about the benefits of probiotics are driving the growth of the probiotics market in the UK.

Market Overview

Probiotics are live bacteria, naturally occurring yeasts, and helpful bacteria, meant to be taken for their potential health advantages. These microbes are added to food and drink to improve the nutritional value of the finished product. It is generally advised to select probiotic supplements that contain bacteria like lactobacillus, bifidobacterium, or Saccharomyces boulardii that have at least 1 billion colony-forming units. Probiotic-containing functional meals and drinks are known to improve gut health and offer additional advantages including boosted immunity. Furthermore, physicians in the area are recommending these digestive supplements to patients who have heartburn or indigestion. As concerns about probiotic bacteria' effectiveness and preventative healthcare grow, the market in the UK is growing. The increased usage of functional foods, which offer vital nutrition as well as the ability to enhance health, has increased the demand for probiotics. Leading companies in the industry are concentrating on new and improved products. For instance, Diorabyota, a probiotic digestion supplement, was introduced by BioGaia in the United Kingdom.

Report Coverage

This research report categorizes the market for the UK probiotics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom probiotics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK probiotics market.

United Kingdom Probiotics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.84 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.6% |

| 2033 Value Projection: | USD 2.62 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 175 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Types By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Nestle SA, Yakult Honsha, Pepsico Inc., Groupe Danone, Lifeway Foods, BioGaia, Now Foods, Optibac Probiotics, Bio & Me, Protexin Probiotics, Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The significance of gut health and its relationship to mental well-being, weight loss, and healthy skin is driving the probiotic product market's expansion in the UK. Probiotics are becoming more and more well-liked across the nation as treating the underlying cause of illness is ultimately more effective than band-aid solutions. The prevention and treatment of conditions including inflammatory bowel disease and lactose intolerance are the factors propelling the probiotics market's expansion. Further, the growing health consciousness and easier availability of probiotics are anticipated to support market expansion.

Restraining Factors

Probiotic-related complex restrictions may impede market expansion. The risk of developing infections by probiotics may impede the expansion of the market.

Market Segmentation

The United Kingdom Probiotics Market share is classified into types and distribution channel.

- The functional food & beverages segment dominates the market with the largest market share during the forecast period.

The United Kingdom probiotics market is segmented by types into functional food & beverages, dietary supplements, and animal feed. Among these, the functional food & beverages segment dominates the market with the largest market share during the forecast period. The healthiest foods are those that are functional and are classified according to certain qualities that either prevent or promote disease. The rising trend of health and wellness as well as consumer inclination towards probiotic application in functional food and beverage products are driving the market.

- The health stores/pharmacies segment is expected to hold the largest market share during the forecast period.

Based on the distribution channel, the U.K. probiotics market is divided into supermarkets/hypermarkets, health stores/pharmacies, online retail stores, and others. Among these, the health stores/pharmacies segment is expected to hold the largest market share during the forecast period. There is an increasing inclination towards healthy products among customers with the expanding probiotics supplements industry. The rising need for non-diary probiotics food products owing to the prevalence of diabetes and obesity rate is bolstering the market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. probiotics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nestle SA

- Yakult Honsha

- Pepsico Inc.

- Groupe Danone

- Lifeway Foods

- BioGaia

- Now Foods

- Optibac Probiotics

- Bio & Me

- Protexin Probiotics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2022, Cymbiotika launched a UK e-commerce store for its probiotic supplements.

- In February 2022, Optibac Probiotics announced the introduction of its first vegan gummy to support gut and immune health among adults.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Probiotics Market based on the below-mentioned segments:

UK Probiotics Market, By Types

- Functional Food & Beverages

- Dietary Supplements

- Animal Feed

UK Probiotics Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Health Stores/Pharmacies

- Online Retail Stores

- Others

Need help to buy this report?