United Kingdom Professional Cleaning Products Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Hand Sanitizers, Hand Wash/Soaps, Surface Spray (Aerosols), Wipes, Liquid Chemicals & Detergents, Air Freshener, Furniture Polish, Glass & Window Cleaners (Spray & Wipe Solution), Laundry Detergents, Floor Cleaners, and Others), By Packaging (Commercial Retail Packaging and Industrial Packaging), By Application (Personal Hygiene, Instruments/ Equipment Sanitization, and Other Surface Disinfection), By End User (Enterprises (Offices), Facility Management Services, Hospitality, Stadium/Arena, Retail (Commercial Facilities), Travel & Transportation, Educational Institutes, and Others), By Distribution Channel (Retail Stores, Online Stores, Pharma/ Medical, and Wholesale Stores), and United Kingdom Professional Cleaning Products Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited Kingdom Professional Cleaning Products Market Insights Forecasts to 2033

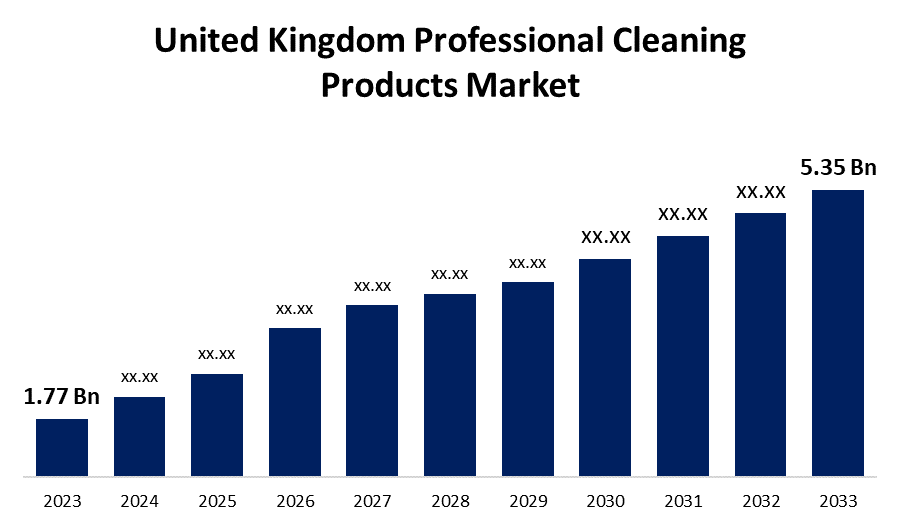

- The U.K. Professional Cleaning Products Market Size was valued at USD 1.77 Billion in 2023.

- The Market Size is Growing at a CAGR of 11.7% from 2023 to 2033

- The U.K. Professional Cleaning Products Market Size is expected to reach USD 5.35 Billion by 2033

Get more details on this report -

The United Kingdom Professional Cleaning Products Market is anticipated to exceed USD 5.35 Billion by 2033, growing at a CAGR of 11.7% from 2023 to 2033. The growing domestic cleaning and increased standards of cleanliness, health, and hygiene are driving the growth of the professional cleaning products market in the UK.

Market Overview

Professional cleaning products, including sanitization and disinfectants, use chemicals, detergents, and soaps to kill bacteria and remove dirt and organic matter from surfaces. In a number of sectors, including retail, food and beverage, healthcare, and hospitality, sanitation and disinfection are essential. Since all of these sectors deal directly with clients or customers, they have high expectations for hygiene, health, and cleanliness. The market for professional cleaning supplies is being greatly impacted by technological developments; the use of smart cleaning technologies and automated cleaning solutions is increasing by 8% a year. The market for intelligent cleaning appliances, such as self-cleaning vacuums, is anticipated to expand, and the incorporation of IoT technology into cleaning supplies is anticipated to improve productivity and consumer satisfaction. With the introduction of recycling programs by forty percent of manufacturers and this technical transition, the UK cleaning products industry is well-positioned for ongoing healthy growth and transformation in the years to come. Furthermore, the trend towards sustainability and environmental consciousness in the cleaning products and adoption of green cleaning products as part of their corporate social responsibility (CSR) initiatives are anticipated to leverage market growth.

Report Coverage

This research report categorizes the market for the UK professional cleaning products market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom professional cleaning products market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK professional cleaning products market.

United Kingdom Professional Cleaning Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1.77 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 11.7% |

| 023 – 2033 Value Projection: | USD 5.35 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Packaging, By Application, By End User, By Distribution Channel |

| Companies covered:: | Cleenol, Talbot Chemicals Ltd, SECHELLE MANUFACTURING LIMITED, Zamo Household Products Ltd, MULTEX CHEMICALS LIMITED, Amity Ltd, Andway Healthcare Ltd, Marken Chemicals, 3M Group, CANTEL Medical Corporation, Unilever, Citron Hygiene, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

Sanitation and disinfection are essential in a number of sectors, including retail, food and beverage, healthcare, and hospitality, as these sectors have a direct interaction with their clients or customers. Thus, the increased demand for health, hygiene, and cleanliness is driving up the market. Further, the changing consumer preferences, busy lifestyle, and time constraints are propelling the market demand for professional cleaning products. In addition, the rising demand for eco-friendly and sustainable cleaning products is driving the UK professional cleaning products market.

Restraining Factors

The increasing requirement of a trained and efficient workforce for handling modern cleaning equipment is challenging the market. Recruitment difficulties in the market for professional cleaning products are also a result of technological improvements and the requirement for specialised expertise.

Market Segmentation

The United Kingdom Professional Cleaning Products Market share is classified into product type, packaging, application, end user, and distribution channel.

- The hand wash/soaps segment held the largest revenue share of the UK professional cleaning products market in 2023.

The United Kingdom professional cleaning products market is segmented by product type into hand sanitizers, hand wash/soaps, surface spray (aerosols), wipes, liquid chemicals & detergents, air freshener, furniture polish, glass & window cleaners (spray & wipe solution), laundry detergents, floor cleaners, and others. Among these, the hand wash/soaps segment held the largest revenue share of the UK professional cleaning products market in 2023. Hand wash/soaps are popularly used as personal care items that remove grease, bacteria and other contaminants from the skin. The accessibility and increased application of hand wash/soaps is driving the market growth.

- The commercial retail packaging segment is expected to witness the fastest CAGR growth during the forecast period.

Based on the packaging, the U.K. professional cleaning products market is divided into commercial retail packaging and industrial packaging. Among these, the commercial retail packaging segment is expected to witness the fastest CAGR growth during the forecast period. Greater cost-per-unit ratios are possible with larger packaging, which is especially important for the many small cleaning businesses in the UK that make up nine out of ten cleaning organisations and are primarily independently owned. The increasing demand of professional cleaning products for commercial purposes are driving the market growth.

- The personal hygiene segment is dominating the market with the largest market share in 2023.

Based on the application, the U.K. professional cleaning products market is divided into personal hygiene, instruments/equipment sanitization, and other surface disinfection. Among these, the personal hygiene segment is dominating the market with the largest market share in 2023. Comparing sales of hand sanitizer and disinfectants to pre-pandemic levels, there has been a 50% increase and a 35% increase, respectively. The increasing demand from households drives the market demand in the personal hygiene segment.

- The hospitality segment is anticipated to grow at the rapid pace in the UK professional cleaning products market during the forecast period.

Based on the end user, the U.K. professional cleaning products market is divided into enterprises (offices), facility management services, hospitality, stadium/arena, retail (commercial facilities), travel & transportation, educational institutes, and others. Among these, the hospitality segment is anticipated to grow at the rapid pace in the UK professional cleaning products market during the forecast period. Cleaning is an essential component of the hospitality industry, comprising a rigorous, detailed process of cleaning and sanitizing the various areas, from guest rooms and restrooms to dining areas and public spaces. The growing awareness about maintaining hygiene in the hospitality sector drives the market demand.

- The retail stores segment accounted for the largest market share in 2023.

Based on the distribution channel, the U.K. professional cleaning products market is divided into retail stores, online stores, pharma/medical, and wholesale stores. Among these, the retail stores segment accounted for the largest market share in 2023. The range of cleaning products is available as per the customer’s need under a single roof. The accessibility of professional cleaning products in retail outlets drives the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. professional cleaning products market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cleenol

- Talbot Chemicals Ltd

- SECHELLE MANUFACTURING LIMITED

- Zamo Household Products Ltd

- MULTEX CHEMICALS LIMITED

- Amity Ltd

- Andway Healthcare Ltd

- Marken Chemicals

- 3M Group

- CANTEL Medical Corporation

- Unilever

- Citron Hygiene

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Professional Cleaning Products Market based on the below-mentioned segments:

UK Professional Cleaning Products Market, By Product Type

- Hand Sanitizers

- Hand Wash/Soaps

- Surface Spray (Aerosols)

- Wipes

- Liquid Chemicals & Detergents

- Air Freshener

- Furniture Polish

- Glass & Window Cleaners (Spray & Wipe Solution)

- Laundry Detergents

- Floor Cleaners

- Others

UK Professional Cleaning Products Market, By Packaging

- Commercial Retail Packaging

- Industrial Packaging

UK Professional Cleaning Products Market, By Application

- Personal Hygiene

- Instruments/ Equipment Sanitization

- Other Surface Disinfection

UK Professional Cleaning Products Market, By End User

- Enterprises (Offices)

- Facility Management Services

- Hospitality

- Stadium/Arena

- Retail (Commercial Facilities)

- Travel & Transportation

- Educational Institutes

- Others

UK Professional Cleaning Products Market, By Distribution Channel

- Retail Stores

- Online Stores

- Pharma/ Medical

- Wholesale Stores

Need help to buy this report?