United Kingdom Refractory Material Market Size, Share, and COVID-19 Impact Analysis, By Chemical Composition (Alumina, Silica, Magnesia, Fireclay, and Others), By Form (Shaped and Unshaped), and United Kingdom Refractory Material Market Insights, Industry Trend, Forecasts to 2033.

Industry: Advanced MaterialsUnited Kingdom Refractory Material Market Insights Forecasts to 2033

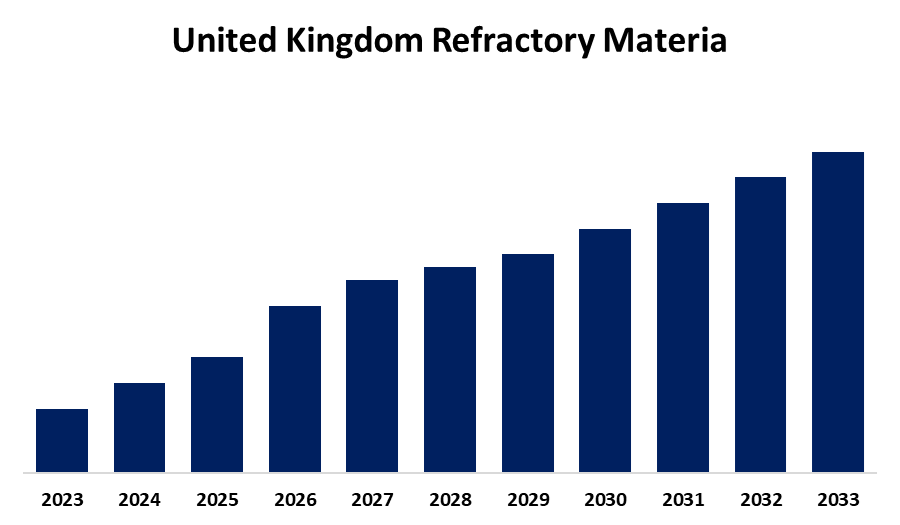

- The Market is Growing at a CAGR of 4.2% from 2023 to 2033

- The UK Refractory Material Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The U.K. Refractory Material Market Size is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 4.2% from 2023 to 2033.

Market Overview

Specialized heat-resistant materials called refractory materials are made to endure tremendous heat and harsh environments without experiencing major physical or chemical changes. These materials are essential for many high-temperature manufacturing operations, including those in reactors, ovens, heaters, and other applications that require high temperatures. These constructions' walls, floors, and other surfaces are lined and protected with refractory materials, which offer durability and insulation. Additionally, buyers have been drawn to employing glass-based components for a variety of purposes due to factors like transparency, recycling capacity, and the inexpensive cost of raw materials. This has boosted the rate of manufacture of glass, where refractory materials are widely used for thermal stability purposes. This could increase the market size for refractory materials in the foreseeable future. Additionally, the market for refractories is possibly driven by an increase in construction activities in the UK. Construction, manufacturing, and energy production are just a few of the many uses for refractories, which are materials that can tolerate high temperatures. Refractories are frequently employed in the building of high-temperature boilers, kilns, and furnaces in the UK construction industry. In the UK, the need for refractories rises in tandem with the need for infrastructure and building materials.

Report Coverage

This research report categorizes the market for the UK refractory material market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom refractory material market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.K. refractory material market.

United Kingdom Refractory Material Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.2% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Chemical Composition, By Form |

| Companies covered:: | RHI Magnesita, Saint-Gobain, Morgan Advanced Materials, Calderys, Vitcas, IFGL Refractories Ltd., Lanexis Enterprises, And Other Key Vendors. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

In 2022, the United Kingdom imported $308M in Ceramic Bricks, becoming the 1st largest importer of Ceramic Bricks in the world. In the same year, Ceramic Bricks was the 352nd most imported product in the United Kingdom1. This surge in imports is driving the growth of the UK's refractory materials market, as the demand for high-quality materials in construction and industrial applications increases. Additionally, the UK's refractory materials industry is expanding due to rising investments in the iron and steel sectors. Rapid infrastructure development and growing demand from the automotive sector, which heavily uses refractory materials for thermal insulation, have increased demand for these materials in the UK. Furthermore, refractory materials in the UK are two to three percent more expensive than steel. The oil and gas, automotive, and increasing infrastructure sectors are driving the growth of the steel industry in the United Kingdom. The success of refractory firms in the UK is greatly influenced by the steel industry, even though the cement, glass, and non-ferrous sectors also have opportunities.

Restraining Factors

Humans are at risk from refractory materials including ceramic fibers, silica, and alumina when their concentrations are exceeded. For example, extended exposure to refractory materials based on ceramic fibers may irritate the skin and upper respiratory tract. Furthermore, inhaling tiny (crystalline) silica particles can result in silicosis and other health risks, as well as mortality.

Market Segmentation

The UK refractory material market share is classified into chemical composition and form.

- The fireclay segment is expected to hold the greatest market share through the forecast period.

The U.K. refractory material market is segmented by chemical composition into alumina, silica, magnesia, fireclay, and others. Among these, the fireclay segment is expected to hold the greatest market share through the forecast period. This highly versatile and cost-effective refractory material, which accounts for over 76% of all refractory material production, is used in cement, iron and steel manufacturing, and other high-temperature operations in other sectors.

- The shaped segment is anticipated to hold a significant share of the United Kingdom refractory material market during the forecast period.

Based on the form, the UK refractory material market is divided into shaped and unshaped. Among these, the shaped segment is anticipated to hold a significant share of the United Kingdom refractory material market during the forecast period. Uses for shaped refractory material include those requiring highly efficient thermal insulation and catalyst support capabilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. refractory material market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- RHI Magnesita

- Saint-Gobain

- Morgan Advanced Materials

- Calderys

- Vitcas

- IFGL Refractories Ltd.

- Lanexis Enterprises

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the UK, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Refractory Material Market based on the below-mentioned segments:

United Kingdom Refractory Material Market, By Chemical Composition

- Alumina

- Silica

- Magnesia

- Fireclay

- Others

United Kingdom Refractory Material Market, By Form

- Shaped

- Unshaped

Need help to buy this report?