United Kingdom Residential Boiler Market Size, Share, and COVID-19 Impact Analysis, By Type (Water Tube Boilers, Fire Tube Boilers, and Electric Boilers), By Technology (Condensing and Non-Condensing), and United Kingdom Residential Boiler Market Insights, Industry Trend, Forecasts to 2033

Industry: Energy & PowerUnited Kingdom Residential Boiler Market Insights Forecasts to 2033

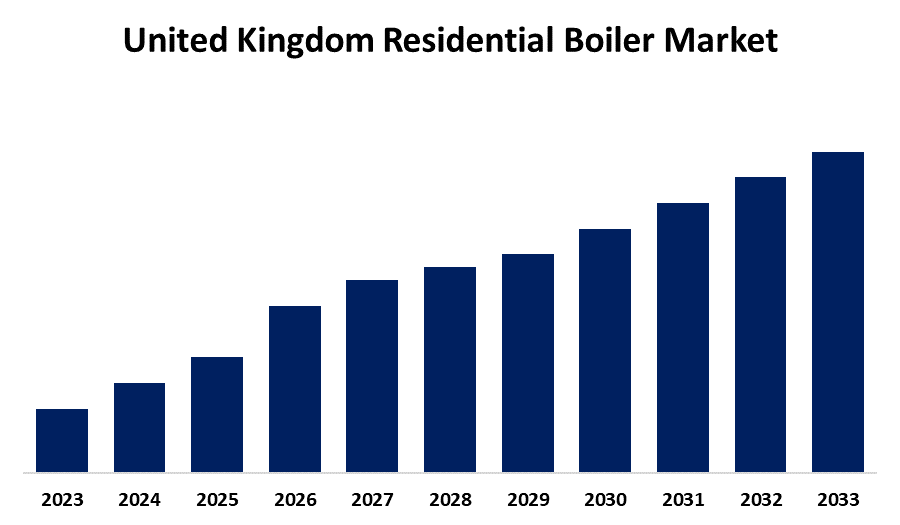

- The Market Size is Growing at a CAGR of 6.88% from 2023 to 2033

- The UK Residential Boiler Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The U.K. Residential Boiler Market Size is Anticipated to Hold a Significant Share by 2033, Growing at a CAGR of 6.88% from 2023 to 2033.

Market Overview

An apparatus that generates heat for the heating of water and space heating is a residential boiler. The capacity of a home boiler can be increased for sporadic use in business environments. Residential boiler systems are typically hot water boilers. The most common fuel used in household boilers is natural gas. The boiler market in the United Kingdom is made up of boiler systems that either burn combustible fuel or utilize electricity to heat and provide hot water to homes. Additionally. the need for air and water heating applications from residential locations, such as homes, flats, vacation homes, farms, and other structures, is expected to drive growth in the UK's residential boiler industry. Additionally, it is projected that the UK's rising wall-hung residential boiler sales will support market expansion throughout the forecast period. Additionally, the market is expected to rise in the next years due to rising demand for gas-fired residential boilers and increased environmental awareness of the need for energy-efficient heating systems.

Report Coverage

This research report categorizes the market for the UK residential boiler market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom residential boiler market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.K. residential boiler market.

United Kingdom Residential Boiler Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.88% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 165 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Technology |

| Companies covered:: | Vaillant Group, Baxi, Ideal Boilers, Worcester Bosch, Keston Boilers, Potterton, Alpha Heating Innovation, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Domestic boiler demand will rise globally due to the UK's growing requirement for high-efficiency residential boilers. While using substantially less fuel, the boiler warms interior rooms by using trapped heat created by the condensation of water vapors. Due to boilers' great efficiency and affordability, the demand for household boilers in the UK is anticipated to rise. Additionally, sales of household boilers in the UK reached nearly 675,000 during the first four months of 2021, up 41% from the same period in 2020, when over 476,000 units were sold, according to UK boiler market statistics from the heating and hot water industry council (HHIC). The UK's residential boiler market is expanding as a result of the rise in household boiler sales. Additionally, government policies in the UK that promote the development of gas infrastructure, and stricter emission regulations, will help bolster the demand for clean, energy-efficient energy systems, such as residential boilers, and contribute to market growth. Furthermore, demand in the UK will rise as more sophisticated boilers are required to replace outdated, inefficient systems.

Restraining Factors

Compared to a heater, replacing a boiler is more expensive. Consequently, the cost of upgrading from an outdated heating system to a boiler heating system is higher, which is expected to limit market expansion throughout the projection period.

Market Segmentation

The UK residential boiler market share is classified into type and technology.

- The fire tube boilers segment is expected to hold the greatest market share through the forecast period.

The U.K. residential boiler market is segmented by type into water tube boilers, fire tube boilers, and electric boilers. Among these, the fire tube boilers segment is expected to hold the greatest market share through the forecast period. In residential settings, fire tube boilers are more common than water tube boilers due to their lower cost, ease of maintenance, compatibility with dirty water, and other advantages.

- The condensing segment is anticipated to hold a significant share of the United Kingdom residential boiler market during the forecast period.

Based on the technology, the UK residential boiler market is divided into condensing and non-condensing. Among these, the condensing segment is anticipated to hold a significant share of the United Kingdom residential boiler market during the forecast period. Condensing boilers are designed to improve energy efficiency and generate heat by the condensation of water vapor. They are usually powered by natural gas and oil. These boilers restore lost heat by using waste gasses. Condensing boilers are more efficient, less expensive, and have smaller environmental effects.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. residential boiler market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Vaillant Group

- Baxi

- Ideal Boilers

- Worcester Bosch

- Keston Boilers

- Potterton

- Alpha Heating Innovation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, the Greenstar 8000+, a next-generation boiler with enhanced features and heating capabilities, has been introduced by Worcester Bosch.

Market Segment

This study forecasts revenue at the UK, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Residential Boiler Market based on the below-mentioned segments:

United Kingdom Residential Boiler Market, By Type

- Water Tube Boilers

- Fire Tube Boilers

- Electric Boilers

United Kingdom Residential Boiler Market, By Technology

- Condensing

- Non-Condensing

Need help to buy this report?