United Kingdom Retail Banking Market Size, Share, and COVID-19 Impact Analysis, By Products (Transactional Accounts, Savings Accounts, Debit Cards, Credit Cards, Loans, And Others), By Type (Public Sector Banks, Private Sector Banks, Foreign Banks, Community Development Banks, And Non-Banking Financial Companies (NBFC)), and United Kingdom Retail Banking Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialUnited Kingdom Retail Banking Market Insights Forecasts to 2033

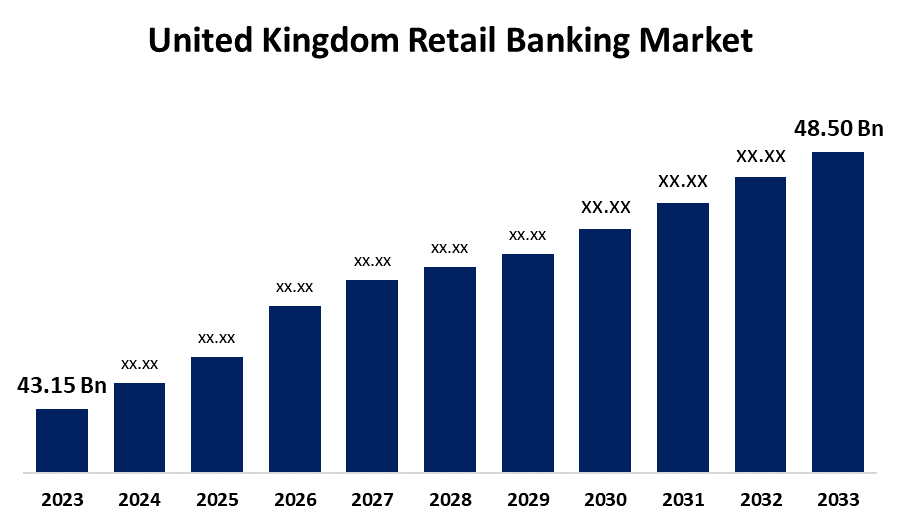

- The United Kingdom Retail Banking Market Size was valued at USD 43.15 billion in 2023.

- The Market is growing at a CAGR of 1.18% from 2023 to 2033

- The U.K. Retail Banking Market Size is expected to reach USD 48.50 billion by 2033

Get more details on this report -

The United Kingdom Retail Banking Market is anticipated to exceed USD 48.50 billion by 2033, growing at a CAGR of 1.18% from 2023 to 2033. The growth in mortgage loans and the increasing adoption of digital banking are driving the growth of the retail banking market in the United Kingdom.

Market Overview

Retail banking, also known as consumer banking, is the provision of services by a bank to individual consumers, offering services such as savings, checking accounts, mortgages, personal loans, and debit/credit cards. It is a cornerstone of personal or consumer banking providing individual financial management. It is a vital component of financial ecology, evolving and adapting to meet the constantly shifting needs of both the general economy and individuals. The increasing deposits in traditional retail banking lead to increasing accessibility of money, promoting economic growth. Digital banking is in the rise because of its benefits including lower operating costs, allowing more competitive interest rates on deposits and loans. Thus, traditional banks are adopting and investing on digital offerings to enhance customer experience and stay competitive in the market. With the growth of Internet and mobile banking, clients can now perform transactions, check balances, and access a variety of services at their fingertips, making banking services more easy and accessible.

Report Coverage

This research report categorizes the market for the UK retail banking market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the retail banking market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the retail banking market.

United Kingdom Retail Banking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 43.15 billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 1.18% |

| 2033 Value Projection: | USD 48.50 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Products, By Type, and COVID-19 Impact Analysis |

| Companies covered:: | HSBC Holdings, Royal Bank of Scotland, Barclay’s PLC, Standard Chartered PLC, Lloyds Banking Group, Santander UK, Nationwide Building Society, Coventry Building Society, Schroders, Close Brothers, and Others Ke vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The improved innovation and services in retail banking are leveraging market growth. The imposition of strict regulations to enhance consumer protection and fair practices in the banking industry are responsible for driving the market growth. Further, the growing mortgage market in the UK are significantly driving the market growth of retail banking. The increasing usage of electronic devices like computers and smartphones as well as expansion of internet connectivity, which allow easy access to the banking system are driving the market.

Restraining Factors

The increasing threats of cybersecurity risks including data breaches, identity theft and fraudulent with the expansion of digitalization are restraining the market.

Market Segmentation

The United Kingdom Retail Banking Market share is classified into products and type.

- The credit cards segment is anticipated to grow at the fastest CAGR during the forecast period.

The United Kingdom retail banking market is segmented by products into transactional accounts, savings accounts, debit cards, credit cards, loans, and others. Among these, the credit cards segment is anticipated to grow at the fastest CAGR during the forecast period. Credit cards offer convenience and flexibility during transactions, eliminating the need for carrying cash with secure purchases. The increasing adoption of credit cards especially among the growing number of working population is driving the market in the credit cards segment.

- The private sector banks segment dominates the market with the largest market share during the forecast period.

The United Kingdom retail banking market is segmented by type into public sector banks, private sector banks, foreign banks, community development banks, and non-banking financial companies (NBFC). Among these, the private sector banks segment dominates the market with the largest market share during the forecast period. Private sector are not constrained by bureaucratic procedures and are quickly adapt to changing market conditions. Banks in the private sector have had success implementing a customer-centric strategy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK retail banking market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- HSBC Holdings

- Royal Bank of Scotland

- Barclay's PLC

- Standard Chartered PLC

- Lloyds Banking Group

- Santander UK

- Nationwide Building Society

- Coventry Building Society

- Schroders

- Close Brothers

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, Lloyds Bank partnered with Fiserv, a leading global provider of payments and financial services technology, as the first bank to widely offer wholesale FX rates to UK and European merchants for dynamic currency conversion (DCC) on card transactions.

- In September 2023, HSBC UK partnered with Nova Credit to become first UK bank to offer newcomers option to include international credit history when applying for a credit card.

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Retail Banking Market based on the below-mentioned segments:

United Kingdom Retail Banking Market, By Products

- Transactional Accounts

- Savings Accounts

- Debit Cards

- Credit Cards

- Loans

- Others

United Kingdom Retail Banking Market, By Type

- Public Sector Banks

- Private Sector Banks

- Foreign Banks

- Community Development Banks

Need help to buy this report?