United Kingdom Rotor Blade Market Size, Share, and COVID-19 Impact Analysis, By Location of Deployment (Onshore and Offshore), By Blade Material (Carbon Fiber, Glass Fiber, and Others), and UK Rotor Blade Market Insights, Industry Trend, Forecasts to 2033

Industry: Energy & PowerUnited Kingdom Rotor Blade Market Insights Forecasts to 2033

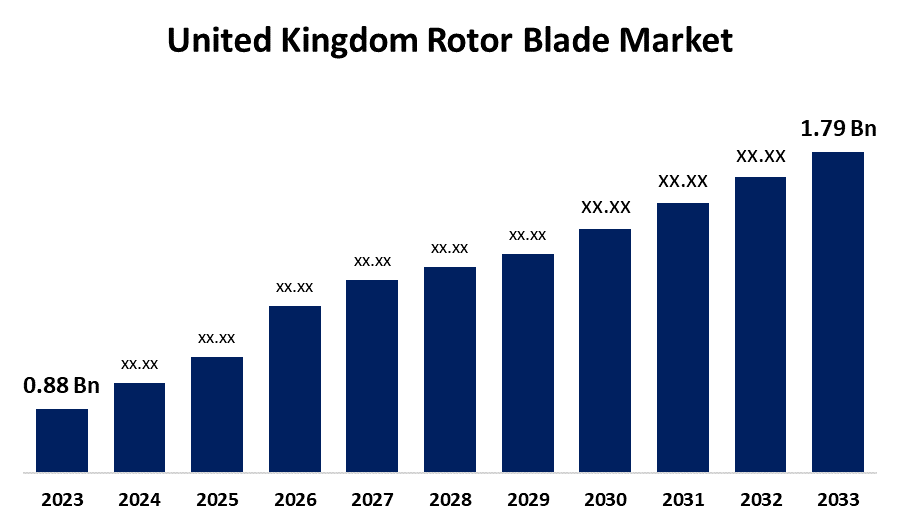

- The UK Rotor Blade Market Size was valued at USD 0.88 Billion in 2023.

- The Market is Growing at a CAGR of 7.36% from 2023 to 2033

- The U.K. Rotor Blade Market Size is Expected to Reach USD 1.79 Billion by 2033

Get more details on this report -

The United Kingdom Rotor Blade Market is Anticipated to Exceed USD 1.79 Billion by 2033, growing at a CAGR of 7.36% from 2023 to 2033.

Market Overview

Rotor blades are hybrid structures that are integral on a large scale. They consist mainly of composites, with bolted connections between the blades and hubs, as well as integrated lightning protection, and incorporate different kinds of composite structural materials and components. Rotor blades play a crucial role in the effectiveness and expenses of a wind power system. The performance is directly affected by the shape of the rotor blades, which determines how efficiently wind energy is converted to torque. The rotor blade of a wind turbine helps in covering a larger area and capturing more wind, allowing for quicker tip turns, and transforming this energy into rotational movements. With these characteristics, it is widely used in many onshore and offshore areas for sailing and producing sustainable energy. Currently, there are wind turbine generators for sale with different blade designs, tilt angles, set-ups, and dimensions. For instance, in November 2023, Aberdeen University in the United Kingdom received a EUR 250,000 investment for crucial research on offshore wind and CCS. Colocation is seen as crucial for the UK to achieve its offshore wind generation and CCS targets, which are necessary for the country's net-zero objectives because of the limited seabed space.

Report Coverage

This research report categorizes the market for the U.K. rotor blade market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the UK rotor blade market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK rotor blade market.

United Kingdom Rotor Blade Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.88 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.36% |

| 2033 Value Projection: | USD 1.79 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 165 |

| Tables, Charts & Figures: | 93 |

| Segments covered: | By Location of Deployment, By Blade Material and COVID-19 Impact Analysis. |

| Companies covered:: | Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy S.A., Nordex SE, Orsted A/S, Vattenfall AB, BayWa R.E AG, Enercon GmbH, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand for different energy sources and the widespread use of wind energy technology to enhance electricity generation has boosted product utilization. Correspondingly, increasing environmental worries have resulted in governments encouraging the use of environmentally friendly assets like wind turbines to reduce carbon emissions, serving as an additional factor promoting growth. Furthermore, the increasing use of different materials like aluminum, wood, and plastics in developing advanced wind turbine rotor blades at affordable prices is contributing to the market expansion. Moreover, the market growth is being fueled by the development of product variants in aircraft wing structures to enhance operational efficiency and the use of glass fiber-reinforced plastics and epoxy in wind turbine rotor blades.

Restraining Factors

The rotor blade industry is encountering obstacles from other forms of renewable energy, particularly solar power and natural gas. Anticipated decrease in wind energy demand due to increasing popularity of cleaner gas and solar energy sources.

Market Segmentation

The United Kingdom rotor blade market share is classified into location of deployment and blade material.

- The onshore segment is expected to hold the largest market share through the forecast period.

The U.K. rotor blade market is segmented by location of deployment into onshore and offshore. Among these, the onshore segment is expected to hold the largest market share through the forecast period. Technology for onshore wind energy has advanced to increase electricity generation per installed megawatt and expand to areas with lower wind speeds. Wind turbines have increased in size, featuring taller hub heights, wider diameters, and larger blades.

- The glass fiber segment dominates the market with the largest market share over the predicted period.

The UK rotor blade market is segmented by blade material into carbon fiber, glass fiber, and others. Among these, the glass fiber segment dominates the market with the largest market share over the predicted period. At present, the majority of large wind turbine rotor blades are made from glass fiber-reinforced plastics (GRP), which consist of glass fiber-reinforced polyester or epoxy. Glass fibers possess a greater density and as a result, are weightier compared to carbon fibers. Glass is a cost-effective material to utilize, particularly when compared to alternative composite materials like carbon or aramid fibers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom rotor blade market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy S.A.

- Nordex SE

- Orsted A/S

- Vattenfall AB

- BayWa R.E AG

- Enercon GmbH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-added resellers (VARs)

Recent Developments

- In November 2023, The British government raised offshore wind farm subsidies by 66%. Before the sixth Allocation Round (AR6) next year, the highest strike price for halted offshore wind projects saw an increase of 52%, from EUR 116/MWh to EUR 176/MWh, and a 66% increase for offshore wind projects, from EUR 44 (USD 54.5)/MWh to EUR 73/MWh.

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Rotor Blade Market based on the below-mentioned segments:

United Kingdom Rotor Blade Market, By Location of Deployment

- Onshore

- Offshore

United Kingdom Rotor Blade Market, By Blade Material

- Carbon Fiber

- Glass Fiber

- Others

Need help to buy this report?