United Kingdom Scaffolding Market Size, Share, and COVID-19 Impact Analysis, By Type (Supported, Suspended, and Rolling), By End-User (Residential, Commercial, and Industrial), and United Kingdom Scaffolding Market Insights, Industry Trend, Forecasts to 2033

Industry: Construction & ManufacturingUnited Kingdom Scaffolding Market Insights Forecasts to 2033

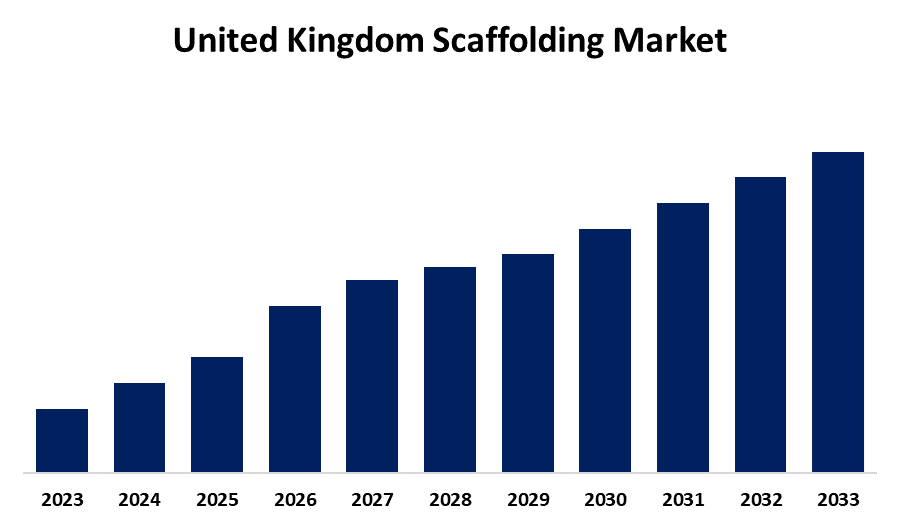

- The Market is Growing at a CAGR of 5.2% from 2023 to 2033

- The UK Scaffolding Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The U.K. Scaffolding Market Size is Anticipated to Hold a Significant Share by 2033, Growing at a CAGR of 5.2% from 2023 to 2033.

Market Overview

A temporary structure known as scaffolding, staging, or scaffolding is utilized for holding the workers and supplies during all phases of construction, maintenance, and rehabilitation of buildings, suspension bridges, and all other building projects. By offering a safe working platform, scaffolding lowers the possibility of mishaps and falls. It helps shield employees from potential risks at high altitudes by incorporating safety elements like guardrails, toe boards, and safety nets. Scaffolding encourages a safer working environment by establishing a stable and controlled atmosphere. The UK is experiencing a noticeable rise in construction activity, particularly within industrial areas, alongside increased projects for bridges and various infrastructure developments, with the public sector playing a significant role in driving this growth; this includes new industrial buildings, road expansions, railway upgrades, and major bridge construction projects. This increase in construction projects drives the market for scaffolding in the UK.

Report Coverage

This research report categorizes the market for the UK scaffolding market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom scaffolding market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.K. scaffolding market.

United Kingdom Scaffolding Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.2% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 88 |

| Segments covered: | By Type, By End-User and COVID-19 Impact Analysis. |

| Companies covered:: | Kaefer, TRAD Group, Brogan Group, GKR Scaffolding, PHD Modular Access, SGB Group, Access Scaffolding, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The UK scaffolding market is being driven by safety standards and government rules. Only qualified individuals may design, install, modify, and disassemble scaffolding, and the work must be done under the supervision of a qualified supervisor. The demand for trustworthy scaffolding solutions is increased as a result of these strict requirements, which guarantee safety and quality in the building sector. Additionally, the need for housing in the UK is on the rise, with population growth and expanding urbanization. The UK government has set a target of building 300,000 new homes per year by the mid-2020s to accommodate this demand. One of the key factors propelling the UK scaffolding market is the rise in the number of home construction projects, which leads to an increased utilization of scaffolding. Furthermore, technology and sustainability are two key elements driving the UK scaffolding market's development. Eco-friendly scaffolding solutions are becoming more and more in demand as greener construction techniques become more necessary. By using recyclable materials, energy-efficient technologies, and environmentally friendly activities, it satisfies the stringent requirements imposed by the UK and its green building programs.

Restraining Factors

A primary constraint on the scaffolding industry is the scarcity of skilled labour. Skilled people who can assemble, use, and remove scaffolding are necessary for its effectiveness. Both price hikes and productivity decline due to a lack of skilled labour have hampered the market's ability to expand.

Market Segmentation

The UK scaffolding market share is classified into type and end-user.

- The suspended segment is expected to hold the greatest market share through the forecast period.

The U.K. scaffolding market is segmented by type into supported, suspended, and rolling. Among these, the suspended segment is expected to hold the greatest market share through the forecast period. Suspended scaffolding is increasingly being used for cleaning and replacing glass panels in skyscrapers, ships, and construction sites. Suspended scaffolding systems have so many advantages, various construction site managers are using them to carry out various building and maintenance tasks on sites.

- The commercial segment is anticipated to hold a significant share of the United Kingdom scaffolding market during the forecast period.

Based on the end-user, the UK scaffolding market is divided into residential, commercial, and industrial. Among these, the commercial segment is anticipated to hold a significant share of the United Kingdom scaffolding market during the forecast period. This can be attributed to a boom in infrastructures and construction, the UK's high rate of urbanization and economic expansion are predicted to gain significant momentum.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. scaffolding market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kaefer

- TRAD Group

- Brogan Group

- GKR Scaffolding

- PHD Modular Access

- SGB Group

- Access Scaffolding

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2022, the acquisition of MP House ApS, situated just outside of Copenhagen, has been completed by StepUp Scaffold UK, a Glasgow-based division of the StepUp Scaffold Group in Memphis (US), which provides scaffolding and access equipment in the United Kingdom market. When it comes to providing Danish scaffolding operators with tools, equipment, and accessories, MP House leads the market.

Market Segment

This study forecasts revenue at the UK, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Scaffolding Market based on the below-mentioned segments:

United Kingdom Scaffolding Market, By Type

- Supported

- Suspended

- Rolling

United Kingdom Scaffolding Market, By End-User

- Residential

- Commercial

- Industrial

Need help to buy this report?