United Kingdom Seed Coating Material Market Size, Share, and COVID-19 Impact Analysis, By Crop Type (Fruits & Vegetables, Cereals & Grains, Oilseeds & Pulses, Others), By Additive (Polymers, Colorants, Pellets, Minerals/Pumice, Others), and United Kingdom Seed Coating Material Market Insights Forecasts to 2033

Industry: AgricultureUnited Kingdom Seed Coating Material Market Insights Forecasts to 2033

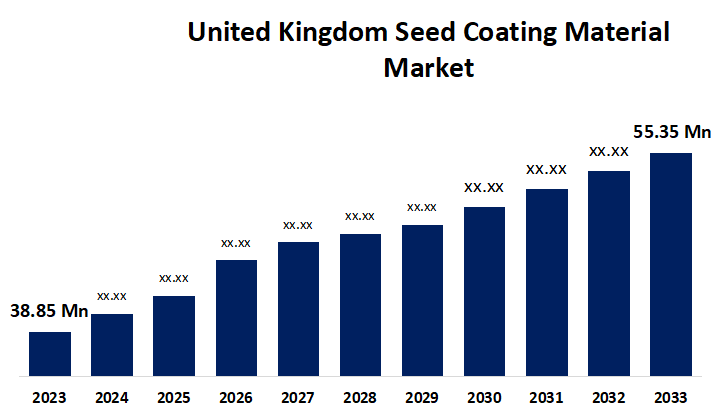

- The United Kingdom Seed Coating Material Market Size was valued at USD 38.85 Million in 2023.

- The Market Size is Growing at a CAGR of 3.6% from 2023 to 2033.

- The United Kingdom Seed Coating Material Market Size is Expected to Reach USD 55.35 Million by 2033.

Get more details on this report -

The United Kingdom Seed Coating Material Market Size is expected to reach USD 55.35 Million by 2033, at a CAGR of 3.6% during the forecast period 2023 to 2033.

Market Overview

Seed technologies such as seed treatment and seed coating have evolved in tandem with technological advancements in farming, such as the use of farm machinery and commercial seeds for crop cultivation. Farmers have begun to protect high-value planting seeds with chemical treatments, as well as using coating materials to plan crop planting operations in the field. The seed coating technique was first used to coat cereal seeds. The physiological, chemical, and biological characteristics of plants' seeds influence their overall performance; thus, it is critical for seeds to be resistant to unfavorable environmental conditions in order to produce high-quality yields in a shorter period of time. Crop growers in UK use a variety of crop protection technologies and crop growth-promoting techniques to meet the rapidly increasing demand for food as the population grows. Seed coating is one of the most effective seed protection methods, used in many major economies where agriculture is practiced. Rising incidences of seed diseases, which are negatively impacting overall crop growth, are driving up demand for seed coating materials in UK to protect them from pests and other harmful microorganisms found in the soil environment.

Report Coverage

This research report categorizes the market for the United Kingdom seed coating material market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom seed coating material market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom seed coating material market.

United Kingdom Seed Coating Material Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 38.85 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.6% |

| 2033 Value Projection: | USD 55.35 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Crop Type, By Additive |

| Companies covered:: | BASF UK Limited, Bayer UK Limited, Germain’s UK Limited, Croda International Plc., Incotec Group, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Technological advancements are critical to the United Kingdom seed coating material market. These advancements have transformed how seeds are protected and nourished, resulting in significant improvements in seed quality. Extensive research and development have resulted in innovative coating technologies such as microencapsulation, polymer coatings, and biological seed coatings. Microencapsulation is the process of enclosing seeds in a protective shell that not only allows for controlled nutrient release but also provides enhanced pest and disease resistance. This technology ensures that seeds receive the nutrients they require at the optimal time, maximizing their growth potential. Precision farming, also known as satellite farming or site-specific crop management, is a modern agricultural practice that combines cutting-edge technologies with data analytics to accurately manage field variations. Precision farming allows farmers to optimize their cultivation practices, maximizing crop yield while using fewer resources. Precision farming is becoming increasingly popular in the United Kingdom as a sustainable approach to agriculture, revolutionizing crop production and positively impacting various sectors of the agricultural industry.

Restraining Factors

Seed coating materials frequently contain chemical compounds that have the potential to harm the environment when they come into contact with soil or water sources. For example, certain seed coatings may contain neonicotinoid pesticides, which have been linked to bee population declines. As a result, the use of neonicotinoids is strictly regulated in many parts of the world, including the European Union, to which the United Kingdom was a member until recently.

Market Segment

- In 2023, the fruits & vegetables segment accounted for the largest revenue share over the forecast period.

Based on the crop type, the United Kingdom seed coating material market is segmented into fruits & vegetables, cereals & grains, oilseeds & pulses, and others. Among these, the fruits & vegetables segment has the largest revenue share over the forecast period. The UK seed coating material market is driven by rising consumer demand for organic produce. With a growing emphasis on health and wellness, UK consumers are looking for organic fruits and vegetables, which are thought to be healthier and safer than conventionally grown alternatives. This has resulted in increased demand for high-quality seeds, which is driving the market for seed coating materials.

- In 2023, the polymers segment accounted for the largest revenue share over the forecast period.

Based on the distribution channel, the United Kingdom seed coating material market is segmented into polymers, colorants, pellets, minerals/pumice, and others. Among these, the polymers segment has the largest revenue share over the forecast period. Polymers are widely used in seed coating owing to their superior ability to improve seed performance. Polymers play an important role in maximizing seed quality and yield by improving physical properties such as resilience and germination potential. Superabsorbent polymers, a type of polymer, have seen a significant increase in their application in seed coatings. These remarkable polymers have the unique ability to absorb and retain large amounts of liquid, which is especially useful in arid or drought-prone areas where water supply may be limited. The ability of superabsorbent polymers to efficiently retain moisture around seeds not only promotes germination but also contributes to healthy seedling growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom seed coating material market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF UK Limited

- Bayer UK Limited

- Germain’s UK Limited

- Croda International Plc.

- Incotec Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2022, Croda International, a leading British specialty chemicals company specializing in sustainable solutions, recently announced a ground-breaking collaboration with Xampla, an innovative company known for its cutting-edge plant protein materials. They have set out on a mission to create an advanced seed coating material that will not only revolutionize the agricultural industry but also address the urgent need for environmentally friendly alternatives.

Market Segment

This study forecasts country revenue from 2020 to 2033. Spherical Insights has segmented the United Kingdom seed coating material market based on the below-mentioned segments:

United Kingdom Seed Coating Material Market, By Crop Type

- Fruits & Vegetables

- Cereals & Grains

- Oilseeds & Pulses

- Others

United Kingdom Seed Coating Material Market, By Additive

- Polymers

- Colorants

- Pellets

- Minerals/Pumice

- Others

Need help to buy this report?