United Kingdom Sleep Tech Devices Market Size, Share, and COVID-19 Impact Analysis, By Type of Device (Wearable Sleep Trackers, Smart Beds & Mattresses, and Sleep Monitoring App), By Applications (Insomnia, Obstructive Sleep Apnea, and Narcolepsy), and United Kingdom Sleep Tech Devices Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareUnited Kingdom Sleep Tech Devices Market Insights Forecasts to 2033

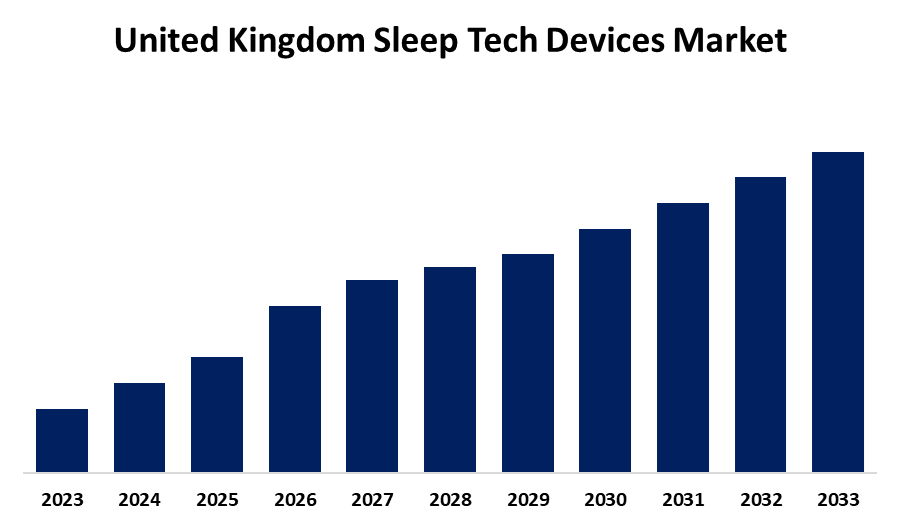

- The Market is Growing at a CAGR of 16.5% from 2023 to 2033

- The UK Sleep Tech Devices Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The U.K. Sleep Tech Devices Market Size is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 16.5% from 2023 to 2033.

Market Overview

A quickly developing field of technology, sleep tech products are intended to improve the quality of sleep and advance general well-being. These cutting-edge gadgets use sophisticated sensors and algorithms to track several facets of sleep, giving users comprehensive information that can enhance their sleep habits and general well-being. Sleep tech equipment is an electronic device designed to improve and track sleep for persons with apnea, insomnia, and sleep narcolepsy. A variety of technologically advanced sleep technology devices are available, including wearable smart bands and watches, rings, headbands, sleep pads, earplugs, and beds. Additionally, the market for sleep technology in the UK has expanded significantly due to advancements in technology and growing awareness of sleep health. The development of wearable and non-wearable devices targeted at tracking and enhancing sleep quality has propelled this market's expansion. The importance of sleep technology is highlighted by the rising incidence of sleep issues in the UK and the growing recognition of the benefits of sleep for overall health and productivity. Sleep technology solutions are used to help control disorders in both clinical and preventive settings.

Report Coverage

This research report categorizes the market for the UK sleep tech devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom sleep tech devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.K. sleep tech devices market.

United Kingdom Sleep Tech Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 16.5% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type of Device, By Applications |

| Companies covered:: | Philips, ResMed, Fitbit, Garmin, Oura Health, Sleepace, And Other Key Vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

In the UK, sleep-related conditions like insomnia and sleep apnea are becoming more widely acknowledged as serious health issues, which is encouraging more people to look for practical remedies. Demand is being driven by UK consumers' growing awareness of the advantages and accessibility of sleep technology products. Additionally, a third (31%) of adults in the UK claim to have insomnia, meaning that up to 16 million of them experience restless nights. As more people look for creative ways to enhance their sleep quality and general well-being, the high prevalence of insomnia is propelling the expansion of the UK sleep technology market. Additionally, in 2022, British people slept for 6.11 hours a night, whereas in 2021, they slept for 6.19 hours. Today, they barely got 5.91 hours on average. Just 36% of respondents claimed to have "excellent" sleep, despite the fact that the average healthy adult requires 7.5 to 8.5 hours of sleep every night, or five sleep cycles. As more people look for creative ways to enhance their sleep and general well-being, the UK sleep tech sector is expanding as a result of this drop in sleep quality.

Restraining Factors

Sensors and algorithms are used by sleep tech devices to monitor and evaluate sleep data. It can be difficult to guarantee the precision and dependability of these instruments, though. The accuracy of sleep measures can be impacted by individual differences in sleep patterns, the location of the device, and environmental conditions. To win over users' trust and faith, manufacturers must constantly enhance the accuracy and dependability of their sleep technology.

Market Segmentation

The UK sleep tech devices market share is classified into types of devices and applications.

- The wearable sleep trackers segment is expected to hold the greatest market share through the forecast period.

The U.K. sleep tech devices market is segmented by type of device into wearable sleep trackers, smart beds & mattresses, and sleep monitoring app. Among these, the wearable sleep trackers segment is expected to hold the greatest market share through the forecast period. Wearable on the wrist or other body parts, these gadgets fit easily into users' evening rituals and do not require complicated setup. They are also more accessible to a larger audience due to they are less costly than more costly solutions like smart beds or mattresses.

- The insomnia segment is anticipated to hold a significant share of the United Kingdom sleep tech devices market during the forecast period.

Based on the applications, the UK sleep tech devices market is divided into insomnia, obstructive sleep apnea, and narcolepsy. Among these, the insomnia segment is anticipated to hold a significant share of the United Kingdom's sleep tech devices market during the forecast period. Healthcare professionals and patients are looking for practical ways to control and lessen the symptoms of sleeplessness. Numerous gadgets, like as smart beds and wearable trackers, are available in the insomnia market that offers comprehensive insights into sleep patterns and pinpoint underlying problems.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. sleep tech devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Philips

- ResMed

- Fitbit

- Garmin

- Oura Health

- Sleepace

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Energy-saving "cell slumber" technology was deployed by BT Group across all of its EE mobile sites nationwide after successful trials in each of the UK's home countries.

Market Segment

This study forecasts revenue at the UK, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Sleep Tech Devices Market based on the below-mentioned segments:

United Kingdom Sleep Tech Devices Market, By Type of Device

- Wearable Sleep Trackers

- Smart Beds & Mattresses

- Sleep Monitoring App

United Kingdom Sleep Tech Devices Market, By Applications

- Insomnia

- Obstructive Sleep Apnea

- Narcolepsy

Need help to buy this report?