United Kingdom Surgical Devices Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Surgical Sutures & Staples, Handheld Surgical Equipment, Minimally Invasive Surgical Instruments, Electrosurgical Devices, and Others), By Application (Neurosurgery, Plastic & Reconstructive Surgeries, Wound Closure, Obstetrics & Gynecology, Urology, Microvascular, Thoracic Surgery, and Others), and United Kingdom Surgical Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited Kingdom Surgical Devices Market Insights Forecasts to 2033

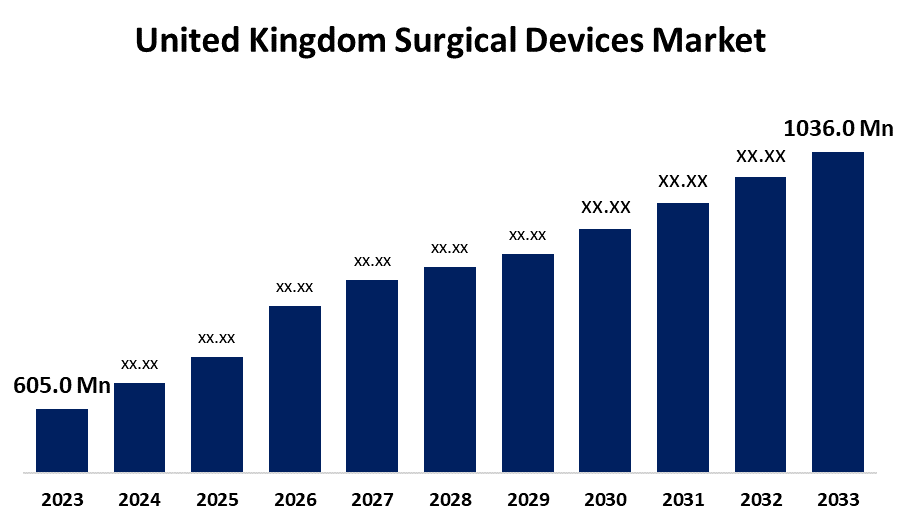

- The U.K. Surgical Devices Market Size was Valued at USD 605.0 Million in 2023.

- The U.K. Surgical Devices Market Size is Growing at a CAGR of 5.53% from 2023 to 2033

- The U.K. Surgical Devices Market Size is Expected to Exceed USD 1036.0 Million by 2033

Get more details on this report -

The United Kingdom Surgical Devices Market Size is Anticipated to Exceed USD 1036.0 Million by 2033, Growing at a CAGR of 5.53% from 2023 to 2033. The Growing prevalence of chronic diseases, adoption of minimally invasive surgeries, innovations such as robotic-assisted surgeries, and advanced imaging technologies are driving the growth of the surgical devices market in the UK.

Market Overview

Surgical devices market refers to the industry manufacturing and selling tools and instruments used for surgical procedures. Surgical devices are the tools used by surgeons to carry out operations during surgical procedures. These surgical devices are categorized based on the type of surgery such as bariatric surgery, breast surgery, cardiothoracic surgery, colon & rectal surgery, craniofacial surgery, endocrine surgery, and general surgery. Handheld devices (cutting, dissecting, clamping, retracting, holding, grasping, examining, suturing, stapling, suction, and aspiration devices), access devices (endoscope, trocars), energy devices (ultrasound, bipolar) are all included in surgical devices. The cases of chronic diseases necessitate a greater number of surgical interventions, requiring specialized surgical instruments, diagnostic tools, and monitoring devices. Further, the demand for minimally invasive surgery and the surge in the geriatric population susceptible to ocular disorders, intestinal disorders, and other health conditions are escalating the market growth. The increasing development of advanced products and adoption of minimally invasive procedures are expected to propel lucrative market growth opportunities.

Report Coverage

This research report categorizes the market for the UK surgical devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom surgical devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK surgical devices market.

United Kingdom Surgical Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 605.0 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.53% |

| 2033 Value Projection: | USD 1036.0 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Product Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | B. Braun SE, Medtronic PLC, Olympus Corporation, Integra LifeSciences, Stryker, Johnson & Johnson Services Inc., Erbe Elektromedizin GmbH, Boston Scientific Corporation, Smith & Nephew, Getinge AB, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The increasing adoption of minimally invasive surgeries (MIS) by surgeons is propelling the market growth. Further, technological innovations which include robotic-assisted surgeries to deliver precise therapies in multiple specialties are propelling the market growth. The introduction of advanced imaging technologies such as CT scans and MRIs in surgery for visualizing bones and soft tissues as well as other imaging techniques like PET scans and 3D printing is escalating the market growth.

Restraining Factors

The strict regulations associated with the use of surgical devices may hamper the market. The poor reimbursement for surgical devices that prevent access to advanced technologies is restraining the market growth.

Market Segmentation

The United Kingdom surgical devices market share is classified into product type and application.

- The surgical sutures & staplers segment dominated the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom surgical devices market is segmented by product type into surgical sutures & staples, handheld surgical equipment, minimally invasive surgical instruments, electrosurgical devices, and others. Among these, the surgical sutures & staplers segment dominated the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period. Surgical sutures and staplers, made from silk, nylon, or absorbable polymers like polyglycolic acid, are used for wound closure and tissue approximation. The rapid healing and low risk of infection by the use of surgical sutures and staplers are propelling the market.

- The plastic & reconstructive surgeries segment dominated the UK surgical devices market in 2023 and is anticipated to grow at the fastest CAGR during the projected period.

The United Kingdom surgical devices market is segmented by application into neurosurgery, plastic & reconstructive surgeries, wound closure, obstetrics & gynecology, urology, microvascular, thoracic surgery, and others. Among these, the plastic & reconstructive surgeries segment dominated the UK surgical devices market in 2023 and is anticipated to grow at the fastest CAGR during the projected period. Scalpels, lasers, and implants are used for plastic & reconstructive surgeries. The rising number of cosmetic procedures and availability of surgical equipment for cosmetic surgeries are significantly contributing to driving the market in the plastic & reconstructive surgeries segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. surgical devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- B. Braun SE

- Medtronic PLC

- Olympus Corporation

- Integra LifeSciences

- Stryker

- Johnson & Johnson Services Inc.

- Erbe Elektromedizin GmbH

- Boston Scientific Corporation

- Smith & Nephew

- Getinge AB

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, Advanced Medical Solutions Group plc, a world-leading specialist in tissue healing technologies, announced that it has entered into an agreement for the proposed acquisition of Peters Surgical, a leading global provider of specialty surgical sutures, mechanical haemostasis and internal cyanoacrylate devices.

- In July 2023, Medical device market leader, Marsden Group, is targeting future growth within international and UK healthcare markets following the acquisition of specialist surgical instruments and medical device manufacturer Bailey Instruments.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Surgical Devices Market based on the below-mentioned segments:

UK Surgical Devices Market, By Product Type

- Surgical Sutures & Staples

- Handheld Surgical Equipment

- Minimally Invasive Surgical Instruments

- Electrosurgical Devices

- Others

UK Surgical Devices Market, By Application

- Neurosurgery

- Plastic & Reconstructive Surgeries

- Wound Closure

- Obstetrics & Gynecology

- Urology

- Microvascular

- Thoracic Surgery

- Others

Need help to buy this report?