United Kingdom Timber Cladding Market Size, Share, and COVID-19 Impact Analysis, By Product (Cedar, Larch, Oak, Spruce, and Others), By End-Use (Residential, Commercial, and Industrial), and United Kingdom Timber Cladding Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsUnited Kingdom Timber Cladding Market Insights Forecasts to 2033

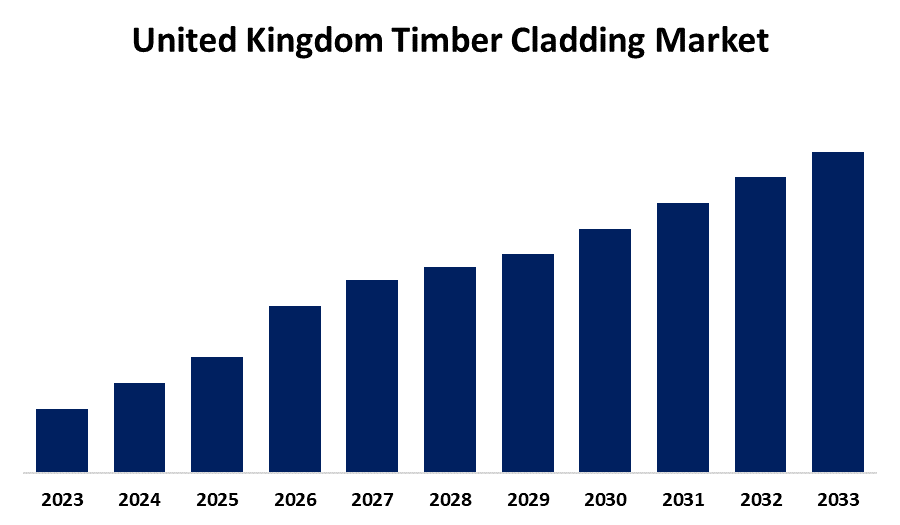

- The Market Size is Growing at a CAGR of 4.15% from 2023 to 2033

- The U.K. Timber Cladding Market Size is Expected to hold a significant share by 2033

Get more details on this report -

The United Kingdom Timber Cladding Market Size is anticipated to hold a significant share by 2033, Growing at a CAGR of 4.15% from 2023 to 2033. The Growing demand for construction activities is driving the Growth of the timber cladding market in the UK.

Market Overview

Timber cladding is a weather-resistant siding that is applied to a building's exterior to protect it from the elements and to enhance its beauty. In timber cladding, boards or planks are layered on top of one another to create a shield. It is a naturally occurring material that enhances the building's overall beauty while keeping the residence warm. Timber cladding has numerous benefits, including increased insulation, affordability, sustainability, durability, and environmental friendliness. It also improves the building's overall appearance. It is frequently utilized both inside and outside of buildings. It is also advantageous to keep buildings warm by adding enough insulation during extremely cold temperatures. Wood cladding is a versatile choice that works well for both traditional and modern homes since it can be specially made to complement distinctive architectural styles. Thus, a variety of design options for houses and structures offered by timber cladding is expected to drive the market opportunities.

Report Coverage

This research report categorizes the market for the UK timber cladding market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom timber cladding market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK timber cladding market.

United Kingdom Timber Cladding Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.15% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 162 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End-Use |

| Companies covered:: | Accsys, BSW Timber Ltd, Glenalmond Timber Company Ltd, Howarth Timber Group, NORclad, Dura Composites Ltd, Russwood ltd, James Hardie Group, Timbmet, Vastern Timber Limited, The Brookridge Group (Brookridge Timber), and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The Office for National Statistics (United Kingdom) reports that the total amount of public housing buildings in Great Britain grew by over 6% in 2021 compared to the year before. Thus, the trend of growing buildings and structures is anticipated to drive up demand in the UK. Various government investments, a rise in real disposable income, and lower interest rates are the factors responsible for driving the market.

Restraining Factors

Timber shortage and combustibles legislation are the factors that may hamper the market for timber cladding.

Market Segmentation

The United Kingdom Timber Cladding Market share is classified into product and end-use.

- The spruce segment dominates the UK timber cladding market with the largest share during the forecast period.

The United Kingdom timber cladding market is segmented by product into cedar, larch, oak, spruce, and others. Among these, the spruce segment dominates the UK timber cladding market with the largest share during the forecast period. Because of its exceptional strength and durability, spruce wood is a popular choice for decking, flooring, and structural framing in both residential and commercial construction projects. The widespread application in interior design and home décor are driving the market demand.

- The residential segment accounted for the largest revenue share of the UK timber cladding market in 2023.

The United Kingdom timber cladding market is segmented by end-use into residential, commercial, and industrial. Among these, the residential segment accounted for the largest revenue share of the UK timber cladding market in 2023. Buildings employ cladding for its aesthetic appeal, weather protection, fire resistance, and thermal insulation. The government mandates for green buildings, increased over-cladding operations, the necessity for building restoration, and growing awareness of energy-efficient structures are anticipated to drive the market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. timber cladding market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Accsys

- BSW Timber Ltd

- Glenalmond Timber Company Ltd

- Howarth Timber Group

- NORclad

- Dura Composites Ltd

- Russwood ltd

- James Hardie Group

- Timbmet

- Vastern Timber Limited

- The Brookridge Group (Brookridge Timber)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2022, the acquisition of the British BSW Timber Ltd., based in Earlston, Scotland, by Binderholz UK Holding GmbH, a subsidiary of the Austrian binderholz Group, was successfully concluded with the closing of the transaction.

- In June 2021, Brickability Group announced its acquisition of the Taylor Maxwell Group, a supplier of timber products, bricks, and cladding to the construction industry.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Timber Cladding Market based on the below-mentioned segments:

UK Timber Cladding Market, By Product

- Cedar

- Larch

- Oak

- Spruce

- Others

UK Timber Cladding Market, By End-Use

- Residential

- Commercial

- Industrial

Need help to buy this report?