United Kingdom Travel Insurance Market Size, Share, and COVID-19 Impact Analysis, By Insurance (Single-trip Travel Insurance, Annual Multi-trip Travel Insurance), By End User (Education Travelers, Business Travelers, Senior Citizens, Family Travelers, Others), and United Kingdom Travel Insurance Market Insights Forecasts to 2033

Industry: Banking & FinancialUnited Kingdom Travel Insurance Market Insights Forecasts to 2033

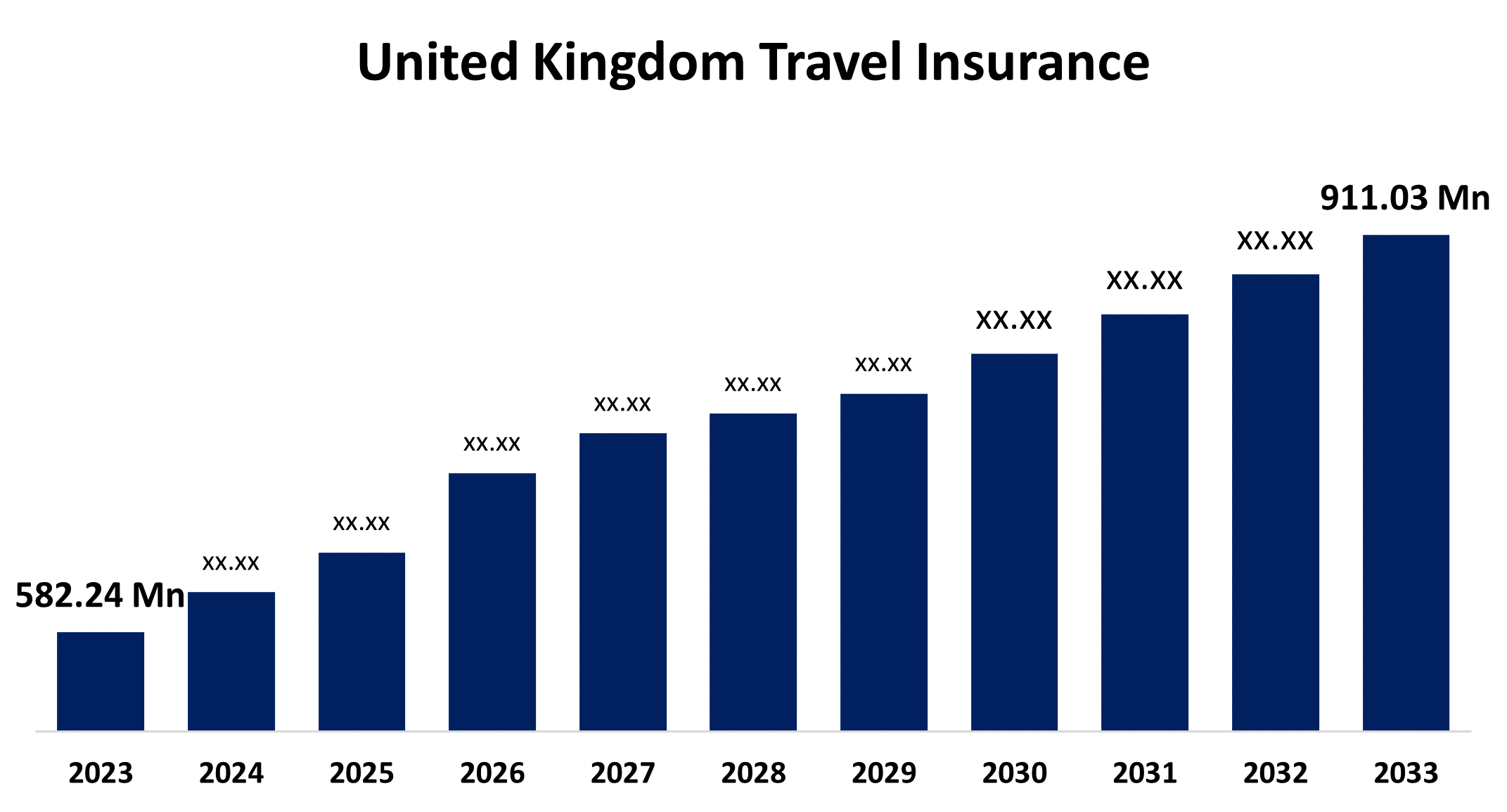

- The United Kingdom Travel Insurance Market Size was valued at USD 582.24 Million in 2023.

- The Market Size is Growing at a CAGR of 4.58% from 2023 to 2033.

- The United Kingdom Travel Insurance Market Size is Expected to Reach USD 911.03 Million by 2033.

Get more details on this report -

The United Kingdom Travel Insurance Market Size is expected to reach USD 911.03 Million by 2033, at a CAGR of 4.58% during the forecast period 2023 to 2033.

Market Overview

Travel insurance protects against financial damages caused by unforeseen circumstances while travelling domestically or abroad. It typically covers the costs of damage, emergency medical care, accidental death, and travel cancellation or interruption. It begins on the day of travel and continues until the insured returns home. Several firms now offer travel insurance with 24-hour emergency services, such as restoring lost passports, cash wire help, and rebooking cancelled flights. They also provide customization options based on geographical area and the needs of the insured individuals. The significant growth in the travel and tourism industry in the United Kingdom, owing to rising disposable incomes, increased business travel, and the ease of access to online travel bookings and discounted package holidays, is one of the major factors driving the United Kingdom travel insurance market. Furthermore, governments in several countries have made it essential to attach travel insurance paperwork when applying for a visa, which is helping to drive market growth. Aside from that, prominent players are using digital tools like application programmer interface (API), artificial intelligence (AI), data analytics, and global positioning system (GPS) to improve distribution systems and provide a more personalized user experience.

Report Coverage

This research report categorizes the market for United Kingdom travel insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom travel insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United Kingdom travel insurance market.

United Kingdom Travel Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 582.24 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.58% |

| 2033 Value Projection: | USD 911.03 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Insurance, By End User |

| Companies covered:: | Munich RE, Allianz, Chubb, Aviva, Saga PLC, Prudential Guarantee, KBC Group, Europ Assistance, AllClear, ABTA, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United Kingdom's travel insurance market is well-established and competitive. It provides a vast choice of insurance solutions to fulfil the needs of travellers, whether they are travelling on a short weekend getaway, a business trip, or an extended holiday overseas. These insurance policies are designed to give financial protection and help in the event of unforeseen catastrophes while travelling. Several reasons contribute to the growth and significance of the United Kingdom's travel insurance market. The United Kingdom's excellent connection to a variety of international destinations has resulted in increased abroad travel. With the rise of international travel, travellers are seeing the value of having comprehensive travel insurance

Restraining Factors

The market's expansion is hampered by a lack of understanding about travel insurance premium rates and coverages. Several factors can influence the premium amount that a traveller pays for domestic and international travel insurance, including the total sum assured, pre-existing medical issues, the insured's age, and the frequency with which they travel.

Recent Devlopment

- In 2023, the single-trip travel segment accounted for the largest revenue share over the forecast period.

Based on the insurance, the United Kingdom travel insurance market is segmented into single-trip travel insurance, and annual multi-trip travel insurance. Among these, the single-trip travel segment has the largest revenue share over the forecast period. Its cost, flexibility, and adaptability for the changing needs of modern travellers, combined with a greater awareness of the need for travel insurance in limiting hazards connected with foreign travel. The growing popularity of long-term travel among digital nomads, remote workers, students, and other travellers, as well as increased recognition of the need for specialized insurance coverage tailored to extended journeys and immersive experiences.

- In 2023, the family travelers segment accounted for the largest revenue share over the forecast period.

On the basis of end user, the United Kingdom travel insurance market is segmented into education travelers, business travelers, senior citizens, family travelers, and others. Among these, the family travelers’ segment has the largest revenue share over the forecast period. The increased focus on safety and security, the financial commitment required in family holidays, the special demands of families travelling with children, and the growing popularity of multigenerational travel experiences will all play a role in future years.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom travel insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Munich RE

- Allianz

- Chubb

- Aviva

- Saga PLC

- Prudential Guarantee

- KBC Group

- Europ Assistance

- AllClear

- ABTA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United Kingdom travel insurance market based on the below-mentioned segments:

United Kingdom Travel Insurance Market, By Insurance

- Single-trip Travel Insurance

- Annual Multi-trip Travel Insurance

United Kingdom Travel Insurance Market, By End User

- Education Travelers

- Business Travelers

- Senior Citizens

- Family Travelers

- Others

Need help to buy this report?