United Kingdom Veterinary Medicine Market Size, Share, and COVID-19 Impact Analysis, By Product (Biologics, Pharmaceuticals, and Medicated Feed Additives), By Animal Type (Production Animals and Companion Animals), By Route of Administration (Oral, Injectable, Topical, and Other Routes), By Distribution Channel (Veterinary Hospitals & Clinics, E-commerce, Offline Retail Stores, and Others), and United Kingdom Veterinary Medicine Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareUnited Kingdom Veterinary Medicine Market Insights Forecasts to 2033

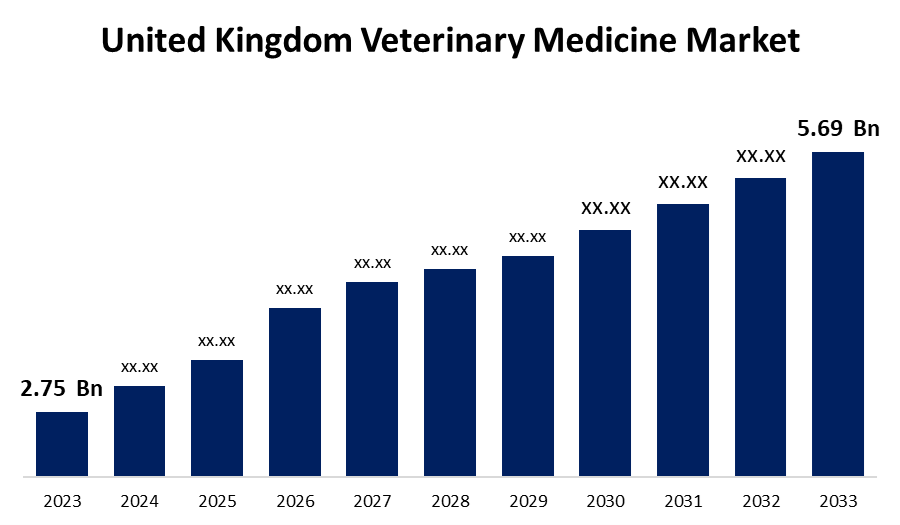

- The U.K. Veterinary Medicine Market Size was valued at USD 2.75 Billion in 2023.

- The U.K. Veterinary Medicine Market is Growing at a CAGR of 7.54% from 2023 to 2033

- The U.K. Veterinary Medicine Market Size is Expected to reach USD 5.69 Billion by 2033

Get more details on this report -

The United Kingdom Veterinary Medicine Market is anticipated to exceed USD 5.69 Billion by 2033, growing at a CAGR of 7.54% from 2023 to 2033. The increasing prevalence of animal diseases, the rising trend of pet ownership, and novel product development are driving the growth of the veterinary medicine market in the UK.

Market Overview

The veterinary medicine market refers to the development, production, and distribution of products and services that are aimed at preventing, diagnosing, and treating diseases in animals, including both companion and livestock animals. Veterinary medicine is the branch of medicine that deals with the prevention, management, diagnosis, and treatment of diseases, disorders, and injury in non-human animals. The surging trend of pet ownership, demand for animal protein, as well as increasing prevalence of animal diseases aid in propelling the market for veterinary medicine. Further, the advancements in veterinary medicine and the penetration of pet insurance are the factors that have fueled the market growth. The increase in chronic conditions and zoonotic illnesses in animals are providing opportunities for the development of novel veterinary products, thereby escalating the market growth.

Report Coverage

This research report categorizes the market for the UK veterinary medicine market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom veterinary medicine market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK veterinary medicine market.

United Kingdom Veterinary Medicine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.75 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.54% |

| 2033 Value Projection: | USD 5.69 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Animal Type, By Route of Administration, By Distribution |

| Companies covered:: | Boehringer Ingelheim International GmbH., Norbrook, Merck & Co., Inc., Elanco, Bimeda, Inc., Zoetis UK Limited., Ceva, BioZyme, Inc., Hill’s Pet Nutrition, Inc., Decra, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising livestock population driving the need for veterinary medicine for ensuring the animal health and productivity for sustainable livestock production is driving the market demand. The increasing need for veterinary care of animal pets with the increasing pet ownership is driving the market demand. For instance, as per the data of Statista, pet ownership levels have peaked up to an unprecedented high of 62% in 2022 due to increased time spent at home during the coronavirus pandemic.

Restraining Factors

The heightened cost of veterinary medicine may limit its adoption, thereby restraining market growth. Further, the lack of awareness about animal health and counterfeit drugs are challenging the market growth.

Market Segmentation

The United Kingdom Veterinary Medicine Market share is classified into product, animal type, route of administration, and distribution channel.

- The pharmaceuticals segment accounted for the largest revenue share in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom veterinary medicine market is segmented by product into biologics, pharmaceuticals, and medicated feed additives. Among these, the pharmaceuticals segment accounted for the largest revenue share in 2023 and is expected to grow at a significant CAGR during the projected period. Medications and drugs included in veterinary pharmaceuticals include vaccines, antibiotics, anti-inflammatory drugs, and more, which are used for preventing or treating diseases. The increasing advancements in R&D for innovative pharmaceutical solutions are propelling the market growth in the pharmaceuticals segment.

- The production animals segment dominated the market with the largest revenue share in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom veterinary medicine market is segmented by animal type into production animals and companion animals. Among these, the production animals segment dominated the market with the largest revenue share in 2023 and is expected to grow at a significant CAGR during the projected period. Antibiotics, anthelmintics (dewormers), vaccines, NSAIDs, and growth promoters are some of the medicines commonly required for the management of diseases in production animals. The rising need for high-quality meat, milk, and other animal products is contributing to driving the market demand in the production animals segment.

- The injectable segment held the largest revenue share of the veterinary medicine market in 2023 and is anticipated to grow at a significant CAGR during the projected period.

The United Kingdom veterinary medicine market is segmented by route of administration into oral, injectable, topical, and other routes. Among these, the injectable segment held the largest revenue share of the veterinary medicine market in 2023 and is anticipated to grow at a significant CAGR during the projected period. Injectable medications such as vaccines and monoclonal antibodies provide faster results in treating acute conditions and managing diseases in animals. The technological development in veterinary medicine are driving the market growth in the injectable segment.

- The veterinary hospitals & clinics segment dominated the market with the largest share in 2023 and is anticipated to grow at a significant CAGR during the projected period.

The United Kingdom veterinary medicine market is segmented by distribution channel into veterinary hospitals & clinics, e-commerce, offline retail stores, and others. Among these, the veterinary hospitals & clinics segment dominated the market with the largest share in 2023 and is anticipated to grow at a significant CAGR during the projected period. Veterinary hospitals and clinics are the primary points for the administration of vet medicines like vaccines and monoclonal antibodies. They further provide a wide range of services from routine checkups to emergency care and surgeries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. veterinary medicine market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Boehringer Ingelheim International GmbH.

- Norbrook

- Merck & Co., Inc.

- Elanco

- Bimeda, Inc.

- Zoetis UK Limited.

- Ceva

- BioZyme, Inc.

- Hill's Pet Nutrition, Inc.

- Decra

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, Zoetis launched CircoMax – a new Porcine Circovirus type 2 (PCV2) vaccine in the UK. CircoMax is the only straight PCV2 vaccine licensed to protect against PCV2a, PCV2b and PCV2d, the three genotypes identified in the UK pig herd. It provides broad protection against the ever-evolving PCV2 threat.

- In April 2021, Boehringer Ingelheim launched Prevexxion RN and Prevexxion RN+HVT+IBD, the next generation of Marek’s disease vaccines, in the UK and Europe. Prevexxion RN+HVT+IBD is a solution combining Prevexxion RN and Vaxxitek HVT+IBD in one ampoule. It is designed to meet the needs of customers in long-life bird segments with protection from the hatchery.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Veterinary Medicine Market based on the below-mentioned segments:

UK Veterinary Medicine Market, By Product

- Biologics

- Pharmaceuticals

- Medicated Feed Additives

UK Veterinary Medicine Market, By Animal Type

- Production Animals

- Companion Animals

UK Veterinary Medicine Market, By Route of Administration

- Oral

- Injectable

- Topical

- Other Routes

UK Veterinary Medicine Market, By Distribution Channel

- Veterinary Hospitals & Clinics

- E-commerce

- Offline Retail Stores

- Others

Need help to buy this report?