United Kingdom Vitamin D Testing Market Size, Share, and COVID-19 Impact Analysis, By Product (25-Hydroxy Vitamin D Testing, 1,25-Dihydroxy Vitamin D Testing, 24,25-Dihydroxy Vitamin D Testing), By Application (Clinical Testing, Research Testing), and United Kingdom Vitamin D Testing Market Insights Forecasts to 2033

Industry: HealthcareUnited Kingdom Vitamin D Testing Market Insights Forecasts to 2033

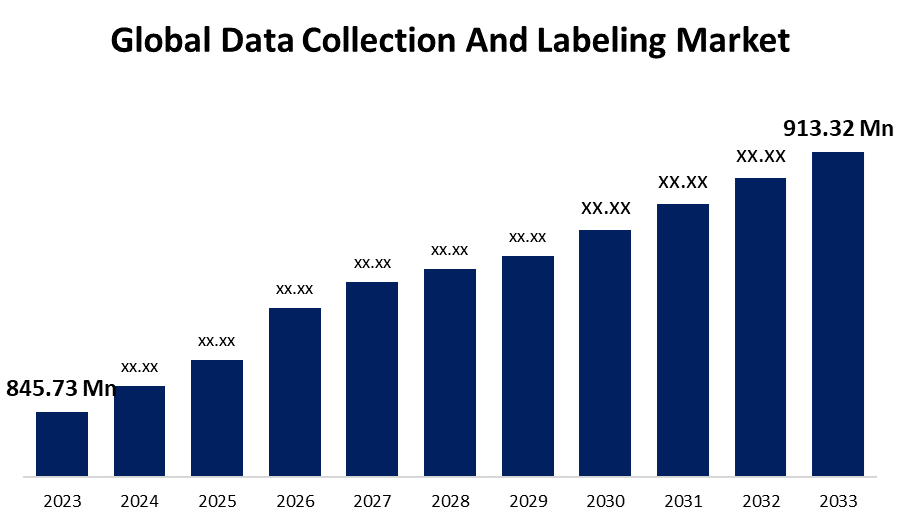

- The United Kingdom Vitamin D Testing Market Size was valued at USD 845.73 Million in 2023.

- The Market Size is Growing at a CAGR of 7.99% from 2023 to 2033.

- The United Kingdom Vitamin D Testing Market Size is Expected to Reach USD 913.32 Million by 2033.

Get more details on this report -

The United Kingdom Vitamin D Testing Market Size is expected to reach USD 913.32 Million by 2033, at a CAGR of 7.99% during the forecast period 2023 to 2033.

Market Overview

Vitamin D is essential for bone health, immune system support, and the regulation of different body processes. As more people become aware of the critical function of vitamin D in overall well-being, the demand for testing services grows considerably. People are becoming increasingly aware of the variables that can contribute to vitamin D deficiency, such as insufficient sun exposure, lifestyle choices, and certain medical disorders. Furthermore, they are actively looking for information about their vitamin D levels. This increased awareness has prompted the launch of healthcare campaigns, educational initiatives, and the distribution of scientific results via various media platforms. Furthermore, healthcare practitioners are increasingly promoting vitamin D testing as part of routine health screenings. The increase in awareness not only benefits individual health but also preventive healthcare. The market has seen the rise of at-home testing kits. These kits enable people to take their samples and send them to laboratories for examination, removing the requirement for a medical visit. Such simplicity encourages more people to take charge of their health by frequently checking their vitamin D levels.

Report Coverage

This research report categorizes the market for United Kingdom vitamin D testing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom vitamin D testing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United Kingdom vitamin D testing market.

United Kingdom Vitamin D Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 845.73 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.99% |

| 2033 Value Projection: | USD 913.32 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application |

| Companies covered:: | F. Hoffmann-La Roche Ltd., Abbott Laboratories Ltd., Quest Diagnostics Incorporated, bioMerieux UK Ltd., Diasorin Ltd., Thermo Fisher Scientific Inc., Beckman Coulter United Kingdom Ltd., Tosoh Bioscience Limited., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rise in the prevalence of chronic diseases in the United Kingdom, which are caused by low vitamin D intake, is likely to drive market expansion over the forecast period. Furthermore, the increased demand for vitamin D testing among pregnant women and newborns for fetal development and personal health is likely to boost the growth of the United Kingdom vitamin D testing market in the approaching years. The increased launch of new products and methodology in the market for speedy and accurate vitamin D testing is expected to drive profitable growth in the United Kingdom.

Restraining Factors

Several nations have adopted regulatory rules governing the frequency of vitamin testing and the use of test kits. This dramatically reduced the overutilization of healthcare resources and expenses, which slowed market growth over the research period.

Market Segment

- In 2023, the 25-Hydroxy vitamin D testing segment accounted for the largest revenue share over the forecast period.

Based on the product, the United Kingdom vitamin D testing market is segmented into 25-Hydroxy vitamin D testing, 1,25-Dihydroxy vitamin D testing, 24,25-Dihydroxy vitamin D testing. Among these, the 25-Hydroxy vitamin D testing segment has the largest revenue share over the forecast period. The 25-hydroxy vitamin D test, often known as the 25(OH)D test or serum 25-hydroxyvitamin D test, is the market's largest and most popular sector. This test detects the concentration of 25-hydroxy vitamin D in the bloodstream, which is thought to be the most reliable predictor of an individual's vitamin D status. It considers both dietary intake and sun exposure, providing an extensive evaluation of vitamin D levels. Healthcare practitioners prefer the 25-hydroxy vitamin D test for routine monitoring, determining deficiency or insufficiency, and making therapy decisions. Its market domination can be due to its efficacy, convenience of use, and dependability in determining a patient's overall vitamin D.

- In 2023, the clinical testing segment accounted for the largest revenue share over the forecast period.

On the basis of application, the United Kingdom vitamin D testing market is segmented into clinical testing, research testing. Among these, the clinical testing segment has the largest revenue share over the forecast period. Clinical testing includes all applications including the diagnosis, monitoring, and management of patients' health issues. Vitamin D testing in a clinical setting is critical for identifying and treating vitamin D insufficiency, which is linked to a variety of health problems including osteoporosis, rickets, thyroid disorders, and others. Vitamin D testing is widely recommended by healthcare providers as part of patient care to guarantee accurate diagnosis and treatment options. Clinical testing is important in preventive healthcare since it helps people maintain appropriate vitamin D levels and general health. As a result, this category accounts for the vast majority of vitamin D testing performed globally and continues to rise in popularity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom vitamin D testing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- F. Hoffmann-La Roche Ltd.

- Abbott Laboratories Ltd.

- Quest Diagnostics Incorporated

- bioMerieux UK Ltd.

- Diasorin Ltd.

- Thermo Fisher Scientific Inc.

- Beckman Coulter United Kingdom Ltd.

- Tosoh Bioscience Limited.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United Kingdom vitamin D testing Market based on the below-mentioned segments:

United Kingdom Vitamin D Testing Market, By Product

- 25-Hydroxy Vitamin D Testing

- 1,25-Dihydroxy Vitamin D Testing

- 24,25-Dihydroxy Vitamin D Testing

United Kingdom Vitamin D Testing Market, By Application

- Clinical Testing

- Research Testing

Need help to buy this report?