United Kingdom Whey Protein Market Size, Share, and COVID-19 Impact Analysis, By Type (Whey Protein Isolates (WPI), Whey Protein Concentrates (WPC), and Whey Protein Hydrolysates (WPH)), By Application (Sports Nutrition, Dietary Supplements, Infant Formula, Food Additives, Beverages, and Feed), and United Kingdom Whey Protein Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited Kingdom Whey Protein Market Size Insights Forecasts to 2033

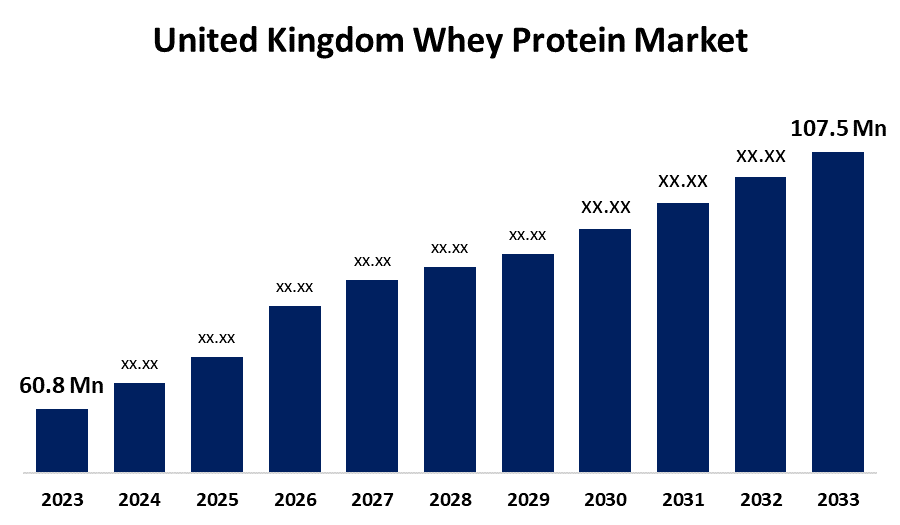

- The U.K. Whey Protein Market Size was valued at USD 60.8 Million in 2023.

- The U.K. Whey Protein Market Size is Growing at a CAGR of 5.86% from 2023 to 2033

- The U.K. Whey Protein Market Size is Expected to reach USD 107.5 Million by 2033

Get more details on this report -

The United Kingdom Whey Protein Market Size is Anticipated to Exceed USD 107.5 Million by 2033, Growing at a CAGR of 5.86% from 2023 to 2033. The Growing adoption of sports & fitness activities and upsurging need for fortified food & beverages are driving the growth of the whey protein market in the UK.

Market Overview

Whey protein market refers to the market selling whey protein which is milk derived protein used as a dietary supplement and food ingredient. The protein also known as whey isolate, is a compound of proteins extracted from whey, a liquid material produced as a byproduct of cheese production. Whey protein consists of α-lactalbumin, β-lactoglobulin, serum albumin, and immunoglobulins. Whey protein is commonly marketed as a protein supplement. There is drawing attention towards the consumption of whey protein owing to the rising awareness of healthy lifestyle and recommendation of protein supplements by fitness and sports clubs. Whey protein is widely used in the food industry in baked goods, dairy products, beverages, cereals, chocolates, and baby foods which is a result of increasing sales of whey protein. The rising interest of consumers towards high-protein snacking and the rising number of companies specializing in protein bars and other fortified products are offering lucrative market growth opportunities for whey protein.

Report Coverage

This research report categorizes the market for the UK whey protein market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom whey protein market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK whey protein market.

United Kingdom Whey Protein Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 60.8 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.86% |

| 2033 Value Projection: | USD 107.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Arla Foods amba, Carbery Food Ingredients Limited, Glanbia PLC, First Milk Limited, Groupe Lactalis, Kerry Group plc, Morinaga Milk Industry Co., Ltd., Royal FrieslandCampina N.V, Volac International Limited, Lactoprot Deutschland GmbH, and Others key Vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growing adoption of sports & fitness activities in the country is responsible for propelling the whey protein market. There is an increasing number of people participating in fitness classes and physical activity along with the government and Sport England support for increasing participation levels. The increasing support by the regulatory bodies for fortifying foods with proteins for enhancing national health metrics is contributing to driving the whey protein market.

Restraining Factors

The increased prevalence of lactose intolerance restricts whey protein adoption for consumption which may hamper the market growth.

Market Segmentation

The United Kingdom Whey Protein Market share is classified into type and application.

- The whey protein concentrates (WPC) segment dominated the market with the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

The United Kingdom whey protein market is segmented by type into whey protein isolates (WPI), whey protein concentrates (WPC), and whey protein hydrolysates (WPH). Among these, the whey protein concentrates (WPC) segment dominated the market with the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The advantages of whey protein concentrates include digestibility, improved muscle content, and low risk of cardiovascular illnesses. The use of WPCs for the manufacturing of yoghurt, beverages, and dairy desserts are propelling the market in the whey protein concentrates (WPC) segment.

- The sports nutrition segment dominated the market with the largest revenue share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom whey protein market is segmented by application into sports nutrition, dietary supplements, infant formula, food additives, beverages, and feed. Among these, the sports nutrition segment dominated the market with the largest revenue share in 2023 and is expected to grow at a significant CAGR during the forecast period. Whey protein is highly appreciated dietary supplement in sport owing to its numerous benefits on performance and muscle recovery. The widespread use of whey protein in sports nutrition and weight management products such as bars, powders, and beverages is driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. whey protein market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arla Foods amba

- Carbery Food Ingredients Limited

- Glanbia PLC

- First Milk Limited

- Groupe Lactalis

- Kerry Group plc

- Morinaga Milk Industry Co., Ltd.

- Royal FrieslandCampina N.V

- Volac International Limited

- Lactoprot Deutschland GmbH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2022, First Milk has agreed a new partnership with Arla Foods Ingredients to produce a specialist whey protein powder at its Lake District Creamery.

- In March 2022, Britain’s largest dairy cooperative, Arla Foods, is planning long-term investments in its UK supply chain, key sales channels and market leading brands like Arla Cravendale, Arla B.O.B, Arla Lactofree, Lurpak, Starbucks and Anchor, as it makes clear its plans to become a leading household name.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Whey Protein Market based on the below-mentioned segments:

UK Whey Protein Market, By Type

- Whey Protein Isolates (WPI)

- Whey Protein Concentrates (WPC)

- Whey Protein Hydrolysates (WPH)

UK Whey Protein Market, By Application

- Sports Nutrition

- Dietary Supplements

- Infant Formula

- Food Additives

- Beverages

- Feed

Need help to buy this report?