United Kingdom White Cement Market Size, Share, and COVID-19 Impact Analysis, By Type (Type I, Type II, and Others), By Application (Residential and Non-Residential), and United Kingdom White Cement Market Insights, Industry Trend, Forecasts to 2033

Industry: Advanced MaterialsUnited Kingdom White Cement Market Insights Forecasts to 2033

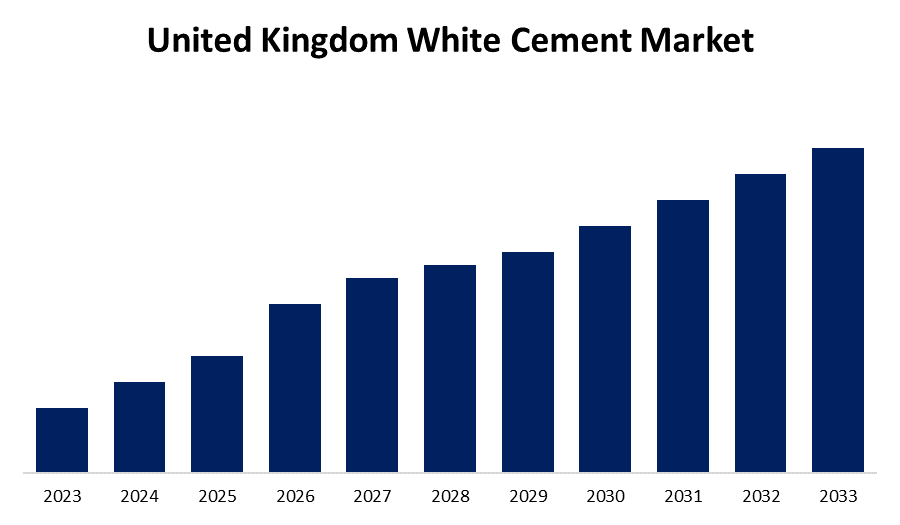

- The Market is growing at a CAGR of 4.24% from 2023 to 2033

- The U.K. White Cement Market Size is expected to hold a significant share by 2033

Get more details on this report -

The United Kingdom White Cement Market is anticipated to hold a significant share by 2033, growing at a CAGR of 4.24% from 2023 to 2033. The increasing demand from construction industry and superior properties over grey cement are driving the growth of the white cement market in the UK.

Market Overview

White cement is a building material that has attractive whiteness and minimal energy use. This cement is frequently used with pigments to provide concrete and mortars eye-catching colours that would otherwise be impossible to achieve with regular grey cement. The presence of iron and manganese is responsible for the white colour of this cement. It is comparable to ordinary portland cement; however, to ensure whiteness, fuel oil is used in place of coal with an iron oxide level of less than 0.4%. It is an essential component of ornamental and architectural concrete used in paints, pavers, terrazzo tiles, and prefabricated goods including tile adhesives and faux walls. The greater focus on creativity and the building of aesthetic and creative senses is anticipated to leverage opportunity for the white cement market. In addition, the industry's broader sustainability goals are aligned with the usage of environmentally friendly white cement ingredients, which have been spurred by the emphasis on green building practices.

Report Coverage

This research report categorizes the market for the UK white cement market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom white cement market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK white cement market.

United Kingdom White Cement Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.24% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Cemex S.A.B. de C.V., Aggregate Industries (Holcim Group), Hanson (HeidelbergCement AG), CRH, Dragon Alpha Cement Ltd, Southern Cement Limited (CRH Company), Breedom Group plc., and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing industrial sector in the UK as well as opportunities for white cement to be used in the construction industry for improved aesthetic and artistic sensibilities upsurge the market demand. The expected rise in the demand for white cement because of the numerous construction projects underway in the United Kingdom is expected to propel the market. For instance, a USD 333 million project called Albion Street in Central Manchester is being developed, featuring a 40-story residential tower and a 14-story office building, which is expected to completed by 2024. Further, the continued trends in infrastructure development, urbanisation, and the demand for premium building material are all responsible for leveraging market expansion. In addition, the architectural trends and commitment to sustainable development are anticipated to drive the market.

Restraining Factors

The increased production cost of white cement as well as the price volatility of raw materials are challenging the UK white cement market.

Market Segmentation

The United Kingdom White Cement Market share is classified into type and application.

- The type I segment dominates the UK white cement market during the forecast period.

The United Kingdom white cement market is segmented by type into type I, type II, and others. Among these, the type I segment dominates the UK white cement market during the forecast period. For nearly every architectural concrete application, genuine, vibrant colours are produced using portland cement as a basis. Low alkali needs can also be fulfilled by this type of white cement. It is also used as a component of cementitious coatings, water-repellent products, tile grout, plastering applications, and masonry mortar.

- The non-residential segment accounted for the largest revenue share of the UK white cement market during the forecast period.

Based on the application, the U.K. white cement market is divided into residential and non-residential. Among these, the non-residential segment accounted for the largest revenue share of the UK white cement market during the forecast period. For tile and paver-related repairs and construction projects, white cement is utilised in the industrial and institutional sectors. Further, it is also used in the renovation and construction of hospitals and educational facilities. The growing development of new office buildings, institutional structures, and other industrial constructions in the UK is driving market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. white cement market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cemex S.A.B. de C.V.

- Aggregate Industries (Holcim Group)

- Hanson (HeidelbergCement AG)

- CRH

- Dragon Alpha Cement Ltd

- Southern Cement Limited (CRH Company)

- Breedom Group plc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom White Cement Market based on the below-mentioned segments:

UK White Cement Market, By Type

- Type I

- Type II

- Others

UK White Cement Market, By Application

- Residential

- Non-Residential

Need help to buy this report?