United States 5G Infrastructure Market Size, Share, and COVID-19 Impact Analysis, By Spectrum (Sub-6 GHz, mmWave, and Others), By Network Architecture (Standalone, Non-Standalone), By Industry Verticals (Enterprise, Corporate, and Industrial), and United States 5G Infrastructure Market Insights Forecasts 2023 - 2033

Industry: Electronics, ICT & MediaUnited States 5G Infrastructure Market Insights Forecasts to 2033

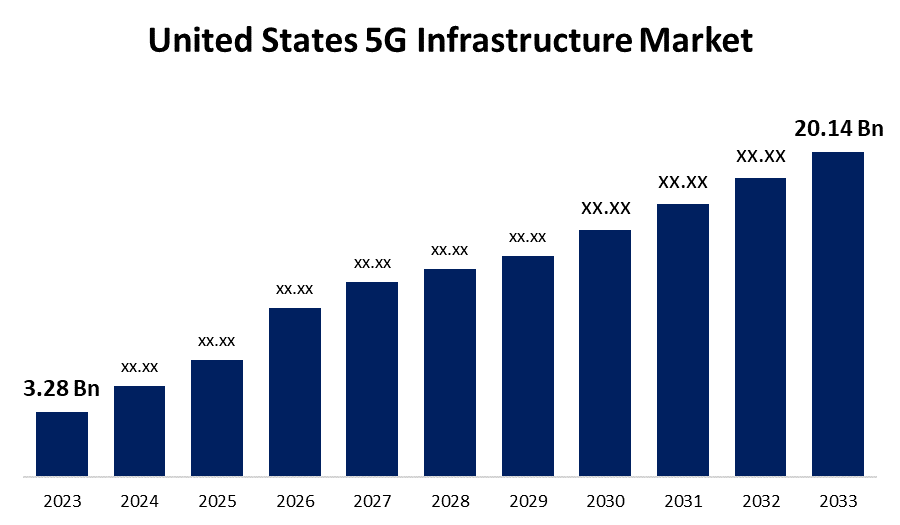

- The United States 5G Infrastructure Market Size Size was valued at USD 3.28 Billion in 2023

- The Market Size is Growing at a CAGR of 19.9% from 2023 to 2033.

- The United States 5G Infrastructure Market Size is Expected to Reach USD 20.14 Billion by 2033.

Get more details on this report -

The United States 5G Infrastructure Market size is Expected to Reach USD 20.14 Billion by 2033, at a CAGR of 19.9% during the forecast period 2023 to 2033.

Market Overview

The 5G infrastructure is a network of equipment, protocols, and technologies designed to support the next generation of wireless communication. It includes improved mobile broadband (eMBB), ultra-reliable low-latency communications (URLLC), and massive machine-type communications (mMTC). It ranges from freestanding (SA) systems, which run on a brand-new network, to non-standalone (NSA) networks, which use existing 4G infrastructure. It provides consumers with quicker and more consistent connections, allowing for seamless streaming, online gaming, and improved telecommuting experiences. Furthermore, data traffic in the United States has been steadily increasing, owing to the population's increased usage of smartphones and the launch of attractive and affordable service plans by providers. Consumer’s increasing consumption of video and audio content highlights the need for reliable connectivity, which 5G networks can provide. 5G technology has a very low latency rate, which has improved user experience while also opening up new opportunities for inventive applications, resulting in market development.

Report Coverage

This research report categorizes the market for the United States 5G infrastructure market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States 5G infrastructure market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States 5G infrastructure market.

United States 5G Infrastructure Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.28 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 19.9% |

| 2033 Value Projection: | USD 20.14 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Spectrum, By Network Architecture, By Industry Verticals. |

| Companies covered:: | Nokia Corporation, Altiostar, Telefonaktiebolaget LM Ericsson, Samsung Electronics Co., Ltd., CommScope Inc., Airspan Networks Holdings Inc., Comba USA, NEC Corporation, Corning, Hewlett Packard Enterprise Development LP, Cisco Systems, Inc., Mavenir, Casa Systems, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising use of 5G technology in the healthcare industry to provide remote consultations and diagnosis is driving market expansion in the United States. It also makes it easier to transmit huge imaging files in real-time, enhances the dependability of remote patient monitoring devices, and promotes the development of AI-powered diagnostic and treatment solutions. In addition, government financing to improve network infrastructure is a significant driver of industry growth. One key reason for this is the increased emphasis on developing smart cities, which provide consumers with greater public safety and security, energy management, and transportation amenities. Furthermore, the increasing availability and efficient use of radio spectrum, which is critical for the implementation of 5G networks, is another primary factor driving market expansion in the United States. Furthermore, the expanding technological breakthroughs in massive MIMO technology, beamforming, and small cell deployments to improve network capacity and coverage are providing a positive market outlook.

Restraining Factors

Significant infrastructure investments are required to implement 5G networks, including the installation of new base stations, small cells, and fiber optic connections. 5G infrastructure rollout requires a denser network design than previous generations of cellular networks due to its emphasis on smaller cell sizes and improved network capacity. This densification raises infrastructure requirements and total capital expenditure, resulting in high initial prices for network operators and service providers. This is projected to limit the market's growth.

Market Segment

- In 2023, the Sub-6 GHz segment accounted for the largest revenue share over the forecast period.

Based on spectrum, the United States 5G infrastructure market is segmented into Sub-6 GHz, mmWave, and others. Among these, the Sub-6 GHz segment has the largest revenue share over the forecast period. This is because the sub-6 GHz spectrum uses older, 4G-like frequencies, it is more dependable and has a greater range than other spectrums. Despite its limited speed, consumers do not face any problems with it. Due to this, leading smartphone and chip manufacturers now choose to have their products support sub-6GHz 5G networks. Furthermore, certain wireless communication technologies like beamforming and massive MIMO are used, which further enhances the signal quality in this area.

- In 2023, the standalone segment is witnessing significant growth over the forecast period.

Based on network architecture, the United States 5G infrastructure market is segmented into standalone, and non-standalone. Among these, the standalone segment is witnessing significant growth over the forecast period. This is a result of the growing number of US activities aimed at developing 5G standalone infrastructure. For instance, AT&T Labs stated that it is developing the nation's first 5G SA Uplink 2-carrier aggregation data call to provide its consumers with more dependable services. Utilizing a dedicated 5G core, the standalone design provides edge functions, ultra-low latency, greater upload rates, and excellent dependability. In the upcoming years, it is anticipated that the increased acceptance of connected technology and ideas like "smart factories" will propel segment expansion at an exponential rate.

- In 2023, the industrial segment is witnessing significant growth over the forecast period.

Based on industry verticals, the United States 5G infrastructure market is segmented into enterprise, corporate, and industrial. Among these, the industrial segment is witnessing significant growth over the forecast period. The demand for fast wireless connectivity is evident in the U.S. as ideas like Industrial IoT and smart factories are being adopted at a rapid pace. The widespread use of sensors, drones, and automated guided vehicles (AGVs) to improve worker safety and efficiency is propelling the use of sophisticated 5G infrastructure. Additionally, 5G makes it possible for sensors on machinery and equipment to gather data more quickly and accurately, which enhances maintenance scheduling, increases machinery longevity, and dramatically lowers process interruptions. It is anticipated that each of these elements will play a significant part in the expanded use of 5G in the industrial environment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States 5G infrastructure market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nokia Corporation

- Altiostar

- Telefonaktiebolaget LM Ericsson

- Samsung Electronics Co., Ltd.

- CommScope Inc.

- Airspan Networks Holdings Inc.

- Comba USA

- NEC Corporation

- Corning

- Hewlett Packard Enterprise Development LP

- Cisco Systems, Inc.

- Mavenir

- Casa Systems

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, American Samoa, a U.S. territory, now has a better connection and a better user experience thanks to the introduction of a non-standalone 5G network by Bluesky, Communications, and Ericsson. With this breakthrough, Bluesky, a local telecom and network service provider, will be able to take advantage of functional 5G features and capabilities to increase area coverage and improve data speeds.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States 5G Infrastructure Market based on the below-mentioned segments:

United States 5G Infrastructure Market, By Spectrum

- Sub-6 GHz

- mmWave

- Others

United States 5G Infrastructure Market, By Network Architecture

- Standalone

- Non-Standalone

United States 5G Infrastructure Market, By Industry Verticals

- Enterprise

- Corporate

- Industrial

Need help to buy this report?