United States Action Figures Market Size, Share, and COVID-19 Impact Analysis, By Type (Superheroes, Movie Characters, Anime Characters, and Others), By End User (Up to 8 Years, 9-15 Years, and 15 Years & Above), By Distribution Channel (Supermarkets & Hypermarkets, Online, Specialty Stores, and Others), and U.S. Action Figures Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsU.S. Action Figures Market Insights Forecasts to 2033

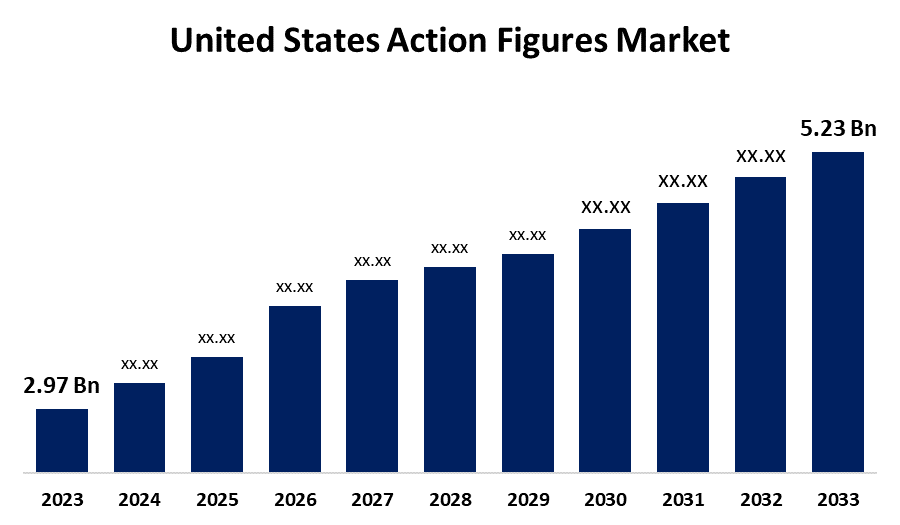

- The United States Action Figures Market Size was Estimated at USD 2.97 Billion in 2023.

- The Market is Growing at a CAGR of 5.82% from 2023 to 2033

- The USA Action Figures Market Size is Expected to Reach USD 5.23 Billion by 2033

Get more details on this report -

The US Action Figures Market Size is Expected to Reach USD 5.23 Billion by 2033, Growing at a CAGR of 5.82% from 2023 to 2033

Market Overview

The industry that produces, distributes, and sells action figures in the US is referred to as the U.S. action figures market. Usually based on characters from video games, comic books, TV series, movies, or creative ideas, action figures are posable toys. These figurines are typically made to appeal to kids, collectors, and franchise lovers. The market offers a vast array of goods, ranging from basic, less expensive toys to intricate, collectible figures that can be offered to adult collectors. The country's action figure market is fueled by fanaticism, nostalgia, and the increasing demand for collectibles. Adults look for connections to treasured childhood memories, while fans interact with intricate figurines of their favorite pop culture personalities. These products have become collectible due to advancements in design and craftsmanship, drawing interest from both investors and consumers. Market expansion is also fueled by a flourishing collector culture and the ongoing appeal of video games, comic books, and films.

Report Coverage

This research report categorizes the market for the U.S. action figures market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. action figures market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. action figures market.

United States Action Figures Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.97 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.82% |

| 2033 Value Projection: | USD 5.23 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Type, By End User, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Hasbro, The LEGO Group, Playmates Toys Ltd., JAKKS Pacific, Inc., Good Smile Company, Inc., Spin Master, McFarlane Toys, Mattel, Bandai Namco Holdings Inc., Diamond Select Toys, and Others key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The US action figures market is driven by the acceptance of high-end, detailed action figures for collecting or display, which is a result of adults (18–49 years old) increasingly considering these figures as investment pieces, culturally significant, or artistically expressive. In addition, many adults interact with intricate figures that depict well-known pop culture icons in an attempt to connect with treasured childhood memories. In addition, Hot Toys and Hasbro's Black Series have enhanced consumer acceptance by using nostalgia and the excitement of possessing exclusive figures to turn mass-market toys into sought-after collectors. Furthermore, action figures have become more widely available due to online shopping, which also makes it simple for customers to buy figures from limited-edition releases or niche businesses.

Restraining Factors

The USA action figures market faces challenges due to consumer expenditure on non-essential products, such as action figures, may decline as a result of economic instability. In addition, the popularity of video games and other digital entertainment can draw people away from real toys and their money. Furthermore, the market expansion may be restricted due to demand for particular kinds of action figures may change in response to changes in customer preferences and interests.

Market Segmentation

The U.S. action figures market share is classified into the type, end user, and distribution channel.

- The superheroes segment accounted for the largest share of 40.27% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the U.S. action figures market is divided into superheroes, movie characters, anime characters, and others. Among these, the superheroes segment accounted for the largest share of 40.27% in 2023 and is expected to grow at a significant CAGR during the forecast period. The growth of comic conventions and the diversification of superhero content beyond traditional comics, including streaming services that offer series centered around superheroes, have given fans additional chances to engage with the superhero world. In addition, segment is growing due to the growth of comic conventions and the diversification of superhero content beyond traditional comics, including streaming services that offer series centered around superheroes, have given fans additional chances to engage with the superhero world.

- The 15 years & above segment accounted for the highest share of 37.80% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the end user, the U.S. action figures market is divided into up to 8 years, 9-15 years, and 15 years & above. Among these, the 15 years & above segment accounted for the highest share of 37.80% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is expanding due to action figures being a common part of this age group's childhood, and as they get older, they still buy figurines to complete their collections or relive happy memories. In addition, adults are increasingly drawn to collectible action figures, with manufacturers offering intricate, limited-edition figures with authenticity and rarity features, despite nostalgia.

- The supermarkets & hypermarkets segment accounted for the largest share of 37.28% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the U.S. action figures market is divided into supermarkets & hypermarkets, online, specialty stores, and others. Among these, the supermarkets & hypermarkets segment accounted for the largest share of 37.28% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing since supermarkets & hypermarkets are so accessible, many of the main toy manufacturers have increased the variety of products they provide by adding action figures from well-known properties like Marvel, Star Wars, Transformers, and Disney. In addition, supermarkets and hypermarkets may draw in a wide range of customers by carrying these popular and in-demand items, which will boost foot traffic and revenue.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. action figures market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hasbro

- The LEGO Group

- Playmates Toys Ltd.

- JAKKS Pacific, Inc.

- Good Smile Company, Inc.

- Spin Master

- McFarlane Toys

- Mattel

- Bandai Namco Holdings Inc.

- Diamond Select Toys

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2023, Hasbro announced that a new line of Transformers One toys based on the upcoming movie will be available at Target in the summer. Quintesson High Commander, Ultimate Energon Optimus Prime, and Energon Glow Bumblebee were among the figures in the range; each had special abilities such as attachments and transformations. The collection also featured packs with a racing theme, such as the Racing Warrior 3-Pack and the Race and Blast 2-Pack.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. action figures market based on the below-mentioned segments:

United States Action Figures Market, By Type

- Superheroes

- Movie Characters

- Anime Characters

- Others

United States Action Figures Market, By End User

- Up to 8 Years

- 9-15 Years

- 15 Years & Above

United States Action Figures Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online

- Specialty Stores

- Others

Need help to buy this report?