United States Agricultural Tractors Market Size, Share, and COVID-19 Impact Analysis, By Tractor Type (Utility Tractors, Row Crop Tractors, Garden & Orchard Type Tractors, Other), By Horse Power (Below 40 HP, 40-100 HP, and above 100 HP), and United States Agricultural Tractors Market Insights Forecasts to 2032

Industry: Machinery & EquipmentUnited States Agricultural Tractors Market Insights Forecasts to 2032

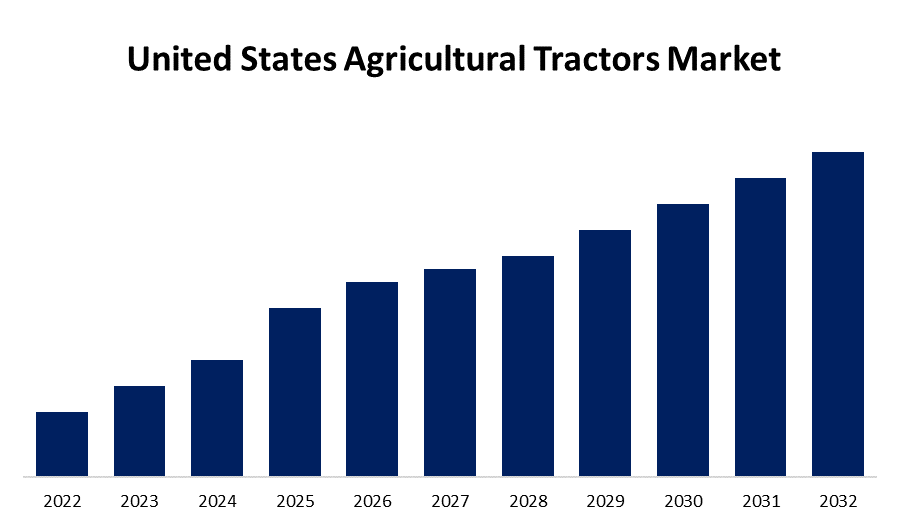

- The Market Size is Growing at a CAGR of 3.47% from 2022 to 2032.

- The United States Agricultural Tractors Market Size is Expected to Hold a Significant Share by 2032.

Get more details on this report -

The United States Agricultural Tractors Market Size is Expected To Hold a significant share by 2032, at a CAGR of 3.47% during the forecast period 2022 to 2032.

Market Overview

Agricultural tractors are primarily used in farms for a variety of farming operations such as tilling, ploughing, and planting fields. They are also utilized for other farming tasks like removing bushes and spreading fertilizer. To meet the needs of customers, a large variety of contemporary agricultural tractors are offered in the market. Growing urbanization has made it more difficult to find skilled workers for agricultural tasks. The market for agricultural tractors is predicted to boost demand as a result of this shortage. Furthermore, A significant advancement in farming techniques has been made possible by evolving industry trends and the creation of increasingly advanced agricultural machinery. Farm mechanization decreased operational risks, enhanced product quality, and increased productivity. But as technology advances, driverless tractors which make use of GPS data and electrical sensors might become useful. Due to their large farm sizes and high levels of mechanization, the United States and Canada are the region's two main markets. Moreover, the newest precision agriculture technology is included in these new tractors, which also gives consumers the option to customize the machine's configuration, features, and horsepower to best suit their needs. These factors boost the market growth in the United States.

Report Coverage

This research report categorizes the market for the United States agricultural tractors market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States agricultural tractors market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each United States agricultural tractors market sub-segment.

United States Agricultural Tractors Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 3.47% |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Tractor Type, By Horse Power. |

| Companies covered:: | Mahindra & Mahindra Ltd, John and Deere, AGCO Corp., Claas KGaA mbH, CNH Industrial NV, Same Deutz-Fahr Deutschland GmbH, Kubota Corporation, Escorts Limited, Tractors and Farm Equipment Ltd, Kverneland Group, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States government's increased use of subsidies to encourage farm mechanization to achieve high yields is contributing to the rise in tractor sales. In addition, technological developments are supporting greater farm mechanization and increasing farmers' awareness of its advantages. A lot of companies have been launching new farm agriculture tractors, which has enabled them to control the market through quicker product launches and improvements. Several significant industry participants are investing in R&D to create innovative machinery and maintain a dominant market share. Agricultural tractor sales in the market are driven by this factor.

Restraining Factors

The agriculture tractor market may be constrained by the lack of workers with the necessary skills to operate specialized and contemporary tractors.

Market Segment

- In 2022, the row crop tractors segment accounted for the largest revenue share over the forecast period.

Based on the tractor type, the United States agricultural tractors market is segmented into utility tractors, row crop tractors, garden & orchard type tractors, and others. Among these, the row crop tractors segment has the largest revenue share over the forecast period. The row crop tractors are great for large-area farmers since they can easily push and pull heavy implements. This type of equipment can perform a variety of tasks including ploughing, harrowing, and weed control. The main function of this machine is to grow crops in a row and then cultivate these crops. These factors will boost the market growth in the forecast period.

- In 2022, the below 40 HP segment accounted for the largest revenue share over the forecast period.

Based on the horse power, the United States agricultural tractors market is segmented into below 40 HP, 40-100 HP, and above 100 HP. Among these, the below 40 HP segment has the largest revenue share over the forecast period. The low cost, small size, and increased convenience provided by less than 40 HP tractors to carry out all routine farming tasks can be credited for the significant growth. The below 40 HP category is expected to grow at the fastest rate due to the growing demand for high-power agricultural tractors for farms larger than 10 hectares, which is anticipated to be a long-term factor.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States agricultural tractors market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mahindra & Mahindra Ltd

- John and Deere

- AGCO Corp.

- Claas KGaA mbH

- CNH Industrial NV

- Same Deutz-Fahr Deutschland GmbH

- Kubota Corporation

- Escorts Limited

- Tractors and Farm Equipment Ltd

- Kverneland Group

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2022, John Deere developed a fully autonomous tractor that is ready for mass production. The device integrates new cutting-edge technologies, a GPS guidance system, a TruSet-enabled chisel plough, and a Deere 8R tractor. Farmers will be able to purchase autonomous tractors in the upcoming years.

Market Segment

This study forecasts regional and country revenue from 2021 to 2032. Spherical Insights has segmented the United States agricultural tractors market based on the below-mentioned segments:

United States Agricultural Tractors Market, By Tractor Type

- Utility Tractors

- Row Crop Tractors

- Garden & Orchard Type Tractors

- Others

United States Agricultural Tractors Market, By Horse Power

- Below 40 HP

- 40-100 HP

- Above 100 HP

Need help to buy this report?