United States Air Conditioner Market Size, Share, and COVID-19 Impact Analysis, By Air Conditioner System Type (Portable, Split, Cassette, Window, Single Packed, Chillers, and Airside), By Application (Residential, Commercial, and Industrial Applications), and United States Air Conditioner Market Insights, Industry Trend, Forecasts to 2033

Industry: Electronics, ICT & MediaUnited States Air Conditioner Market Insights Forecasts to 2033

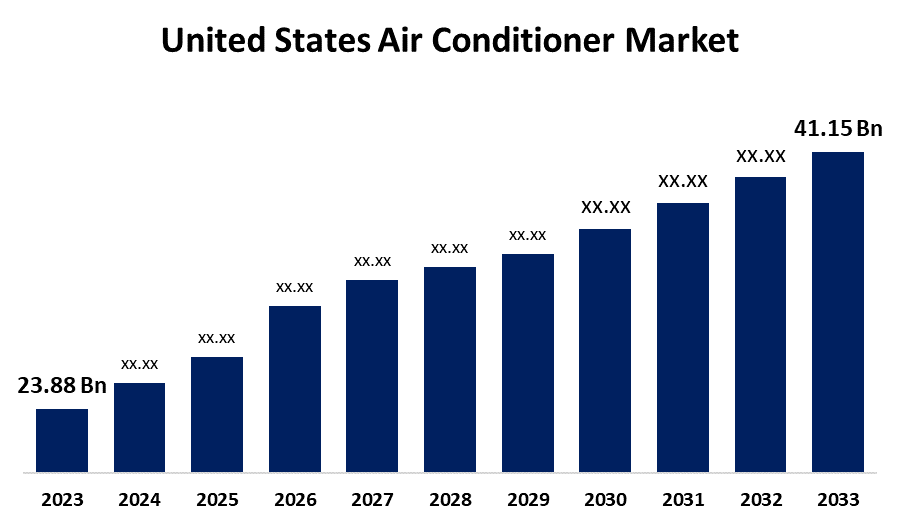

- The United States Air Conditioner Market Size was valued at USD 23.88 Billion in 2023.

- The Market is growing at a CAGR of 5.59% from 2023 to 2033

- The United States Air Conditioner Market Size is expected to reach USD 41.15 Billion by 2033

Get more details on this report -

The United States Air Conditioner Market is anticipated to exceed USD 41.15 Billion by 2033, growing at a CAGR of 5.59% from 2023 to 2033.

Market Overview

The technique of eliminating heat from an enclosed room to achieve a more comfortable interior temperature sometimes referred to as "comfort cooling" and, in certain situations, rigorously managing the humidity of interior air is known as air conditioning, often abbreviated as A/C. Individuals can attain air conditioning using several techniques such as passive and ventilative cooling, or by using a mechanical 'air conditioner'. The market is expanding due to the widespread usage of air conditioners (AC) in the commercial, industrial, and residential domains. The rapid temperature rise caused by climate change is driving up demand for air conditioners in cooler places like Portland, Seattle, and Oregon, among others. This is driving up industrial growth. The United States middle-class and lower-class families' increasing need for affordable air conditioners (AC) is driving the market's expansion. The development of energy-efficient and sustainable air conditioners (AC) is accelerating, which is providing further fuel to the industry expansion. The efficiency and appeal of modern air conditioning systems to businesses have increased due to technological improvements. Smart controls, better refrigerants, and energy-efficient designs are examples of innovations in industrial air conditioning system utilization that assist businesses in cutting expenses and enhancing sustainability. The adoption of new systems is propelled by these improvements.

Report Coverage

This research report categorizes the market for the United States air conditioner market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the air conditioner market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the air conditioner market.

United States Air Conditioner Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 23.88 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 5.59% |

| 2033 Value Projection: | USD 41.15 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Air Conditioner System Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Nortek, AB Electrolux, LG Electronics, DAIKIN INDUSTRIES, Ltd., Fujitsu General Limited, Johnson Controls, and Others Key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The sector is expanding as a result of the increasing incorporation of cutting-edge technology like 3D printing in the production of air conditioners. It is anticipated that the ability of 3D printing to efficiently tailor air conditioner designs to customers' preferences would increase demand for these products. Furthermore, it is projected that the application of 3D printing will improve the air conditioners' manufacturing speed and cost-effectiveness, which will fuel market expansion during the projected period. The market is anticipated to develop as a result of the increased research being done to improve the energy and cost-effectiveness of air conditioners. The air conditioning business is expected to increase rapidly due to the adoption of thin and environmentally friendly saline membranes to lower the cost of AC units. Furthermore, it is expected to enhance market growth when solar thermal energy is used as an AC power source to reduce utility costs and increase air conditioner sustainability. There is a growing number of researchers working on developing non-air or water-based cooling solutions, which should help the market expand.

Restraining Factors

Obstacles impeding market expansion include energy consumption, cost, environmental concerns, and the need to convert older facilities to accommodate sophisticated technology. Persuading customers of the advantages of more recent technologies is still a difficult task.

Market Segmentation

The United States air conditioner market share is classified into air conditioner system type and application.

- The chillers segment is expected to hold the largest market share through the forecast period.

The United States air conditioner market is segmented by air conditioner system type into portable, split, cassette, window, single packed, chillers, and airside. Among them, the chillers segment is expected to hold the largest market share through the forecast period. This technique serves as both a cost-effective means of cooling down the machinery and a safeguard against overheating. Additionally, chiller air conditioning systems offer lower operating expenses and lower power bills. Considering their lower operating expenses, they also offer strong cooling levels.

- The commercial segment dominates the market with the largest market share over the predicted period.

The United States air conditioner market is segmented by application into residential, commercial, and industrial applications. Among them, the commercial segment dominates the market with the largest market share over the predicted period. This is a result of both the growing demand for business space and the rate of urbanization. Commercial air conditioning systems, which are found on the rooftops of buildings like hotels, retail centers, theatres, and offices, take up a lot of space. They take into consideration the ideal energy usage. Therefore, replacing and retrofitting AC units are the best ways to reduce their energy usage. In the upcoming years, it is anticipated that this will accelerate the deployment of air conditioning systems in commercial spaces.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States air conditioner market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nortek

- AB Electrolux

- LG Electronics

- DAIKIN INDUSTRIES, Ltd.

- Fujitsu General Limited

- Johnson Controls

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2022, Personalized Air Conditioning, a South Florida-based HVAC, generator, and home services business that has been active in the neighborhood since 1970, was acquired by Air Pros USA, a Fort Lauderdale-based company. As an Air Pros USA Company, Personalized Air will gain from complete operational and sales integration with the Air Pros USA platform to take advantage of increased resources and maintain the company's 50-year commitment to providing superior customer service.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Air Conditioner Market based on the below-mentioned segments:

United States Air Conditioner Market, By Air Conditioner System Type

- Portable

- Split

- Cassette

- Window

- Single Packed

- Chillers

- Airside

United States Air Conditioner Market, By Application

- Residential

- Commercial

- Industrial Applications

Need help to buy this report?