United States Air Freshener Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Sprays/Aerosols, Electric Air Fresheners, Gels, Candles, and Others), By Application (Residential, Commercial, Cars, and Others), and United States Air Freshener Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited States Air Freshener Market Insights Forecasts to 2033

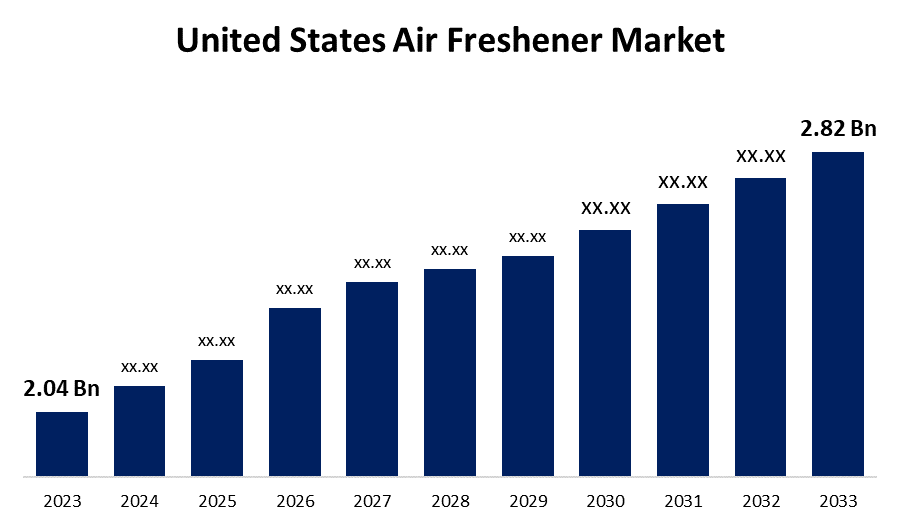

- The U.S. Air Freshener Market Size was valued at USD 2.04 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.29% from 2023 to 2033

- The U.S. Air Freshener Market Size is expected to reach USD 2.82 Billion by 2033

Get more details on this report -

The United States Air Freshener Market is anticipated to exceed USD 2.82 Billion by 2033, growing at a CAGR of 3.29% from 2023 to 2033. The growing urbanization, population density, and increasing awareness of indoor air quality are driving the growth of the air freshener market in the US.

Market Overview

An air freshener is a product that is typically used to freshen, clean, smell, or deodorise the air in the surrounding area. According to a recent survey by the Simmons National Consumer Survey (NHCS) and Census data, over 80% of Americans use air freshener items, mostly for home use. Manufacturers are experimenting a lot with perfumes as there is widespread consumer awareness and product adjustments. The current all-time high demand for essential oils in perfumes suggests a progressive diversification of products in this area. Consumers believe that air fresheners do more than merely mask odours; they also enhance the ambiance of their homes and their well-being. The market is reflecting growing customer interest in natural and eco-friendly formulations, which is in line with a trend towards sustainable and health-conscious consumer choices. Product innovations that combine convenience, health advantages, and environmental friendliness are becoming more and more popular. Examples of these innovations include smart air fresheners that come with GPS and USB ports, as well as a range of forms like sprays, gels, and candles. Due to their longer-lasting scents, mobility, and convenience compared to traditional air fresheners, electric air fresheners are becoming more and more popular among consumers. Electric air fresheners have a lot of room to develop as more consumers become aware of the product and its benefits over more conventional options.

Report Coverage

This research report categorizes the market for the US air freshener market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States air freshener market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US air freshener market.

United States Air Freshener Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 2.04 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 3.29% |

| 023 – 2033 Value Projection: | USD 2.82 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Procter & Gamble Co., Reckitt Benckiser Group plc, SC Johnson & Son Inc., Church & Dwight Co. Inc., California Scents, Farcent Enterprise Co., Ltd., Kobayashi Pharmaceutical Co., Ltd., ACS International Products, Inc., Candle-lite Company, Henkel AG & Co. KGaA, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The growing urbanization, population density, and increasing awareness of indoor air quality are significantly driving the market growth. The rising economic indicators such as disposable income, population growth, and per capita income of the US people are contributing to the market growth. The rising auto sales, an increase in pet ownership, and customer willingness to spend more on upscale goods like air fresheners are anticipated to drive the market. The growing demand for public spaces to have clean air and proper hygiene is also responsible for propelling the market growth.

Restraining Factors

The high cost of production and product delivery is contributing to impede that market growth. The rise in sensitivities to particular ingredients in air fresheners is anticipated to hamper market expansion.

Market Segmentation

The United States Air Freshener Market share is classified into product type and application.

- The sprays/aerosols segment held the largest market share during the forecast period.

The United States air freshener market is segmented by product type into sprays/aerosols, electric air fresheners, gels, candles, and others. Among these, the sprays/aerosols segment held the largest market share during the forecast period. The product’s superior odour-neutralising qualities- which are further boosted by the chemicals found in the aerosol/spray cans, are driving the market demand.

- The residential segment dominates the US air freshener market during the forecast period.

Based on the application, the U.S. air freshener market is divided into residential, commercial, cars, and others. Among these, the residential segment dominates the US air freshener market during the forecast period. The growing trend of customers gradually realising that a well-scented home is a year-round requirement. According to a poll, 10% of consumers carry an air freshener product in their supermarket bag.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. air freshener market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Procter & Gamble Co.

- Reckitt Benckiser Group plc

- SC Johnson & Son Inc.

- Church & Dwight Co. Inc.

- California Scents

- Farcent Enterprise Co., Ltd.

- Kobayashi Pharmaceutical Co., Ltd.

- ACS International Products, Inc.

- Candle-lite Company

- Henkel AG & Co. KGaA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, Lysol, a Reckitt brand, announced the launch in the U.S. of its new Lysol Air Sanitizer, the first and only air sanitizing spray approved by the EPA, that kills 99.9% of airborne viruses and bacteria while eliminating odours in the air.

- In April 2022, Phoenix Flavors and Fragrances (“Phoenix” or the “Company”), a leading developer and compounder of high-performance flavors and fragrances, announced the acquisition of Innovative Fragrances Inc. (“IFI”), an Atlanta-based developer and compounder of fragrance compounds serving a diverse set of end markets, including home fragrance, personal care, candles, and other air fresheners.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Air Freshener Market based on the below-mentioned segments:

US Air Freshener Market, By Product Type

- Sprays/Aerosols

- Electric Air Fresheners

- Gels

- Candles

- Others

US Air Freshener Market, By Application

- Residential

- Commercial

- Cars

- Others

Need help to buy this report?