United States Airframe MRO Market Size, Share, and COVID-19 Impact Analysis, By Aircraft Type (Fixed Wing and Rotary Wing), By Component (Fuselage, Wings & Rotors, Landing Gears, and Others), By Application (Commercial Aviation, Military Aviation, and General Aviation), and U.S. Airframe MRO Market Insights, Industry Trend, Forecasts to 2033

Industry: Aerospace & DefenseUnited States Airframe MRO Market Insights Forecasts to 2033

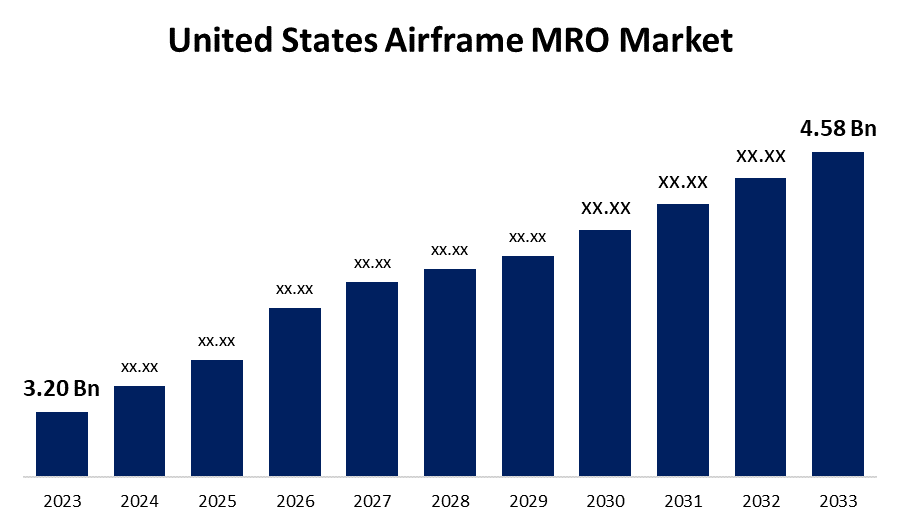

- The U.S. Airframe MRO Market Size was Valued at USD 3.20 Billion in 2023

- The U.S. Airframe MRO Market Size is Growing at a CAGR of 3.65% from 2023 to 2033

- The U.S. Airframe MRO Market Size is Expected to Reach USD 4.58 Billion by 2033

Get more details on this report -

The U.S. Airframe MRO market size is anticipated to exceed USD 4.58 Billion by 2033, growing at a CAGR of 3.65% from 2023 to 2033. The USA airframe MRO is driven by the aging fleet of aircraft, intense FAA regulations, and growing air travel. Growth in predictive maintenance and digital products increases efficiency.

Market Overview

The USA airframe maintenance, repair, and overhaul (MRO) market is the industry dedicated to the maintenance, repair, and overhaul of the airframes of aircraft used in the United States. These activities include inspections, modifications, corrosion prevention, painting, and structural repair of commercial, military, and general aviation airframes. Moreover, the growth of the United States Airframe MRO market is driven by ageing aircraft fleets, rising demand for air travel, and stringent FAA regulations. Improved predictive maintenance, automation, and digital MRO solutions increase efficiency. Growth in defence spending and commercial aviation expansion also increases demand. Moreover, the move towards sustainable materials and light airframes offers new opportunities, and alliances between airlines and MRO companies facilitate market growth. For instance, in September 2022, the US Department of Defense (DoD) awarded two five-year, USD 1.8 billion contracts to Rolls-Royce to maintain US Navy and Marine Corps aircraft engines. The initial contract is for intermediate, depot-level maintenance and logistics support on more than 200 Rolls-Royce F405 engines powering USA Navy T-45 flight trainer aircraft. The second contract is for depot-level engine repair services for Rolls-Royce AE 2100D3 turboprop engines that drive C-130J and KC-130J transport airport aircraft operated by the US Marine Corps.

Report Coverage

This research report categorizes the market for the U.S. airframe MRO market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA airframe MRO market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US airframe MRO market.

United States Airframe MRO Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.20 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | CAGR of 3.65% |

| 023 – 2033 Value Projection: | USD 4.58 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Aircraft Type, By Application |

| Companies covered:: | AAR CORP Delta Airlines, Inc. Lufthansa Technik Singapore Technologies Engineering Ltd. Barnes Aerospace Aviation Technical Services StandardAero RTX Corporation General Electric Company Honeywell International Inc. Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The US airframe MRO market is spurred by fleet growth, rising utilization of aircraft, and a commitment to extending the lifespan of aircraft. Airlines are prompted to outsource MRO operations due to growing demand for cost-efficient maintenance solutions. Technological innovations such as AI-based diagnostics and robotics-based inspections enhance efficiency. Low-cost carriers and e-commerce-driven airfreight aviation growth also contribute to demand, supported by regulatory requirements to ensure uniform maintenance cycles and drive market growth.

Restraining Factors

High labor costs, lack of skilled technicians, and strict compliance with regulations contribute to higher operating costs. Long turnaround times and supply chain interruption further test the MRO suppliers, restricting the market growth and efficiency.

Market Segmentation

The U.S. airframe MRO market share is classified into aircraft type, component, and application.

- The fixed wing segment accounted for the largest share of the USA airframe MRO market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of aircraft type, the USA airframe MRO market is divided into fixed wing and rotary wing. Among these, the fixed wing segment accounted for the largest share of the USA airframe MRO market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is because of the large commercial airline, cargo, and military aircraft fleets. High flight hours, high maintenance standards mandated by the FAA, and older aircraft fuel demand. Furthermore, rising air transport and fleet modernization programs also increase fixed-wing aircraft MRO service demand further solidifying their market leadership.

- The fuselage segment accounted for a substantial share of the U.S. airframe MRO market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of component, the U.S. airframe MRO market is divided into fuselage, wings & rotors, landing gears, and others. Among these, the fuselage segment accounted for a substantial share of the U.S. airframe MRO market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is due to its high-level importance for aircraft safety and structure. The necessity for recurring inspections, damage repair, and corrosion prevention, and the resultant high demand for maintenance create strong demand factors. Furthermore, older fleets of aircraft and compliance-driven FAA regulatory environments guarantee high fuselage MRO activity to support the continuous presence of revenue flow.

- The commercial aviation segment accounted for the largest share of the US airframe MRO market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of application, the US airframe MRO market is divided into commercial aviation, military aviation, and general aviation. Among these, the commercial aviation segment accounted for the largest share of the US airframe MRO market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is Because of the large number of aeroplanes, intense flight frequency, and strict FAA maintenance regulations. Increasing passenger volumes, fleet growth, and old aircraft motivate MRO needs. Furthermore, cost-cutting measures by airlines promote outsourcing of MRO activities, which stimulates further growth in the commercial aviation business segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States airframe MRO market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AAR CORP

- Delta Airlines, Inc.

- Lufthansa Technik

- Singapore Technologies Engineering Ltd.

- Barnes Aerospace

- Aviation Technical Services

- StandardAero

- RTX Corporation

- General Electric Company

- Honeywell International Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024s, AAR CORP. revealed a five-year indefinite-delivery/indefinite-quantity contract with an estimated value of around USD 1.2 billion to the US Navy's Naval Air Systems Command (NAVAIR). The contract includes P-8A Poseidon depot airframe maintenance and depot field team support for the US Navy, Australian government, and foreign military sales customers.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. airframe MRO market based on the below-mentioned segments:

U.S. Airframe MRO Market, By Aircraft Type

- Fixed Wing

- Rotary Wing

U.S. Airframe MRO Market, By Component

- Fuselage

- Wings & Rotors

- Landing Gears

- Others

U.S. Airframe MRO Market, By Application

- Commercial Aviation

- Military Aviation

- General Aviation

Need help to buy this report?