United States Alkylate Gasoline Market Size, Share, and COVID-19 Impact Analysis, By Engine Type (2-Stroke and 4-Stroke), By Application (Automotive, Agriculture, and Others), and US Alkylate Gasoline Market Insights, Industry Trend, Forecasts to 2033.

Industry: Energy & PowerUnited States Alkylate Gasoline Market Insights Forecasts to 2033

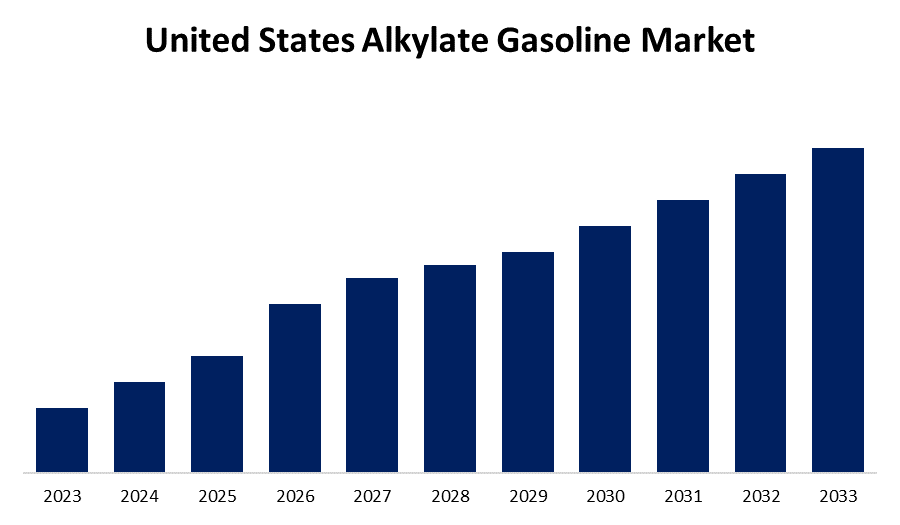

- The Market is growing at a CAGR of 6.7% from 2023 to 2033

- The U.S. Alkylate Gasoline Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The US Alkylate Gasoline Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 6.7% from 2023 to 2033.

Market Overview

Alkylate is a type of gasoline blend made by reacting olefins with normal hydrocarbons using acid catalysts to create iso-alkanes with increased boiling points and octane levels. Alkylate fuel is a high-octane gasoline made by alkylation, a process that mixes isobutane with propylene or butylene using an acid catalyst. Alkylate gasoline has a high-octane rating, minimal sulfur content, and no aromatics, resulting in reduced vehicle emissions. It also has minimal fuel volatility and evaporative emissions, making it ideal for areas with air pollution problems. The increase in lawn and garden equipment sales is driving the growth of the alkylate gasoline market, as more alkylate gasoline is being used in these areas. Alkylate gasoline is ideal for smaller engines like those in lawnmowers, chainsaws, and other outdoor power equipment. It has a significantly longer duration of preservation compared to standard gasoline, thus making it a perfect choice for equipment that is not used frequently. Furthermore, the growth of gardens, parks, and landscaping efforts in residential, commercial, and public areas will result in an increased need for alkylate gasoline in the projected timeframe.

Report Coverage

This research report categorizes the market for the US alkylate gasoline market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States alkylate gasoline market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. alkylate gasoline market.

United States Alkylate Gasoline Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.7% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Engine Type, By Application |

| Companies covered:: | Neste, Warter Fuels, Preem, Haltermann, Aspen, Hercutec Chemie, Gulf Pro Fuels, Lukoil, Shell, BP, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Because of strict environmental regulations and aggressive goals to reduce carbon emissions, there is increasing use of alkylate gasoline in lawnmowers, generators, motorcycles, and small agricultural equipment. Alkylate gasoline is preferred for 4T engines over 2T engines as it emits less greenhouse gases, which is necessary for powering smaller equipment like mowers, hedge trimmers, and chainsaws due to the high demand for recreational equipment, marine engines, and high-performance vehicles. The existence of extensive agriculture, including landscaping and forestry, also aids in the expansion of the market.

Restraining Factors

The market for Alkylate gasoline was adversely affected by the COVID-19 pandemic. Lockdowns, travel restrictions, and economic slowdowns caused a decline in oil and gasoline demand amid the pandemic. This has led to decreased prices for crude oil and gasoline, including alkylating gasoline.

Market Segmentation

The US alkylate gasoline market share is classified into product type and material type.

- The 2-stroke segment is expected to hold a significant market share through the forecast period.

The United States alkylate gasoline market is segmented, by engine type into 2-stroke and 4-stroke. Among these, the 2-stroke segment is expected to hold a significant market share through the forecast period. Due to its use in compact, portable devices like chainsaws, leaf blowers, and a few marine outboard engines. The increasing need for alkylate gasoline in two-stroke engines is driven by the necessity of cleaner-burning properties for the upkeep and durability of small engines in this equipment.

- The automotive segment is expected to dominate the US alkylate gasoline market during the projected period.

Based on the application, the United States alkylate gasoline market is divided into automotive, agriculture, and others. Among these, the automotive segment is expected to dominate the US alkylate gasoline market during the projected period. The automotive sector is the top segment in the market because of its increasing need for an additive in high-quality gasoline. It boosts the octane level and minimizes emissions in high-performance car fuels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States alkylate gasoline market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Neste

- Warter Fuels

- Preem

- Haltermann

- Aspen

- Hercutec Chemie

- Gulf Pro Fuels

- Lukoil

- Shell

- BP

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, Next Wave Energy Partners LP introduced Project Traveler, a facility that produces alkylate from ethylene, at its site in Pasadena, Texas, close to the Houston Ship Channel. The factory is currently manufacturing Optimate, which is an alkylate with zero olefins that have low sulfur, high octane, and low RVP. The product is being sold as a gasoline additive to address the increasing need for more environmentally friendly fuels in North America.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Alkylate Gasoline Market based on the below-mentioned segments:

United States Alkylate Gasoline Market, By Engine Type

- 2-Stroke

- 4-Stroke

United States Alkylate Gasoline Market, By Application

- Automotive

- Agriculture

- Others

Need help to buy this report?