US Alternative Protein Ingredients Market Size, Share, and COVID-19 Impact Analysis, By Product (Micro-based Protein, Plant Protein, and Insect Protein), By Application (Ready to Drink Nutritional Drinks, Instant Nutritional Drinks, Animal Feed, and Others), and United States Alternative Protein Ingredients Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsUS Alternative Protein Ingredients Market Insights Forecasts to 2033

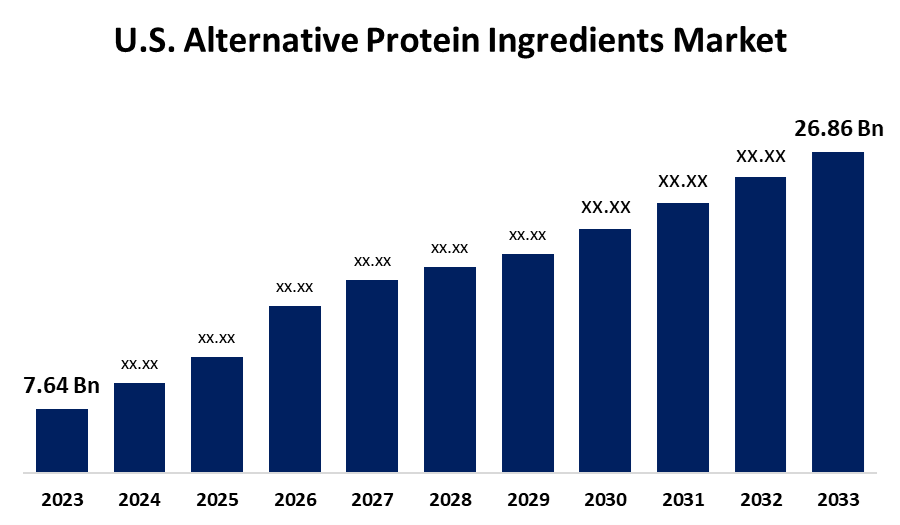

- The USA Alternative Protein Ingredients Market Size was estimated at USD 7.64 billion in 2023.

- The Market Size is Growing at a CAGR of 13.40% from 2023 to 2033

- The United States Alternative Protein Ingredients Market Size is Expected to Reach USD 26.86 billion by 2033

Get more details on this report -

The U.S. Alternative Protein Ingredients Market Size is Expected to Reach USD 26.86 billion by 2033, growing at a CAGR of 13.40% from 2023 to 2033.

Market Overview

The market for alternative protein ingredients in the United States is the sector devoted to creating and distributing protein sources that are substitutes for conventional animal-based proteins. These substitutes include microbe-based proteins, insect proteins, and plant-based proteins (such as soy, pea, rice, and hemp). The growing popularity of fitness culture, weight management, and muscle-building trends has fueled a move toward high-protein diets and increased demand for protein-based goods. Additionally, the market is growing due to protein-enriched meals and drinks, such as protein bars, powders, plant-based meat substitutes, and functional dairy products, are becoming more and more popular among consumers. In addition, the industry is expanding as a result of social media and fitness influencers raising awareness of the advantages of eating protein. Furthermore, the market is driven by technology improvements and growing public acceptance, the industrial landscape has seen enormous investment in the development of novel protein sources, such as cultured meat and microbial proteins.

Report Coverage

This research report categorizes the market for the US alternative protein ingredients market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States alternative protein ingredients market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA alternative protein ingredients market.

U.S. Alternative Protein Ingredients Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.64 billion |

| Forecast Period: | 2023 – 2033. |

| Forecast Period CAGR 2023 – 2033. : | 13.40% |

| 023 – 2033. Value Projection: | USD 26.86 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Application, By Product and COVID-19 Impact Analysis |

| Companies covered:: | ADM, Cargill Inc., Lightlife Foods, Inc., Impossible Foods Inc., Axiom Foods Inc., Tate & Lyle PLC, SunOpta Inc., Glanbia plc, Ingredion Inc., Kerry Group, Glanbia plc, AGT Food and Ingredients, The Green Labs LLC., Harvest Innovations, Emsland Group, Ynsect and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is expanding significantly due to being driven by growing consumer consciousness of ethical, sustainable, and health issues. Additionally, the U.S. alternative protein ingredients market is growing because the increased demand for cruelty-free and ecologically friendly protein sources has prompted food producers to investigate and develop innovative concepts in the alternative protein market. In addition, growing consumer desires for more sustainable, functional, and healthier nutrition options are driving product innovation in the US alternative protein ingredients market through developments in plant-based, microbial, and alternative protein technologies.

Restraining Factors

The United States alternative protein ingredients market faces challenges since plant-based proteins frequently contain allergens, including soy, nuts, and legumes, negative effects from allergies may slow down the market for alternative proteins by deterring consumers from attempting or regularly consuming these products.

Market Segmentation

The USA alternative protein ingredients market share is classified into the product and the application.

- The plant protein segment accounted for the largest share of 68.42% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the product, the United States alternative protein ingredients market is divided into micro-based protein, plant protein, and insect protein. Among these, the plant protein segment accounted for the largest share of 68.42% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing due to plant-based proteins becoming more and more popular among consumers because of their alleged health advantages, which include lower cholesterol, fewer saturated fats, and a higher fiber content. In addition, the demand for pea, soy, almond, and rice proteins in regular diets has increased due to rising awareness of heart health, diabetes prevention, and weight management.

- The animal feed segment accounted for the highest share of 12.38% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the application, the US alternative protein ingredients market is divided into ready-to-drink nutritional drinks, instant nutritional drinks, animal feed, and others. Among these, the animal feed segment accounted for the highest share of 12.38% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is growing due to the desire for creative animal feed solutions, which is fueled by the expansion of the US livestock industry, and alternative proteins provide a scalable and cost-effective substitute for conventional components.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States alternative protein ingredients market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ADM

- Cargill Inc.

- Lightlife Foods, Inc.

- Impossible Foods Inc.

- Axiom Foods Inc.

- Tate & Lyle PLC

- SunOpta Inc.

- Glanbia plc

- Ingredion Inc.

- Kerry Group

- Glanbia plc

- AGT Food and Ingredients

- The Green Labs LLC.

- Harvest Innovations

- Emsland Group

- Ynsect

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2024, the French insect protein business Innova Feed collaborated with ADM to build its first U.S. pilot facility in Decatur, Illinois, to increase the production of insect-based protein. Utilizing ADM's maize processing waste, the facility will produce up to 20,000 tons of oils and 60,000 metric tons of animal feed protein annually.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States alternative protein ingredients market based on the below-mentioned segments:

US Alternative Protein Ingredients Market, By Product

- Micro-based Protein

- Plant Protein

- Insect Protein

US Alternative Protein Ingredients Market, By Application

- Ready to Drink Nutritional Drinks

- Instant Nutritional Drinks

- Animal Feed

- Others

Need help to buy this report?