United States Ambulatory Surgical Centers Market Size, Share, and COVID-19 Impact Analysis, By Type of Center (Single-specialty, Multi-specialty), By Ownership (Physician-owned, Hospital-owned, Corporate-owned), By Application (Diagnostic Services, Surgical Services), and US Ambulatory Surgical Centers Market Insights Forecasts to 2032

Industry: HealthcareUnited States Ambulatory Surgical Centers Market Insights Forecasts to 2032

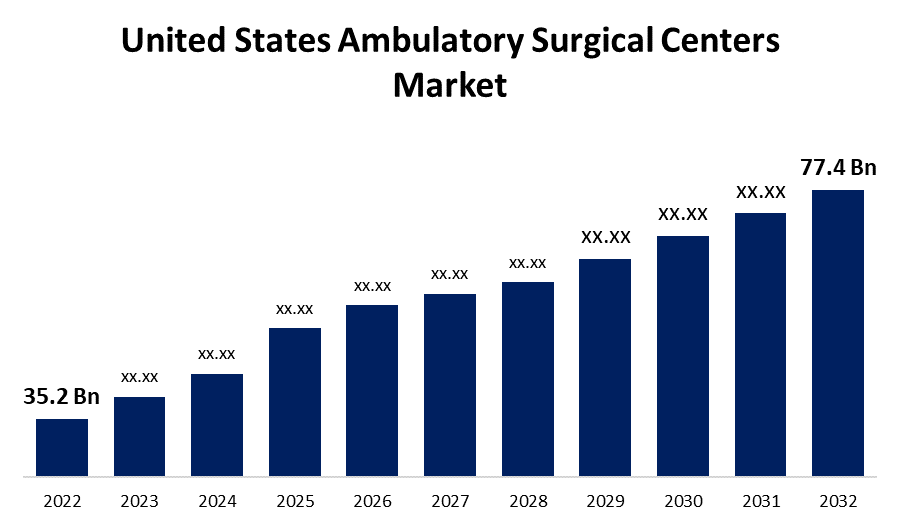

- The United States Ambulatory Surgical Centers Market Size was valued at USD 35.2 Billion in 2022

- The Market Size is Growing at a CAGR of 8.2% from 2022 to 2032

- The United States Ambulatory Surgical Centers Market Size is Expected to Reach USD 77.4 Billion by 2032

Get more details on this report -

The United States Ambulatory Surgical Centers Market Size is Expected to Reach USD 77.4 Billion by 2032, at a CAGR of 8.2% during the forecast period 2022 to 2032.

Market Overview

Ambulatory surgical centers (ASCs) are modern outpatient healthcare facilities that provide same-day surgical services, including diagnostic and preventive services. When compared to most hospitals in the United States, these settings provide a more convenient environment and more cost-effective surgical services. Pain management, orthopedics, gastroenterology, ophthalmology, urology, and dermatology are common specialties provided in these settings. Ambulatory services have had a positive impact on the United States healthcare system, making healthcare more accessible, efficient, and cost-effective for both patients and providers. Because of the shift of procedures to ASCs, the number of inpatient admissions has decreased significantly in recent years. More than 65% of surgeries in the United States are performed in ASCs. This is primarily due to the high cost of inpatient hospitalization and the increased adoption of advanced technologies by ASCs, which enable rapid and cost-effective treatment provision. Growing payer and Medicare pressure have also increased the number of people choosing diagnostic tests in nearby ambulatory community care units rather than city hospitals.

Report Coverage

This research report categorizes the market for the United States ambulatory surgical centers market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States ambulatory surgical centers market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States ambulatory surgical centers market.

United States Ambulatory Surgical Centers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 35.2 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.2% |

| 2032 Value Projection: | USD 77.4 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Ownership, By Application |

| Companies covered:: | AMSURG (Kohlberg Kravis Roberts & Co. L.P.), T.H. Medical, Surgery Partners, SurgCenter, Surgical Care Affiliates, HCA Healthcare, Physicians Endoscopy, LLC, Covenant Physician Partners, Inc., Constitution Surgery Alliance, ASD Management, Medical Facilities Corporation, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increasing Preference for ASCs to support United States ambulatory surgical centers market growth during the forecast period. The shift from hospital-based surgical procedures to ambulatory settings is driving market growth. The number of surgical procedures in ambulatory surgical centers has seen a significant increase over the forecast period. Because of factors such as shorter stays, innovative technologies, cost-effective surgical procedures, and lower infection risks, a large number of patients prefer these healthcare facilities for various surgeries. Increasing U.S. government investments in the development of new ambulatory settings are expected to drive market growth over the forecast period. Reimbursement is one of the primary factors for market growth. Favorable reimbursement policies are driving the Centers for Medicare & Medicaid Services (CMS) to expand the list of surgical procedures that are permitted in ASCs. Rising commercial payer initiatives to encourage physicians to perform a variety of surgical procedures in these facilities are expected to fuel the market during the forecast period.

Restraining Factors

A significant percentage of the patient population in the U.S. has preferred outpatient surgery centers for surgical procedures over the forecast period. However, several drawbacks of ambulatory surgical centers (ASCs) are expected to restrain market growth during the forecast period. These drawbacks include a lack of overnight accommodations, complications, and emergencies during certain surgical procedures, and no contingency plans. Some surgical procedures may require patients to be transferred from ambulatory surgical centers to nearby hospitals due to difficulties or complications. As a result, some patients prefer hospitals for surgical procedures.

Market Segment

- In 2022, the single-specialty segment is expected to hold the largest share of the United States ambulatory surgical centers market during the forecast period.

Based on the type of center, the United States ambulatory surgical centers market is classified into single-specialty and multi-specialty. Among these, the single-specialty segment is expected to hold the largest share of the United States ambulatory surgical centers market during the forecast period. The dominance of the single-specialty settings is attributed to the growing incidence & prevalence of ophthalmic disorders and the strong presence of single-specialty ambulatory surgical centers in the United States

- In 2022, the physician-owned segment accounted for the largest revenue share over the forecast period.

Based on the ownership, the United States ambulatory surgical centers market is segmented into physician-owned, hospital-owned, and corporate-owned. Among these, the physician-owned segment has the largest revenue share over the forecast period. Physician-owned ambulatory settings are the most common, with doctors owning 100% of the stock. The large share of this segment is also due to factors such as physicians' convenience in scheduling surgical procedures, which leads to increased preference for this type of ownership in the United States.

- In 2022, the surgical services segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States ambulatory surgical centers market is segmented into diagnostic services and surgical services. Among these, the surgical services segment has the largest revenue share over the forecast period. The increasing number of surgical procedures performed in ambulatory settings is responsible for this segment's rapid growth. These procedures primarily include ophthalmology, gastroenterology, pain management, and orthopedic surgeries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States ambulatory surgical centers market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AMSURG (Kohlberg Kravis Roberts & Co. L.P.)

- T.H. Medical

- Surgery Partners

- SurgCenter

- Surgical Care Affiliates

- HCA Healthcare

- Physicians Endoscopy, LLC

- Covenant Physician Partners, Inc.

- Constitution Surgery Alliance

- ASD Management

- Medical Facilities Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2021, T.H. Medical announced plans in 2021 to acquire up to 25 to 40 surgery centers. The company intends to spend approximately USD 150 million to acquire these surgery centers.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the United States ambulatory surgical centers market based on the below-mentioned segments:

United States Ambulatory Surgical Centers Market, By Type of Center

- Single-specialty

- Multi-specialty

United States Ambulatory Surgical Centers Market, By Ownership

- Physician-owned

- Hospital-owned

- Corporate-owned

United States Ambulatory Surgical Centers Market, By Application

- Diagnostic Services

- Surgical Services

Need help to buy this report?