United States Anticholinergic Drug Market Size, Share, and COVID-19 Impact Analysis, By Type (Natural Alkaloids, Semisynthetic Derivatives, Synthetic Compounds, and Others), By Product Type (Prescription and Over-the-counter (OTC)), and United States Anticholinergic Drug Market Insights Forecasts to 2033

Industry: HealthcareUnited States Anticholinergic Drug Market Insights Forecasts to 2033

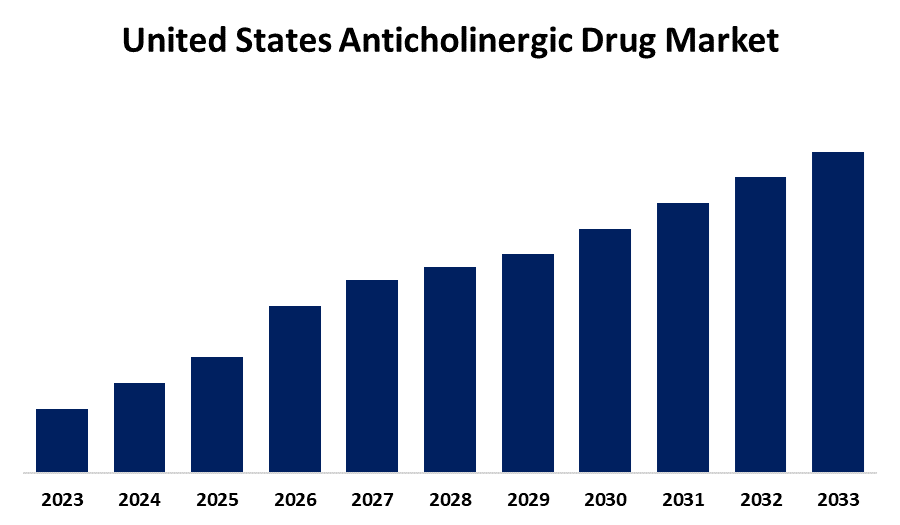

- The Market is Growing at a CAGR of 7.9% from 2023 to 2033

- The US Anticholinergic Drug Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The US Anticholinergic Drug Market Size is Anticipated to Hold a Significant Share by 2033, Growing at a CAGR of 7.9% from 2023 to 2033.

Market Overview

Anticholinergic drugs are a class of medications that block the action of acetylcholine, a neurotransmitter involved in various bodily functions. By inhibiting acetylcholine receptors, these drugs are primarily used to treat conditions related to the central nervous system, such as Parkinson's disease, overactive bladder, and chronic obstructive pulmonary disease (COPD). They are also employed in managing gastrointestinal disorders and as adjunct therapies for certain psychiatric conditions. The United States anticholinergic drug market has been experiencing steady growth, driven by an increasing prevalence of age-related neurological and chronic diseases. The rising incidence of Parkinson’s disease, dementia, and respiratory ailments has heightened the demand for anticholinergic treatments. Additionally, the expanding geriatric population, with higher susceptibility to conditions requiring long-term medication, is further propelling market expansion. Government initiatives, including increased funding for research on neurological disorders and chronic conditions, have positively impacted the development and accessibility of anticholinergic therapies. Policies aimed at enhancing healthcare infrastructure and promoting affordable access to essential medications have contributed to market growth. Moreover, advancements in drug formulation and delivery systems, along with a surge in demand for more effective and targeted treatments, continue to shape the market dynamics, fostering both innovation and competition within the sector.

Report Coverage

This research report categorizes the market for the United States anticholinergic drug based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States anticholinergic drug market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each United States anticholinergic drug market sub-segment.

United States Anticholinergic Drug Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.9% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By Product Type and COVID-19 Impact Analysis. |

| Companies covered:: | Pfizer Inc., Merck & Co., Inc., Johnson & Johnson, AbbVie Inc., AstraZeneca PLC, Eli Lilly and Company, Teva Pharmaceutical Industries Ltd., Novartis International AG, Bristol-Myers Squibb, GlaxoSmithKline plc, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States anticholinergic drug market is primarily driven by several key factors. The increasing prevalence of neurological disorders, such as Parkinson's disease, Alzheimer's disease, and various cognitive impairments, has significantly boosted demand for anticholinergic treatments. Additionally, the rising incidence of respiratory diseases, particularly chronic obstructive pulmonary disease (COPD), has further fueled market expansion. The aging population, with a higher incidence of these conditions, is a critical factor. Furthermore, advancements in drug development, including the creation of more effective and targeted formulations, have enhanced treatment outcomes, contributing to market growth. Increased awareness and early diagnosis also play a significant role.

Restraining Factors

Restraints on the United States anticholinergic drug market include potential side effects, including cognitive impairment, dry mouth, and urinary retention, as well as growing concerns over long-term usage and drug interactions.

Market Segment

The U.S. anticholinergic drug market share is classified into type and product type.

- The synthetic compounds segment is expected to hold the largest market share through the forecast period.

The US anticholinergic drug market is by type into natural alkaloids, semisynthetic derivatives, synthetic compounds, and others. Among these, the synthetic compounds segment is expected to hold the largest market share through the forecast period. This is attributed to the broad range of synthetic anticholinergic drugs available for various therapeutic applications, including the treatment of Parkinson's disease, overactive bladder, chronic obstructive pulmonary disease (COPD), and gastrointestinal disorders.

- The prescription segment is expected to hold the largest market share through the forecast period.

The US anticholinergic drug market is segmented by product type into prescription and over-the-counter (OTC). Among these, the prescription segment is expected to hold the largest market share through the forecast period. This is attributed to the widespread use of prescription anticholinergic drugs for the treatment of chronic and serious conditions, such as Parkinson's disease, chronic obstructive pulmonary disease (COPD), and overactive bladder.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States anticholinergic drug market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pfizer Inc.

- Merck & Co., Inc.

- Johnson & Johnson

- AbbVie Inc.

- AstraZeneca PLC

- Eli Lilly and Company

- Teva Pharmaceutical Industries Ltd.

- Novartis International AG

- Bristol-Myers Squibb

- GlaxoSmithKline plc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts regional and country revenue from 2022 to 2033. Spherical Insights has segmented the United States anticholinergic drug market based on the below-mentioned segments:

United States Anticholinergic Drug Market, By Type

- Natural Alkaloids

- Semisynthetic Derivatives

- Synthetic Compounds

- Others

United States Anticholinergic Drug Market, By Product Type

- Prescription

- Over-the-counter (OTC)

Need help to buy this report?