United States Anticoagulation Therapy Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Drugs (NOACs), Warfarin, PT/INR Testing Devices, and Service), By Clinic (Hospital Associated Clinic, Independent Clinics, and Pharmacy-Based Clinics), and United States Anticoagulation Therapy Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Anticoagulation Therapy Market Insights Forecasts to 2033

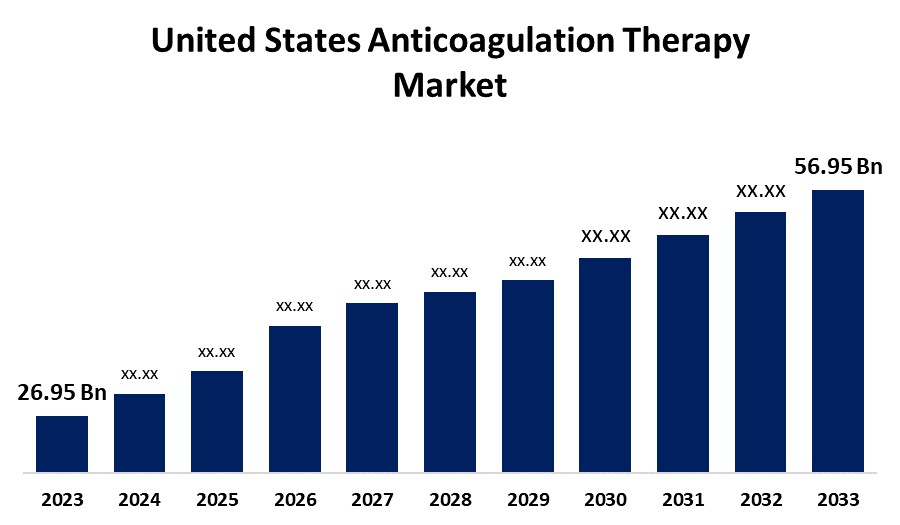

- The US Anticoagulation Therapy Market Size was valued at USD 26.95 Billion in 2023.

- The Market is growing at a CAGR of 7.77% from 2023 to 2033

- The U. S. Anticoagulation Therapy Market Size is expected to reach USD 56.95 Billion by 2033

Get more details on this report -

The United States Anticoagulation Therapy Market is anticipated to exceed USD 56.95 Billion by 2033, growing at a CAGR of 7.77% from 2023 to 2033.

Market Overview

Blood thinners, or anticoagulants, are chemical substances that prolong the time it takes for blood to coagulate by reducing or preventing it from undertaking accordingly. Since they serve to keep the bite region unclotted for an extended period, blood-eating creatures like vampire finches, leeches, and mosquitoes can also be used as a natural medium for anticoagulant treatment. Anticoagulants are a class of drugs used in the treatment of thrombotic diseases. Many patients also take oral anticoagulants (OACs) as pills or tablets, and hospitals and clinics employ different dosing forms for arterial anticoagulants. Certain anticoagulants are utilized in medical devices such as blood transfusion bags, test tubes, serum-separating tubes, and dialysis equipment. The market for anticoagulation medications is expanding due to several factors, including the increased prevalence of blood vessel occlusion, arrhythmia, and stroke; the prolonged administration and substantial residual sales of medical assistance pharmaceuticals; and the growing need for innovative oral anticoagulants (NOACs). Furthermore, the market for anticoagulation clinics is growing due in large part to the growing incidence of blood disorders and cardiovascular diseases, the high degree of medication adherence associated with these clinics, and the aging population. The market for anticoagulation therapy in the United States is thriving due to factors such as the increased prevalence of stroke, atrial fibrillation, and venous thromboembolism; long-term administration; high volume of recurrent sales of anticoagulation drugs; and the growing demand for novel oral anticoagulants (NOACs).

Report Coverage

This research report categorizes the market for the United States anticoagulation therapy market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States anticoagulation therapy market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States anticoagulation therapy market.

United States Anticoagulation Therapy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 26.95 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 7.77% |

| 2033 Value Projection: | USD 56.95 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type, By Clinic, and COVID-19 Impact Analysis |

| Companies covered:: | Bristol-Myers Squibb, Johnson & Johnson, Pfizer, Portola Pharmaceuticals, Abbott, Eli Lilly & Company, Alere, CoaguSense, and Otrhers Key Vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Two key drivers driving the growth of the US market are the growing awareness of cardiovascular health and the consequent rise in new pharmacological releases. Drugs that thin the blood are an essential component of the treatment plan. Cardiovascular therapy is a broad approach that could lead to the prescription of many different kinds of drugs. Several noteworthy industry leaders have introduced a range of anticoagulants in response to the pressing need for blood clot prevention treatment. Technological advances in anticoagulant product creation and the rise in chronic illness cases are believed to be related to rapid urbanization. The prevalence of ischemic heart disease has grown and is predicted to rise quickly.

Restraining Factors

Along with advancements in technology and anticoagulant quality, the industry's growth is being hampered by the growing cost of pharmaceuticals. The US anticoagulation market's expansion is hampered by all of these problems.

Market Segmentation

The United States anticoagulation therapy market share is classified into product type and clinic.

- The drugs (NOACs) segment is expected to hold the largest market share through the forecast period.

The United States anticoagulation therapy market is segmented by product type into drugs (NOACs), warfarin, PT/INR testing devices, and service. Among them, the drugs (NOACs) segment is expected to hold the largest market share through the forecast period. NOACs are being utilized increasingly often because they are safer and more effective than conventional therapy. Important players in the market, including Portola Pharmaceuticals, which got FDA clearance for its NOAC Betrixaban are also concentrating on NOAC development to take advantage of the expansion prospects brought about by this change in the dynamics of the market. To ensure the segment's continuous expansion, many additional businesses are anticipated to concentrate on creating safer and more effective NOACs in the upcoming years.

- The pharmacy-based clinics segment dominates the market with the largest market share over the predicted period.

The United States anticoagulation therapy market is segmented by clinic into hospital associated clinic, independent clinics, and pharmacy-based clinics. Among them, the pharmacy-based clinics segment dominates the market with the largest market share over the predicted period. The US has seen a significant increase in the number of anticoagulation clinics housed within pharmacies in recent years. This is so because treatment overseen by experienced pharmacists produces better outcomes than care administered by family doctors. Because these clinics offer therapy at a cheaper cost than independent and hospital-affiliated anticoagulation clinics, the market for pharmacy-based anticoagulation clinics is expected to expand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States anticoagulation therapy market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bristol-Myers Squibb

- Johnson & Johnson

- Pfizer

- Portola Pharmaceuticals

- Abbott

- Eli Lilly & Company

- Alere

- CoaguSense

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, A novel oral anticoagulant medication was approved for use in the US by the Food and Drug Administration (FDA). The goal of this new treatment is to give patients more choices for treating anticoagulation-dependent illnesses like venous thromboembolism and atrial fibrillation. The clearance marks a major development in the anticoagulant treatment landscape in the United States market.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Anticoagulation Therapy Market based on the below-mentioned segments:

United States Anticoagulation Therapy Market, By Product Type

- Drugs (NOACs)

- Warfarin

- PT/INR Testing Devices

- Service

United States Anticoagulation Therapy Market, By Clinic

- Hospital Associated Clinic

- Independent Clinics

- Pharmacy-Based Clinics

Need help to buy this report?