United States Aquaculture Fertilizer Market Size, Share, and COVID-19 Impact Analysis, By Source (Urea, Triple Superphosphate, Di-Ammonium Phosphate, Potassium Chloride, SSP, Specialty Fertilizers, and Others), By Application (Seawater Aquaculture and Onshore Aquaculture), and United States Aquaculture Fertilizer Market Insights Forecasts to 2033

Industry: AgricultureUnited States Aquaculture Fertilizer Market Insights Forecasts to 2033

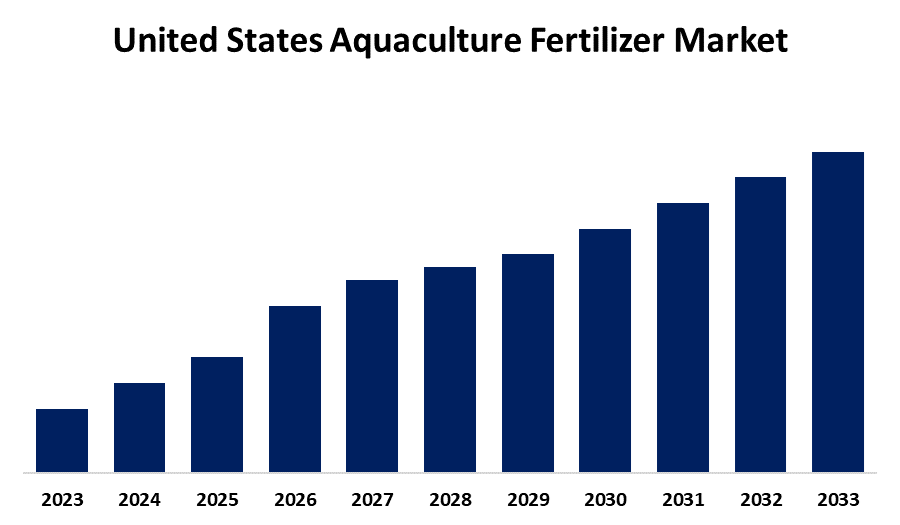

- The Market is Growing at a CAGR of 6.1% from 2023 to 2033

- The US Aquaculture Fertilizer Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The US Aquaculture Fertilizer Market Size is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 6.1% from 2023 to 2033.

Market Overview

Aquaculture fertilizer refers to a group of nutrient-rich substances, specifically designed to increase the productivity of aquatic ecosystems in fish farming, shellfish cultivation, and other types of aquacultures. These fertilizers provide essential nutrients like nitrogen, phosphorus, and potassium, which are important for promoting the growth of aquatic plants and for general health improvement of the farmed species. Aquaculture fertilizers are one of the most essential factors in maintaining a balance in water quality, enhancing the production of phytoplankton, and ensuring sustainable conditions for aquaculture. There are several growth-promoting factors for the market of aquaculture fertilizer in the United States. It is due to increased demands for seafood products along with the expansion of aquaculture farms, which is causing growth in the demand for proper nutrient management solutions. With the increasing adoption of sustainable farming practices and growing awareness on the environmental impact of their farming practices, demand is being pushed for organic and eco-friendly types of aquaculture fertilizers. The growth of the market is being promoted even further by government policies. The federal and state-level policies to support sustainable aquaculture through financial incentives and grants to adopt eco-friendly production methods provide a conducive environment for the market to grow. In addition, the investments in nutrient management technology research and development will increase the efficiency and adoption rate of specialized aquaculture fertilizers in the U.S.

Report Coverage

This research report categorizes the market for the United States aquaculture fertilizer based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States aquaculture fertilizer market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each United States aquaculture fertilizer market sub-segment.

US Aquaculture Fertilizer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.1% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 205 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Source, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | The Mosaic Company, Nutriad, Cargill, Inc., Aquafauna Bio-Marine, Inc., GrowBest, Omega Protein Corporation, Innovasea Systems, Skretting (a part of Nutreco), Alltech Inc., BASF SE, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Key drivers include the growing demand for seafood from U.S. consumers and the depletion of wild fish supplies. It increases growth in aquaculture production, which in turn demands efficient nutrient management solutions to optimize production. The use of eco-friendly and organic products is becoming more prevalent, as not only the consumer but the producer too is becoming more conscious of the negative environmental impacts arising from the cultivation. Technological advancements in formulations of fertilizers and nutrient enrichment along with water quality management are also contributing to expanded markets.

Restraining Factors

These factors include the cost of special fertilizers used in aquaculture, which is relatively high; limited awareness of their benefits among small producers; and regulation challenges concerning the environmental impact of the overuse of nutrients in aquaculture systems.

Market Segment

The U.S. aquaculture fertilizer market share is classified into source and application.

- The urea segment is expected to hold the largest market share through the forecast period.

The US aquaculture fertilizer market is by source into urea, triple superphosphate, di-ammonium phosphate, potassium chloride, SSP, specialty fertilizers, and others. Among these, the urea segment is expected to hold the largest market share through the forecast period. This is attributed to the urea is the most common fertilizer used for aquaculture purposes. The use of urea for aquaculture is known to increase the growth of aquatic life in a short period.

- The seawater aquaculture segment is expected to hold the largest market share through the forecast period.

The US aquaculture fertilizer market is segmented by application into seawater aquaculture and onshore aquaculture. Among these, the seawater aquaculture segment is expected to hold the largest market share through the forecast period. This is attributed to the growing demand for seafood along with the rise of large-scale marine aquaculture operations, like fish farming off the coast.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States aquaculture fertilizer market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Mosaic Company

- Nutriad

- Cargill, Inc.

- Aquafauna Bio-Marine, Inc.

- GrowBest

- Omega Protein Corporation

- Innovasea Systems

- Skretting (a part of Nutreco)

- Alltech Inc.

- BASF SE

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts regional and country revenue from 2022 to 2033. Spherical Insights has segmented the United States aquaculture fertilizer market based on the below-mentioned segments:

United States Aquaculture Fertilizer Market, By Source

- Urea

- Triple Superphosphate

- Di-Ammonium Phosphate

- Potassium Chloride

- SSP

- Specialty Fertilizers

- Others

United States Aquaculture Fertilizer Market, By Application

- Seawater Aquaculture

- Onshore Aquaculture

Need help to buy this report?