United States Asset Management Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution and Service), By Asset Type (Digital Assets and In-transit Equipment), and United States Asset Management Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialUnited States Asset Management Market Insights Forecasts to 2033

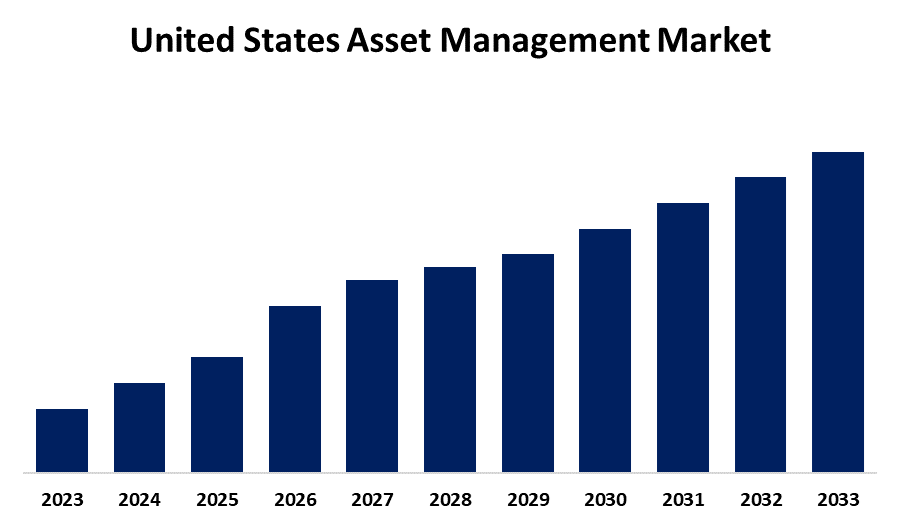

- The Market is Growing at a CAGR of 18.10% from 2023 to 2033

- The United States Asset Management Market Size is Expected to Reach Substantial Share by 2033

Get more details on this report -

The United States Asset Management Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 18.10% from 2023 to 2033. The market for portfolio management systems in the United States is expected to develop rapidly due to the continued digital transformation and business expansion.

Market Overview

Asset management is a professional service that manages financial assets on behalf of people, businesses, or governments. It includes a variety of investment assets, such as stocks, bonds, and real estate, to increase returns while mitigating risk by personalizing investment methods to the client's specific requirements. To manage investments, asset managers use a variety of methods, including asset allocation, risk management strategies, and market analysis. To meet their clients' goals, they also employ a variety of investment vehicles, including exchange-traded funds (ETFs), mutual funds, and alternative investments. The task of keeping an eye on customers' investments, making trading choices, and carrying out trades falls to a group of portfolio managers and financial analysts. To guarantee that asset managers provide the greatest service and protect the interests of their clients, the asset management sector is highly competitive and regulated. Asset management is a critical component of the financial industry, assisting individuals, organizations, and governments in managing their financial assets, maximizing returns, and minimizing risk. Asset managers help customers achieve their financial goals and build long-term wealth by implementing investment strategies and financial plans.

Report Coverage

This research report categorizes the market for the United States asset management market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States asset management market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States asset management market.

United States Asset Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 18.10% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 211 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Component and By Asset Type |

| Companies covered:: | Fidelity Investments, BlackRock Inc, Brookfield Asset Management, The Vanguard Group, Inc., Goldman Sachs Group, and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The US portfolio management systems market is poised for rapid growth, fueled by a boom in businesses and ongoing digital transformation. With rising investments in a variety of sectors, the US market is seeing a significant increase in the adoption of portfolio management systems, owing to their low cost. Concurrently, the North American project portfolio management market is poised for tremendous growth, fueled by the incorporation of cutting-edge technologies. Notably, industries such as healthcare, manufacturing, banking, financial services, and construction in the United States have become more dependent on project portfolio management. This strategic move attempts to streamline processes and reduce expenses, creating an atmosphere suitable for market growth.

Restraining Factors

The high cost of deploying new asset management systems is one of the main challenges. This can be especially problematic for small and medium-sized enterprises with tight budgets. Moreover, companies often have trouble integrating the new asset management systems with their current IT setup. An additional obstacle is the maintenance expenses linked with asset management systems, as they necessitate consistent maintenance to guarantee their efficient operation, hence augmenting the system's total cost.

Market Segmentation

The United States asset management market share is classified into component and asset type.

- The solution segment is expected to hold the largest market share through the forecast period.

The United States asset management market is segmented by component into solution and service. Among these, the solution segment is expected to hold the largest market share through the forecast period. The solution segment comprises real-time location systems (RTLS), barcodes, mobile computers, labels, global positioning systems (GPS), and other technologies. Image-based barcode scanners are increasing in popularity due to their 2D code-reading capabilities, long-term dependability, and adaptability.

- The digital assets segment is expected to dominate the United States asset management market during the forecast period.

Based on the asset type, the United States asset management market is divided into digital assets and in-transit equipment. Among these, the digital assets segment is expected to dominate the United States asset management market during the forecast period. The ongoing digitization trend is beneficial for digital solutions and service providers. Increasing volumes and densities of digital assets across enterprises are expected to enhance demand for digital solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States asset management market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fidelity Investments

- BlackRock Inc

- Brookfield Asset Management

- The Vanguard Group, Inc.

- Goldman Sachs Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2023, a leading supplier of automated finance and equities management software, Shoobx was purchased by Fidelity Investments. In addition to IPOs, Shoobx serves private enterprises in a range of growth stages.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Asset Management Market based on the below-mentioned segments:

United States Asset Management Market, By Component

- Solution

- Service

United States Asset Management Market, By Asset Type

- Digital Assets

- In-transit Equipment

Need help to buy this report?