United States Athletic Footwear Market Size, Share, and COVID-19 Impact Analysis, By Type (Aerobic Shoes, Running Shoes, Walking Shoes, Trekking & Hiking Shoes, and Sports Shoes), By End-User (Men, Women, and Children), and United States Athletic Footwear Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited States Athletic Footwear Market Insights Forecasts to 2033

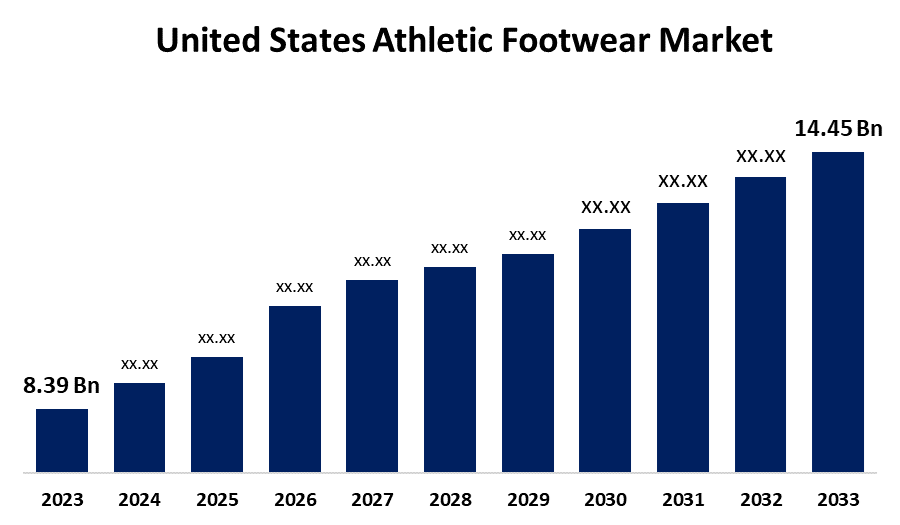

- The U.S. Athletic Footwear Market Size was valued at USD 8.39 Billion in 2023.

- The Market is growing at a CAGR of 5.59% from 2023 to 2033

- The U.S. Athletic Footwear Market Size is Expected to Reach USD 14.45 Billion by 2033

Get more details on this report -

The United States Athletic Footwear Market is Anticipated to Exceed USD 14.45 Billion by 2033, growing at a CAGR of 5.59% from 2023 to 2033. The growing popularity of sports & fitness activities and eco-friendly footwear is driving the growth of the athletic footwear market in the US.

Market Overview

Athletic footwear is a show designed to be worn for sports, exercise, or any recreational activities. Like clothing and equipment, athletic footwear is made for maximum performance and is regarded as an essential component of an athlete's gear. For a variety of sports, athletic shoes offer grip, stability, cushioning, flexibility, and durability. The demand for footwear items is being driven by rising fitness trends and rising rates of sports involvement among the populace. There is an increasing incorporation of new features in athletic footwear designs for a more appealing appearance and increased durability. Athletic shoe sales are rising due to advancements in technology, the release of creative new styles, and growing awareness of the significance of wearing the right shoes to prevent leg and muscle strains. Designer athletic shoes that combine athleisure trends with sports design are preferred by customers. Athleisure shapes the choices of millennial parents, which also contributes to the popularity of athletic footwear for kids. There is an increasing prioritization on product innovation, offering enhanced comfort and durability through the introduction of low-carbon choices that feature faux leather and other synthetic materials supplies responsibly. Nike aims to reduce the carbon footprint of the market by recycling used shoes through its Move to Zero campaign.

Report Coverage

This research report categorizes the market for the US athletic footwear market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States athletic footwear market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US athletic footwear market.

United States Athletic Footwear Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.39 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.59% |

| 2033 Value Projection: | USD 14.45 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Adidas AG, Amer Sports Corp., ASICS Corp., British Knights Int B.V., Columbia Sportswear Co., Brooks Sports Inc., K Swiss Inc., Mizuno Corp, New Balance Athletics Inc., Nfinity Athletic LLC, PUMA SE, Nike Inc., Skechers USA Inc., Newton Running Co. Inc., Under Armour Inc., VF Corp., Wolverine World Wide Inc., and Others Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

In 2023, there were 242 million Americans who engaged in at least one sport or physical activity, accounting for about 80% of all Americans aged 6 and over according to a report by Sports Destination Management. The growing popularity of sports & fitness activities among the people are driving the market demand. Consumer awareness of sustainability is increasing, driving demand for environmentally friendly products. For instance, Air Zoom Alphafly Next Nature sneakers NEXT% developed by Nike are made with an eco-friendly design composed of 20% recycled TPU, 45% recycled polyester, 100 % recycled PEBA, 100% recycled polyester, and 50% recycled TPU. The growing popularity of eco-friendly footwear owing to the consumer awareness of sustainability drives the market growth.

Restraining Factors

Customers have access to an expanding number of athletic footwear brands and goods. Further, some customers are growing more price-sensitive and open to switching brands in search of the greatest offers, which makes it challenging for businesses to retain market share and foster brand loyalty. These factors are restraining the market.

Market Segmentation

The United States Athletic Footwear Market share is classified into type and end-user.

- The running shoes segment dominates the US athletic footwear market with the largest share in 2023.

The United States athletic footwear market is segmented by type into aerobic shoes, running shoes, walking shoes, trekking & hiking shoes, and sports shoes. Among these, the running shoes segment dominates the US athletic footwear market with the largest share in 2023. Running shoes often have more padding in the heel and toe areas but are lighter overall. The increasing popularity of sports shoes as everyday running shoes, along with an increase in physical fitness and leisure pursuits are driving the market.

- The men segment dominates the market with the largest market share in 2023.

The United States athletic footwear market is segmented by end-user into men, women, and children. Among these, the men segment dominates the market with the largest market share in 2023. Men's preference for outdoor activities has increased demand for men's footwear. Manly sports have long included golf, cricket, hockey, and trekking are responsible for driving the market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. athletic footwear market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Adidas AG

- Amer Sports Corp.

- ASICS Corp.

- British Knights Int B.V.

- Columbia Sportswear Co.

- Brooks Sports Inc.

- K Swiss Inc.

- Mizuno Corp

- New Balance Athletics Inc.

- Nfinity Athletic LLC

- PUMA SE

- Nike Inc.

- Skechers USA Inc.

- Newton Running Co. Inc.

- Under Armour Inc.

- VF Corp.

- Wolverine World Wide Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, NIKE, Inc. extended its position as the undisputed leader of footwear and apparel innovation by debuting a new line-up of products that signaled a multi-year innovation cycle.

- In September 2023, Made Plus, a pioneering footwear brand founded by industry veterans Trey Hentz, Kevin Fisher, and Alan Guyan, officially sets sail.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Athletic Footwear Market based on the below-mentioned segments:

US Athletic Footwear Market, By Type

- Aerobic Shoes

- Running Shoes

- Walking Shoes

- Trekking & Hiking Shoes

- Sports Shoes

US Athletic Footwear Market, By End-User

- Men

- Women

- Children

Need help to buy this report?