United States Automotive Aftermarket Industry Market Size, Share, and COVID-19 Impact Analysis, By Replacement Parts Type (Battery, Brake Pads, Filters, Gaskets & Seals, Lighting Components, Body Parts, Wheels & Tires, Others), By Vehicle Type (Passenger Vehicle, Commercial Vehicle), and United States Automotive Aftermarket Industry Market Insights Forecasts to 2033

Industry: Automotive & TransportationUnited States Automotive Aftermarket Industry Market Size Insights Forecasts to 2033

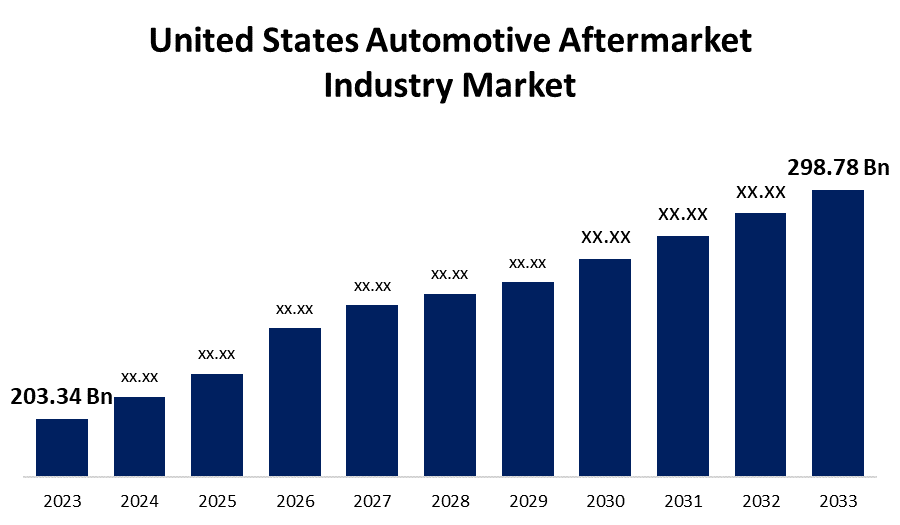

- The United States Automotive Aftermarket Industry Market Size was valued at USD 203.34 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.92% from 2023 to 2033.

- The United States Automotive Aftermarket Industry Market Size is Expected to Reach USD 298.78 Billion by 2033.

Get more details on this report -

The United States Automotive Aftermarket Industry Market Size is Expected to Reach USD 298.78 Billion by 2033, at a CAGR of 3.92% during the forecast period 2023 to 2033.

Market Overview

The automotive aftermarket includes activities such as vehicle manufacturing, remanufacturing, distributing, redistribution, end-retail, reselling, and installation. The aftermarket includes components for performance, appearance, collision, and replacement. The integration of advanced technologies has led to the digitalization of automotive repair and component sales, thereby boosting the popularity of the automotive aftermarket. Products and services with a strong digital component are creating new trends and accelerating market growth in United States. Furthermore, this allows various stakeholders, including car owners, to assess repair and replacement costs. Because of their unique specifications and lower costs, auto enthusiasts prefer to order custom parts—like mufflers and resonators—from overseas through online services. In addition, the quick development of digital technologies has given automakers and service providers the chance to produce cutting-edge goods to compete in the U.S. market. Auto parts suppliers or distributors must operate on a large scale to become a major player in the aftermarket industry, given the rise of internationalization and consolidation in aftermarket trends. In additional, Customers are increasingly keeping older vehicles as second vehicles rather than exchanging or discarding them. The need for replacement parts, maintenance, and repairs as a result of aging vehicles is driving the automotive aftermarket market's expansion in United States.

Report Coverage

This research report categorizes the market for United States automotive aftermarket industry market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States automotive aftermarket industry market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States automotive aftermarket industry market.

United States Automotive AfterMarket Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 203.34 Billion |

| Forecast Period: | 2023 to 2033. |

| Forecast Period CAGR 2023 to 2033. : | 3.92% |

| 2033. Value Projection: | USD 298.78 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Replacement Parts Type, By Vehicle Type, and COVID-19 Impact Analysis |

| Companies covered:: | Cooper Tire & Rubber Company, 3M Company, Aptiv PLC, HELLA KGaA Hueck & Co., Robert Bosch GmbH, Tenneco Inc., Valeo Group, Continental AG, Delphi Automotive PLC, Denso Corporation, ZF Friedrichshafen AG, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Original equipment manufacturers have steadily increased their level of activity and focus within the automotive parts aftermarket value chain by, for example, establishing networks of non-car brand-specific repair shops. To compete with independent aftermarket players and retain customers in their networks, major market players have introduced second service formats, second brands (such as VW Direkt Express), or remanufactured parts to keep up with the vehicle-age-driven market in United States. To retain customers and automate decision-making regarding maintenance and repair, OEMs are also investing in customer experience optimization initiatives including launching distinctive aftermarket service offerings such factors will boost the market growth in United States. Furthermore, modern technology has made equipment more sensor-equipped, so even small wear and tear on car components won't prevent the market from expanding by necessitating part replacements.

Restraining Factors

The lack of standardization in such automotive parts has resulted in an increase in the trade of counterfeit components, which is expected to hamper market growth during the forecast period.

Market Segment

- In 2023, the filters segment accounted for the largest revenue share over the forecast period.

Based on the replacement parts type, the United States automotive aftermarket industry market is segmented into battery, brake pads, filters, gaskets & seals, lighting components, body parts, wheels & tires, others. Among these, the filters segment has the largest revenue share over the forecast period. Increasing customer awareness of the need for and replacement of cabin air filters, as well as the availability of higher-quality filter products in developed areas, and growing market penetration.

- In 2023, the passenger vehicle segment is expected to hold the largest share of the United States automotive aftermarket industry market during the forecast period.

Based on the vehicle type, the United States automotive aftermarket industry market is classified into passenger vehicle, and commercial vehicle. Among these, the passenger vehicle segment is expected to hold the largest share of the United States automotive aftermarket industry market during the forecast period. The growth can be attributed to several factors, including the growing urban population and the need for commuting. People's concerns about low operating costs and rising pollution levels are driving up demand. Both sales and product offerings are rising in the commercial vehicle industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States automotive aftermarket industry market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cooper Tire & Rubber Company

- 3M Company

- Aptiv PLC

- HELLA KGaA Hueck & Co.

- Robert Bosch GmbH

- Tenneco Inc.

- Valeo Group

- Continental AG

- Delphi Automotive PLC

- Denso Corporation

- ZF Friedrichshafen AG

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On April 2023, Kaspar Ranch Hand Equipment, LLC has been acquired by Lippert Components Inc. Lippert Components Inc. sought to increase its market share in the aftermarket for automotive parts with this acquisition.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States automotive aftermarket industry market based on the below-mentioned segments:

United States Automotive Aftermarket Industry Market, By Replacement Parts Type

- Battery

- Brake Pads

- Filters

- Gaskets & Seals

- Lighting Components

- Body Parts

- Wheels & Tires

- Others

United States Automotive Aftermarket Industry Market, By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

Need help to buy this report?