U.S. Automotive Composites Market Size, Share, and COVID-19 Impact Analysis, By Fiber (Glass, Carbon and Natural), By Application (Exterior, Interior, Structure & Power train, and Other), and U.S. Automotive Composites Market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationUnited States Automotive Composites Market Insights Forecasts to 2033

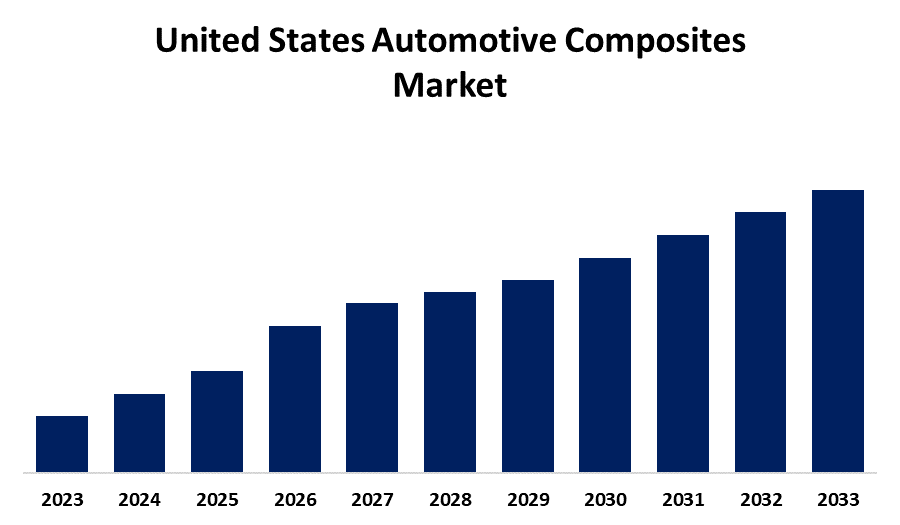

- The Market Size is Growing at a CAGR of 12.9% from 2023 to 2033

- The U.S. Automotive Composites Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The U.S. Automotive Composites Market Size is Anticipated to Hold a Significant Share by 2033, Growing at a CAGR of 12.9% from 2023 to 2033.

Market Overview

Automotive composites are lightweight materials primarily utilized in trucks, cars, and other vehicles, mainly in the engine compartment and the interior. Composites are the preferred materials for decreasing the weight of cars, therefore they are utilized for numerous automotive interior and exterior purposes. The automotive sector has seen a rise in the use of composite materials recently because of their exceptional dimensional stability. Characteristics of composite materials like shape stability, minimal thermal expansion, corrosion resistance in both dry and wet environments, simple production processes, and lighter weight for decreased vehicle mass contribute to their popularity. The future of the automotive composites industry appears promising due to advancements in technology and manufacturing processes. As raw materials and composite materials continue to evolve, they are increasingly being used in various components, gradually replacing steel and aluminum. An online community of automotive composites manufacturers and researchers was established to efficiently conduct the research. Simultaneously, the virtual network will unite industry professionals to connect all aspects of the automotive composites value chain, facilitating the advancement of the industry and material into mainstream acceptance. The United States has a concentrated automotive composite market. Industry participants are expected to encounter strong competition from tactics like acquisitions, pricing adjustments, mergers, and the launch of new products. Important participants in the industry are Hexcel Corporation, Mitsubishi Chemical Carbon Fibre and Composite Inc., SGL Carbon, and Toray Industries Inc.

Report Coverage

This research report categorizes the market for the US automotive composites market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States automotive composites market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. automotive composites market.

United States Automotive Composites Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.9% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 178 |

| Tables, Charts & Figures: | 110 |

| Companies covered:: | 3B Fiberglass, Base Group, BASF, BMW, Cytec Industries Inc, Delphi Auto, General Motors Company, Nippo Sheet Glass Co Ltd, SGL Group, 6Toray Industries Inc, Teijin Limited, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Tough emission control rules, especially in developed nations, along with a growing need for lightweight materials in the automotive sector, are predicted to boost the demand for automotive composites in the coming years. Rising environmental worries and strict pollution regulations have compelled automotive manufacturers to regulate emissions from vehicles. The curb weight is one of the most crucial factors that impacts both fuel efficiency and vehicular emissions. Reducing the weight of the vehicle can greatly boost fuel efficiency, leading to a decrease in pollution from vehicles.

Restraining Factors

Recycling automotive composites presents more complex challenges compared to recycling metallic materials. This is because fiber reinforcement components are usually attached to other parts by being fixed with metal.

Market Segmentation

The US automotive composites market share is classified into type and application.

- The glass segment is expected to hold a significant market share through the forecast period.

The United States automotive composites market is segmented by fiber into glass, carbon, and natural. Among these, the glass segment is expected to hold a significant market share through the forecast period. Glass fiber composites are widely utilized in the automotive sector because of their high strength, stiffness, flexibility, and chemical resistance. Over the last couple of years, there has been a significant need for lightweight materials to enhance fuel efficiency and reduce emissions. Due to being cheaper than carbon and natural fiber, glass fiber composites are extensively used in the automotive industry.

- The exterior segment is expected to dominate the US automotive composites market during the projected period.

Based on the application, the United States automotive composites market is divided into exterior, interior, structure & power train, and other. Among these, the exterior segment is expected to dominate the US automotive composites market during the projected period. Exterior automotive applications like headlamps and heat shielding components often utilize automotive composites. Numerous OEMs are also concentrating on incorporating composites into their vehicle chassis. Recent advancements show that reinforced thermoplastics might be the upcoming trend, as proven by the use of thermoplastic composites in the exterior components of BMW's i3, the first car to incorporate them in mass production.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States automotive composites market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3B Fiberglass

- Base Group

- BASF

- BMW

- Cytec Industries Inc

- Delphi Auto

- General Motors Company

- Nippo Sheet Glass Co Ltd

- SGL Group

- 6Toray Industries Inc

- Teijin Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, BASF, a top chemical company, collaborated with Chroma Color, a maker of color and additive concentrates, to improve the utilization of advanced automotive composites. This partnership seeks to offer fresh solutions for lightweight and high-performance materials in automotive use.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Automotive Composites Market based on the below-mentioned segments:

United States Automotive Composites Market, By Fiber

- Glass

- Carbon

- Natural

United States Automotive Composites Market, By Application

- Exterior

- Interior

- Structure & Power train

- Other

Need help to buy this report?