United States Automotive Glass Market Size, Share, and COVID-19 Impact Analysis, By Glass Type (Laminated Glass, Tempered Glass, and Others), By Material Type (IR PVB, Metal Coated Glass, Tinted Glass, and Others), By Application (Windshield, Sidelight, Backlite, Rear Quarter Glass, Sideview Mirror, Rearview Mirror, and Others), and US Automotive Glass Market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationUnited States Automotive Glass Market Insights Forecasts to 2033

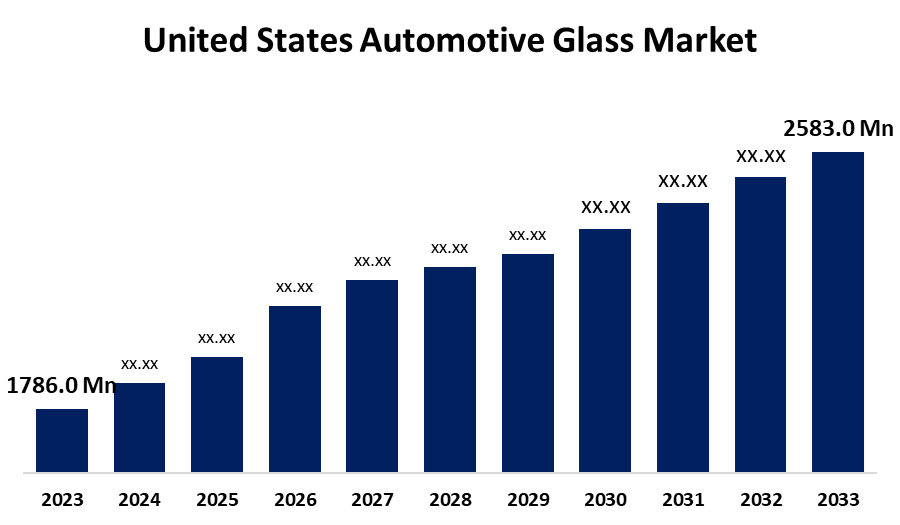

- The U.S. Automotive Glass Market Size was Valued at USD 1,786.0 Million in 2023

- The U.S. Automotive Glass Market Size is Growing at a CAGR of 3.76% from 2023 to 2033

- The U.S. Automotive Glass Market Size is Expected to Reach USD 2,583.0 Million by 2033

Get more details on this report -

The US automotive glass market size is anticipated to exceed USD 2,583.0 Million by 2033, growing at a CAGR of 3.76% from 2023 to 2033. The USA automotive glass market is driven by growing vehicle production, safety standards, and innovations in smart glass technology. The growing use of ADAS, HUD screens, and laminated windshields also boost market growth, improving safety and efficiency.

Market Overview

The US automotive glass market is the production and sale of glass utilized in automobiles, such as windshields, windows, and sunroofs. It has laminated, tempered, and smart glass technologies for safety, toughness, and UV protection. ADAS integration, thermal insulation, and improved visibility are supported by advancements, thus propelling the growth of the market. Moreover, sweeping factors responsible for the long-term growth prospects of the U.S. automotive glass market include the rising use of ADAS-friendly windshields, growing demands for lightweight, energy-efficient glass, and innovative advancements in smart glass technology. Enhanced electric vehicle (EV) production, strict safety standards, and consumer choices in favour of panoramic sunroofs also lead to increased demands. Self-healing and solar-control glass advancements improve market possibilities and promote sustainability and efficiency across advanced automotive design.

Report Coverage

This research report categorizes the market for the USA automotive glass market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US automotive glass market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. automotive glass market.

United States Automotive Glass Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1,786.0 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.76% |

| 2033 Value Projection: | USD 2,583.0 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Material Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | AGC Inc., Saint-Gobain Sekurit, Fuyao Glass America Inc., Pilkington North America (NSG Group), Guardian Glass LLC, Vitro Automotive Glass, Xinyi Glass Holdings Limited, Central Glass Co., Ltd., Corning Incorporated, and Other key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Drivers for the United States automotive glass market is the growth of autonomous vehicle development, growth in the application of augmented reality (AR) head-up displays (HUDs) in windshields, and demand for soundproof glass to improve cabin comfort. The trend towards pushing advanced glazing solutions to enhance aerodynamics and fuel efficiency, as well as recyclable glass materials for sustainability, is also driving market growth. Growing vehicle customization trends also increase demand for premium glass features.

Restraining Factors

Constraining factors are high manufacturing expenses of high-end glass, complicated installation procedures, vulnerability to damage and costly replacement, supply chain interruptions, and strict safety codes, which hinder innovation and growth in the market.

Market Segmentation

The U.S. automotive glass market share is classified into glass type, material type, and application.

- The laminated glass segment accounted for the largest share of the US automotive glass market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of glass type, the US automotive glass market is divided into laminated glass, tempered glass, and others. Among these, the laminated glass segment accounted for the largest share of the US automotive glass market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is owing to its extensive application in windshields, providing enhanced safety, noise elimination, and UV blockage. It is a favourite due to its shatter resistance in the event of an impact, particularly with the growing use of ADAS and smart windshield technology in current vehicles, further boosting demand.

- The IR PVB segment accounted for a substantial share of the United States automotive glass market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of material type, the Unites States automotive glass market is divided into IR PVB, metal coated glass, tinted glass, and others. Among these, the IR PVB segment accounted for a substantial share of the Unites States automotive glass market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is because of its better heat insulation, UV protection, and improved safety features. Its growing use in windshields and sunroofs, especially in electric and luxury cars, fuels demand, as it enhances energy efficiency by lowering cabin heat buildup and air conditioning consumption.

- The windshield segment accounted for the largest share of the U.S. automotive glass market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of application, the U.S automotive glass market is divided into windshield, sidelight, backlight, rear quarter glass, sideview mirror, rearview mirror, and others. Among these, the above windshield segment accounted for the largest share of the U.S. automotive glass market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is because of their critical function in vehicle safety, aerodynamics, and structural soundness. Further demand is created by the increasing use of ADAS-integrated windshields, HUD projections, and laminated glass to resist impacts. Stringent security regulations and EV adoption also make windshields continue to reign supreme in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US automotive glass market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AGC Inc.

- Saint-Gobain Sekurit

- Fuyao Glass America Inc.

- Pilkington North America (NSG Group)

- Guardian Glass LLC

- Vitro Automotive Glass

- Xinyi Glass Holdings Limited

- Central Glass Co., Ltd.

- Corning Incorporated

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2025, When the Consumer Electronics Show (CES) opened, Gentex Corporation debuted a host of next-generation products, including display-integrated dimmable sun visors, digital rearview mirrors with OLED displays, mirror-integrated driver and in-cabin monitoring systems, and enhancements to HomeLink, the industry’s most comprehensive and versatile car-to-home automation system.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the USA automotive glass market based on the below-mentioned segments:

US Automotive Glass Market, By Glass Type

- Laminated Glass

- Tempered Glass

- Others

US Automotive Glass Market, By Material Type

- IR PVB

- Metal Coated Glass

- Tinted Glass

- Others

US Automotive Glass Market, By Application

- Windshield

- Sidelight

- Backlite

- Rear Quarter Glass

- Sideview Mirror

- Rearview Mirror

- Others

Need help to buy this report?