United States Automotive Service Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Maintenance Services, Mechanical, Exterior & Structural), By Vehicle Type (Passenger Cars, Commercial Vehicles), and United States Automotive Service Market Insights Forecasts to 2033

Industry: Automotive & TransportationUnited States Automotive Service Market Insights Forecasts to 2033

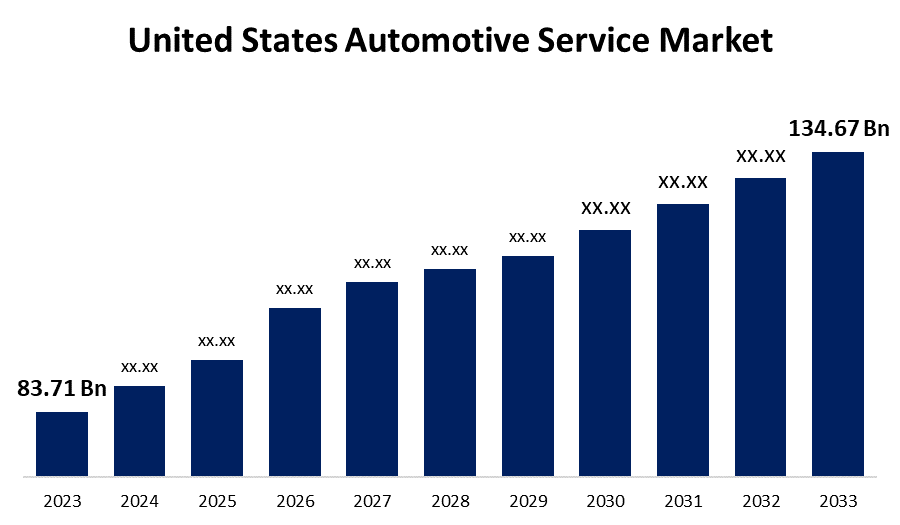

- The United States Automotive Service Market Size was valued at USD 83.71 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.87% from 2023 to 2033.

- The United States Automotive Service Market Size is Expected to Reach USD 134.67 Billion by 2033.

Get more details on this report -

The United States Automotive Service Market Size is Expected to Reach USD 134.67 Billion by 2033, at a CAGR of 4.87% during the forecast period 2023 to 2033.

Market Overview

Automobile service includes any building, structure, improvements, or land used for any kind of repair or replacement part for an automobile that doesn't require removing the engine head, pan, transmission, or differential. This includes, but isn't limited to, cooling, electrical, fuel, and exhaust systems; wheel alignment and balancing, brake adjustment, relining and repairs, mufflers, tires, sales and services, shock absorbers, installation of stereo equipment, car alarms, or cell phone installations. Furthermore, the United States is the most important market for premium automobiles. The primary driver of luxury car growth in the automotive industry is the rising demand for upscale SUVs. Luxury SUV sales in the US are far higher than those of other luxury vehicles because of the accessibility of low-cost borrowing, the decline in gasoline prices, and the growing need for personal mobility. Luxury cars are defined as high-end automobiles with cutting-edge features and design, which increase demand when combined with easily accessible financing. Therefore, it is anticipated that growing consumer preference for luxury vehicles will drive up demand for automotive services, which will drive the United States automotive service market's growth throughout the forecast period.

Report Coverage

This research report categorizes the market for United States automotive service market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States automotive service market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States automotive service market.

United States Automotive Service Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 83.71 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.87% |

| 2033 Value Projection: | USD 134.67 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Service Type, By Vehicle Type, and COVID-19 Impact Analysis. |

| Companies covered:: | Safelite Group, Firestone Complete Auto Care, Jiffy Lube International, Inc., Meineke Car Care Centers, LLC., Midas International, LLC, Monro Inc., Walmart Inc., Pep Boys, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Governments are placing a lot of pressure on manufacturers of passenger automobiles to develop efficient, low-emission vehicles, which has increased the demand on those businesses to invest in research and development. Because of the rising need for automobile manufacturing and sales, the automotive services sector is projected to expand throughout the course of the projection period. Furthermore, the key trend shaping market growth is increased vehicle digitalization and electrification. The desire for more information for drivers, less fuel consumption, less pollutants, improved safety, driver assistance, and a simple and enjoyable driving experience is driving the growth of the automotive industry. To keep up with this trend, original equipment manufacturers (OEMs) are getting ready to release new products.

Restraining Factors

The automotive industry is raising its dependency on computer technologies to provide improved performance and several advanced features. Therefore, the growth of vehicle connectivity leads to increased security constraints that can impact the vehicle's functionality, thus restraining the market growth in United States.

Market Segment

- In 2023, the mechanical segment accounted for the largest revenue share over the forecast period.

Based on the service type, the United States automotive service market is segmented into maintenance services, mechanical, exterior & structural. Among these, the mechanical segment has the largest revenue share over the forecast period. Mechanical services give detailed technical input for handoff between designers and manufactures. Vehicle parts are made by the Iron after some time corrosion will occur so mechanical maintenance will boost the market growth in the forecast period.

- In 2023, the commercial vehicles segment is expected to hold the largest share of the United States Automotive Service market during the forecast period.

Based on the vehicle type, the United States automotive service market is classified into passenger cars and commercial vehicles. Among these, the commercial vehicles segment is expected to hold the largest share of the United States automotive service market during the forecast period. The rising sales for the commercial vehicles and government stringent regulation towards safety for vehicle maintenance such factor is boost the market growth in forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States automotive service market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Safelite Group

- Firestone Complete Auto Care

- Jiffy Lube International, Inc.

- Meineke Car Care Centers, LLC.

- Midas International, LLC

- Monro Inc.

- Walmart Inc.

- Pep Boys

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On December 2022, one of the biggest auto retailers in America, AutoNation Inc., recently announced the acquisition of Repair Smith, a full-service mobile vehicle repair and maintenance company with its headquarters located in Los Angeles, California, and a sizable operational presence throughout the western and southern regions of the country.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States automotive service market based on the below-mentioned segments:

United States Automotive Service Market, By Service Type

- Maintenance Services

- Mechanical

- Exterior & Structural

United States Automotive Service Market, By Vehicle Type

- Passenger Cars

- Commercial Vehicles

Need help to buy this report?