United States Automotive Thermoplastic Polymer Composites Market Size, Share, and COVID-19 Impact Analysis, By Production Type (Hand Layup, Resin Transfer Molding, Vacuum Infusion Processing, Injection Molding, and Compression Molding), By Application (Structural Assembly, Power Train Components, Interior, Exterior, and Others), and U.S. Automotive Thermoplastic Polymer Composites Market Insights, Industry Trend, Forecasts to 2033.

Industry: Chemicals & MaterialsUnited States Automotive Thermoplastic Polymer Composites Market Insights Forecasts to 2033

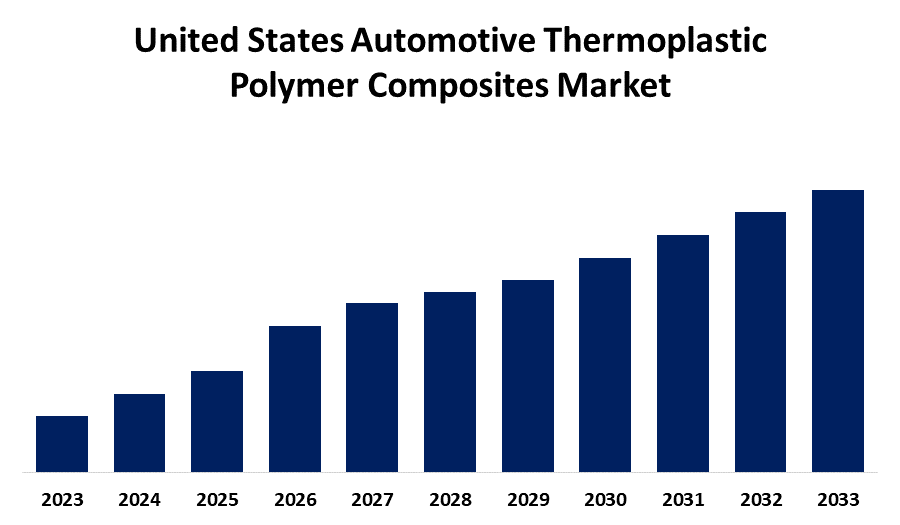

- The Market is Growing at a CAGR of 2.94% from 2023 to 2033

- The U.S. Automotive Thermoplastic Polymer Composites Market Size is Anticipated to hold a significant share by 2033.

Get more details on this report -

The U.S. Automotive Thermoplastic Polymer Composites Market is Anticipated to hold a significant share by 2033, growing at a CAGR of 2.94% from 2023 to 2033. The U.S. automotive thermoplastic polymer composites market is growing because of the demand for lightweight, high-strength materials, driven by fuel efficiency regulations, EV adoption, and advancements in cost-effective manufacturing and recycling technologies.

Market Overview

The U.S. automotive thermoplastic polymer composites market is the production and use of lightweight, high-strength thermoplastic composites such as carbon and glass fiber-reinforced materials in vehicles. These improve fuel efficiency, durability, and performance. Growth is driven by demand for lightweight solutions, emission regulations, and advancements in manufacturing technologies. Moreover, the U.S. automotive thermoplastic polymer composites market holds much potential due to increasing demands for lightweight and high-strength materials, such as the growing demand for efficiency and better vehicle performance through higher fuel efficiency. Moreover, due to stricter emissions standards, rapid growth in new manufacturing technologies, and increased usage of electric vehicles, this industry will grow rapidly. Innovation in recyclable, low-cost, and effective thermoplastic composites creates an enormous scope that will become necessary for sustainable future automotive manufacturing in the United States.

Report Coverage

This research report categorizes the market for the U.S. automotive thermoplastic polymer composites market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. automotive thermoplastic polymer composites market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. automotive thermoplastic polymer composites market.

United States Automotive Thermoplastic Polymer Composites Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.94% |

| Historical Data for: | 2021-2022 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Production Type, By Application |

| Companies covered:: | 3B-Fiberglass, BASF, Gurit, Solvay, Arkema Group, Cytec Industries Inc., Celanese Corporation, Daicel Polymer Ltd, DuPont de Nemours, and Others |

| Pitfalls & Challenges: | COVID-19 impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth in demand for lightweight materials for improved fuel efficiency and compliance with corporate average fuel economy (CAFE) standards drives the U.S. automotive thermoplastic polymer composites market. In addition, the increased adoption of electric vehicles, the increasing use of automated manufacturing, and the recyclability of thermoplastics drive the demand further. Moreover, growing investments in carbon fiber and glass fiber composites, as well as low-cost production methods, are also driving market growth and innovation in the automotive sector.

Restraining Factors

High material costs, intricate manufacturing, lower recycling, and poor performance in extreme conditions have been restraining factors for the U.S. market of automotive thermoplastic polymer composites along with slow uptake by automakers and supply chain challenges.

Market Segmentation

The U.S. automotive thermoplastic polymer composites market share is classified into production type and application.

- The injection molding segment accounted for the largest share of the U.S. automotive thermoplastic polymer composites market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of production type, the U.S. automotive thermoplastic polymer composites market is divided into hand layup, resin transfer molding, vacuum infusion processing, injection molding, and compression molding. Among these, the injection molding segment accounted for the largest share of the U.S. automotive thermoplastic polymer composites market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is because it has very high production efficiency, low costs, and precision in the creation of complex shapes. This enables mass production of weightlight components that reduce the weight of the vehicle. Moreover, its automation potential plus its compatibility with multiple thermoplastics makes it dominant in the market.

- The structural assembly segment accounted for a substantial share of the U.S. automotive thermoplastic polymer composites market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of application, the U.S. automotive thermoplastic polymer composites market is divided into structural assembly, power train components, interior, exterior, and others. Among these, the structural assembly segment accounted for a substantial share of the U.S. automotive thermoplastic polymer composites market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is due to the increasing demand for lightweight and high-strength materials that enhance vehicle safety, fuel efficiency, and durability. Increasingly, automobile manufacturers are using thermoplastic composites in chassis, frames, and body structures to meet strict emission regulations and improve crash resistance and overall performance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. automotive thermoplastic polymer composites market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3B-Fiberglass

- BASF

- Gurit

- Solvay

- Arkema Group

- Cytec Industries Inc.

- Celanese Corporation

- Daicel Polymer Ltd

- DuPont de Nemours

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. automotive thermoplastic polymer composites market based on the below-mentioned segments:

U.S. Automotive Thermoplastic Polymer Composites Market, By Product Type

- Hand Layup

- Resin Transfer Molding

- Vacuum Infusion Processing

- Injection Molding

- Compression Molding

U.S. Automotive Thermoplastic Polymer Composites Market, By Application

- Structural Assembly

- Power Train Components

- Interior

- Exterior

- Others

Need help to buy this report?