United States Aviation Market Size, Share, and COVID-19 Impact Analysis, By Aircraft Type (Commercial Aviation, General Aviation, Military Aviation), and United States Aviation Market Insights, Industry Trend, Forecasts to 2033.

Industry: Aerospace & DefenseUnited States Aviation Market Insights Forecasts to 2033

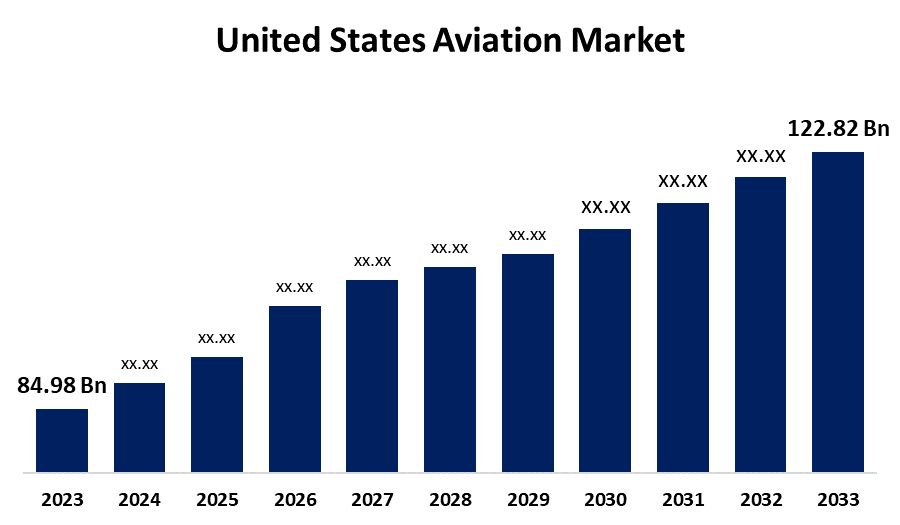

- The U.S. Aviation Market Size was Valued at USD 84.98 Billion in 2023

- The United States Aviation Market Size is Growing at a CAGR of 3.75% from 2023 to 2033

- The US Aviation Market Size is Expected to Reach USD 122.82 Billion by 2033

Get more details on this report -

The United States Aviation Market Size is anticipated to exceed USD 122.82 Billion by 2033, growing at a CAGR of 3.75% from 2023 to 2033. The U.S. aviation market is growing as a result of increased air travel demand, modernization of the fleet, and aerospace innovation.

Market Overview

The U.S. aviation market is comprised of both civil and military markets, addressing commercial airlines, general aviation, military planes, aerospace manufacturing, and aviation services. It comprises passenger and cargo transportation, airplane manufacturing, MRO, air traffic management, and airport management, driven by regulations, technological developments, and economic considerations governing air travel demand. Moreover, the development of the US aviation market relies on technology innovation, growth in air travel demand, upgrading infrastructure, and sustainability efforts. Major drivers include growing passenger and cargo traffic, investment in future aircraft, development of urban air mobility, and regulatory encouragement. Improved MRO services, digitalization, and military aviation technologies also support market growth, whereas fuel prices and geopolitical tensions impact long-term growth opportunities.

Furthermore, the dedication to military aviation progress is further supported by recent strategic purchases and modernization initiatives. For instance, in April 2024, the USA purchased a major quantity of 81 Soviet-era fighter and bomber aircraft from Kazakhstan, which include MiG-31 interceptors, MiG-27 fighter bombers, MiG-29 fighters, and Su-24 bombers. This purchase, as part of a general auction of 117 military jets, demonstrates the continued investment in increasing and diversifying the military aircraft fleet. The consistent high defense spending allows for the acquisition of advanced military aircraft and facilitates ongoing research and development in cutting-edge aviation technology, keeping the region technologically ahead in military aviation.

Report Coverage

This research report categorizes the market for the US aviation market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. aviation market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA aviation market.

United States Aviation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 84.98 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.75% |

| 2033 Value Projection: | USD 122.82 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Aircraft Type |

| Companies covered:: | The Boeing Company, Airbus SE, Lockheed Martin Corporation, Northrop Grumman Corporation, General Dynamics Corporation, Bombardier Inc., Embraer, Dassault Aviation, Leonardo S.p.A, Textron Inc., Pilatus Aircraft Ltd, Piper Aircraft Inc., Cirrus Design Corporation, Air Tractor Inc., ATR, MD Helicopters LLC, Robinson Helicopter Company Inc., Honda Motor Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Factors driving the U.S. aviation industry are its extensive domestic air transportation network, market dominance by large airlines, a sophisticated aerospace manufacturing industry dominated by Boeing, and significant military air programs. The USA is also a world leader in aviation innovation, with developments in urban air mobility, space tourism, and autonomous flights. Robust FAA regulations and worldwide influence on aviation policies further distinguish its market dynamics from other nations. For instance, Boeing's higher deliveries benefit the US aviation industry by improving airline capacity, supporting aerospace employment, and increasing global exports. Increased production stimulates investment, innovation in fuel-efficient aircraft, and supply chain improvements. Expanding airline fleets generate more passenger traffic, stimulating economic growth, and more robust international sales enhance USA dominance in global aviation and emerging technologies.

Restraining Factors

Tight FAA regulations, supply chain interruptions, and economic instability hold back growth in the US aviation market. Increased fuel prices and sustainability pressures drive up airline costs. Geopolitical tensions, labor shortages, and safety issues also affect aircraft production, deliveries, and overall market growth.

Market Segmentation

The U.S. aviation market share is classified into aircraft type.

- The commercial aviation segment accounted for the largest share of the US aviation market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of aircraft type, the US aviation market is divided into commercial aviation, general aviation, and military aviation. Among these, the commercial aviation segment accounted for the largest share of the US aviation market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is due to strong passenger and cargo demand, a robust airline network, and ongoing fleet expansion. Large carriers such as American, Delta, and United power market growth, backed by Boeing's production of aircraft. Increasing air travel, airport infrastructure spending, and more international routes further cement its hold.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the USA aviation market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Boeing Company

- Airbus SE

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- General Dynamics Corporation

- Bombardier Inc.

- Embraer

- Dassault Aviation

- Leonardo S.p.A

- Textron Inc.

- Pilatus Aircraft Ltd

- Piper Aircraft Inc.

- Cirrus Design Corporation

- Air Tractor Inc.

- ATR

- MD Helicopters LLC

- Robinson Helicopter Company Inc.

- Honda Motor Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, Boeing received a contract from the US government to produce 184 AH-64E Apache attack helicopters for the US armed forces and foreign buyers. The US government announced an investment, which means the helicopter will be supplied to the US armed forces and foreign buyers - namely Australia and Egypt - as part of the paramilitary process to the Foreign Service (FMS) by the U.S. government. Completion of the contract is anticipated by the end of 2027.

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. aviation market based on the below-mentioned segments:

United States Aviation Market, By Aircraft Type

- Commercial Aviation

- General Aviation

- Military Aviation

Need help to buy this report?