United States Aviation MRO Software Market Size, Share, and COVID-19 Impact Analysis, By Deployment (Cloud-Based and On-Premise), By End User (Airlines, Mros, and OEMs), and United States Aviation MRO Software Market Insights, Industry Trend, Forecasts to 2033.

Industry: Aerospace & DefenseUnited States Aviation MRO Software Market Insights Forecasts to 2033

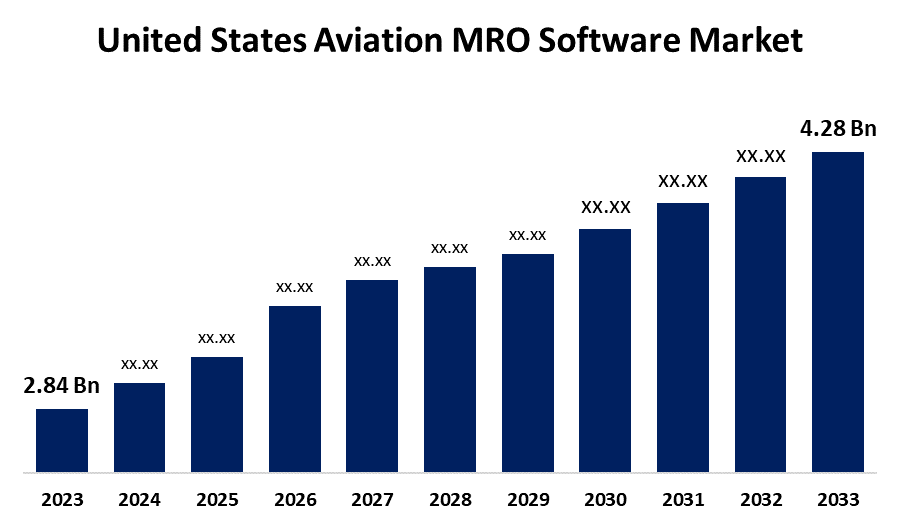

- The U.S. Aviation MRO Software Market Size was Valued at USD 2.84 Billion in 2023

- The United States Aviation MRO Software Market Size is Growing at a CAGR of 4.19% from 2023 to 2033

- The USA Aviation MRO Software Market Size is Expected to Reach USD 4.28 Billion by 2033

Get more details on this report -

The USA Aviation MRO Software Market Size is anticipated to exceed USD 4.28 Billion by 2033, growing at a CAGR of 4.19% from 2023 to 2033. The US aviation MRO software market is expanding due to digital transformation, predictive maintenance demand, and cloud adoption.

Market Overview

The USA aviation MRO software market is the industry that involves computer programs aimed at simplifying, organizing, and maximizing maintenance, repair, and overhaul processes in the US aviation sector. The market requires software applications that assist airlines, MRO providers, OEMs, and military aviation services in predictive maintenance, inventory control, compliance management, work order management, and real-time analysis. Moreover, rising aircraft fleets, growing digital solutions adoption, and regulatory compliance fuel the growth of the U.S. aviation MRO software market. Cloud computing and AI-enabled predictive maintenance save time and resources by cutting down on downtime and expenses. Rising demand for real-time analytics, blockchain to safeguard records, and IoT integration accelerate growth. Growing military aviation and aftermarket business also drive market potential, and innovation and competition among software solutions providers drive market growth. For instance, in September 2024, Texas, American Airlines announced almost 500 new aviation maintenance positions and other lines of heavy maintenance work at the carrier's maintenance bases in Charlotte, North Carolina; Pittsburgh; and Tulsa, Oklahoma. The increased headcount will enable the airline to conduct more heavy maintenance check work at these facilities.

Report Coverage

This research report categorizes the market for the US aviation MRO software market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. aviation MRO software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA aviation MRO software market.

United States Aviation MRO Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.84 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.19% |

| 2033 Value Projection: | USD 4.28 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Deployment, By End User |

| Companies covered:: | IBM Corporation, Oracle Corporation, The Boeing Company, Jet Support Services Inc., SAP SE, GE Aviation, Camp Systems International Inc., Honeywell Automation Ltd, Flatrion Solutions Inc., APT Inc., and Others |

| Pitfalls & Challenges: | COVID-19 impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The USA aviation MRO software market is propelled by growing aircraft fleets, enhanced demand for predictive maintenance, and strict FAA regulations for safety and compliance. Airlines and MRO operators are embracing digital solutions to improve efficiency, minimize downtime, and streamline inventory management. The development of AI, IoT, and cloud-based platforms further enhances market growth, while increasing air passenger traffic generates ongoing maintenance and repair demands.

Restraining Factors

High cost of implementation, security threats, and compatibility issues with old systems hold back the US aviation MRO software market. Furthermore, aversion to digitalization and data protection issues prevent mass usage among smaller MRO providers.

Market Segmentation

The U.S. United States aviation MRO software market share is classified into deployment, and end user.

- The cloud-based segment accounted for the largest share of the US aviation MRO software market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of deployment, the United States aviation MRO software market is divided into cloud-based and on-premise. Among these, the cloud-based segment accounted for the largest share of the United States Aviation MRO Software market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is because of its scalability, affordability, and remote accessibility. Cloud solutions are favoured by airlines and MRO suppliers for real-time data analysis, predictive maintenance, and smooth integration. Moreover, increased cybersecurity evolution and decreased IT infrastructure costs propel cloud adoption as against on-premise solutions.

- The airlines segment accounted for a substantial share of the U.S. aviation MRO software market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of end user, the U.S. aviation MRO software market is divided into airlines, Mros, and OEMs. Among these, the airlines segment accounted for a substantial share of the U.S. aviation MRO software market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is because of their high maintenance requirements, fleet growth, and compliance needs. Airlines increasingly opt for digital MRO solutions to enable predictive maintenance, cost savings, and operational efficiency, creating more demand versus market players in the form of MRO providers and OEMs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the USA aviation MRO software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IBM Corporation

- Oracle Corporation

- The Boeing Company

- Jet Support Services Inc.

- SAP SE

- GE Aviation

- Camp Systems International Inc.

- Honeywell Automation Ltd

- Flatrion Solutions Inc.

- APT Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, EmpowerMX, the cloud-based aircraft maintenance software provider, announced the release of EMX Vision, an AI-driven module that revolutionizes MRO planning and execution, developed on machine learning, artificial intelligence, and predictive modeling to provide MRO organizations with the capability to use internal and external data to provide highly accurate turn-around times to customers.

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US aviation MRO software market based on the below-mentioned segments:

United States Aviation MRO Software Market, By Deployment

- Cloud-Based

- On-Premise

United States Aviation MRO Software Market, By End User

- Airlines

- Mros

- OEMs

Need help to buy this report?