United States Banking-As-A-Service Market Size, Share, and COVID-19 Impact Analysis, By Deployment (Cloud-Based and On-Premises), By Offering (Products and Services), By Providers (Traditional Banks and Fintech Companies/NBFC), and United States Banking-As-A-Service Market Insights Forecasts 2023 - 2033.

Industry: Banking & FinancialUnited States Banking-As-A-Service Market Insights Forecasts to 2033

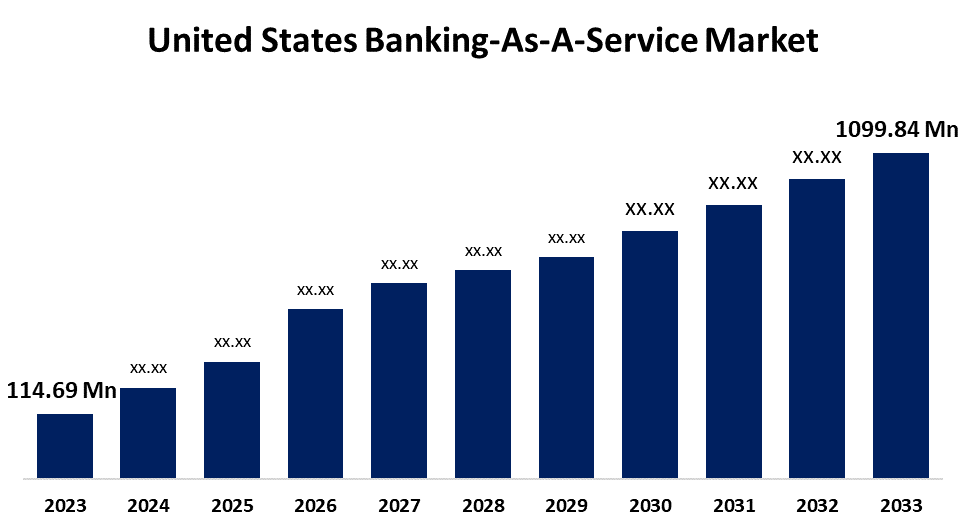

- The United States Banking-As-A-Service Market Size was valued at USD 114.69 Million in 2023

- The Market Size is Growing at a CAGR of 25.37% from 2023 to 2033.

- The United States Banking-As-A-Service Market Size is Expected to Reach USD 1099.84 Million by 2033.

Get more details on this report -

The United States Banking-As-A-Service Market Size is Expected to reach USD 1099.84 Million by 2033, at a CAGR of 25.37% during the forecast period 2023 to 2033.

Market Overview

Third-party financial service providers can integrate and supply banking functions using the Banking as a Service (BaaS) model without having to set up a conventional banking infrastructure. BaaS makes it possible to effortlessly access essential banking services including loans, deposits, and payments through APIs. Fintech enterprises, startups, and non-banking entities can create and provide financial products to end consumers with this strategy. BaaS promotes creativity, shortens the time it takes for new financial solutions to reach the market, and improves client satisfaction. To create a more competitive and dynamic financial environment, BaaS providers can concentrate on developing customized financial solutions by utilizing the current banking infrastructure. By making sophisticated financial tools more accessible to a wider range of enterprises and customers, this cooperative framework fosters diversity in financial services and the democratization of banking. The availability of Application Programming Interfaces (APIs), the quickening pace of digitization, and the growing need for financial services are the main factors driving market progress. The growing acceptance of online banking is another factor contributing to the industry's rise. Online banking is becoming more and more popular among consumers as a way to access a variety of services, such as account statements, financial transfers, and online shopping.

Report Coverage

This research report categorizes the market for the United States banking-as-a-service market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States banking-as-a-service market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States banking-as-a-service market.

United States Banking-As-A-Service Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 114.69 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 25.37% |

| 2033 Value Projection: | USD 1099.84 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 173 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Deployment, By Offering, By Providers |

| Companies covered:: | Green Dot Corporation, Treasury Prime, BOKU, Dwolla, Intuit, Square Inc, PayPal, Prosper Marketplace, Movencorp Inc, SynapseFI, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Increasing adoption of BaaS in financial services is a key driver driving the BaaS market. The growing use of financial services such as banking, business advisory, wealth management, mutual funds, insurance, stock exchange, treasury/debt instruments, tax/audit consultancy, capital restructuring, and portfolio management reflects the growing use of digital transactions in banking. In recent years, an increasing number of Internet services have fueled the digital revolution, which has impacted BaaS among mobile-based users and business owners adopting digital technologies in the banking sector, including banking software, audit software, and services. Furthermore, the platform facilitates banks' and FinTech's financial service streamlining, service enhancement, and client experience, all of which contribute to market growth. Furthermore, it facilitates the provision of customer-focused financial services by financial institutions and enhances their funding sources to cater to their sizable clientele, hence propelling market expansion.

Restraining Factors

The high cost of adopting this technology for various banking institutions has hindered the expansion of the BaaS business. The increase in cyber-attacks in the financial sector to collect customer information is restraining the market growth.

Market Segment

The United States banking-as-a-service market share is classified into deployment, offering, and providers.

- The cloud-based segment accounted for the largest revenue share over the forecast period.

Based on deployment, the United States banking-as-a-service market is segmented into cloud-based and on-premises. Among these, the cloud-based segment has the largest revenue share over the forecast period. The installation (management) of banking infrastructure to oversee financial processes and banking cloud services without the requirement for specialized physical servers is referred to as cloud banking services. Cloud banking refers to the on-demand delivery of hosted computer services (servers, analytics, networking, data storage, apps, and communication) to the banking industry. a platform for cloud-hosted banking-as-a-service (BaaS) to generate revenue from investments in regulated banking ecosystems. Cloud-based systems facilitate the one-click economy by the seamless integration of core banking and non-financial operations through the use of Application Protocol Interfaces (APIs).

- The products segment accounted for the largest revenue share over the forecast period.

Based on offering, the United States banking-as-a-service market is segmented into products and services. Among these, the products segment accounted for the largest revenue share over the forecast period. Credit cards, mutual funds, savings accounts, current accounts, fixed deposits, money transfers, personal loans, house loans, auto loans, and Visa debit cards are just a few of the items offered. BaaS enables third-party suppliers to provide lending products such as personal loans, business loans, and consumer credit.

- The traditional banks segment accounted for the largest revenue share over the forecast period.

Based on providers, the United States banking-as-a-service market is segmented into traditional banks, fintech companies/NBFC. Among these, the traditional banks segment accounted for the largest revenue share over the forecast period. The banking sector has historically been seen as outdated. It makes sense—banks have been around for hundreds of years. Traditional banks are those that have a physical location and a domestic banking license. These are well-known banks, like Bank of America, ING, and Banco Santander, to name a few. Conventional banks have long served as the stable backbone of the financial system.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States banking-as-a-service market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Green Dot Corporation

- Treasury Prime

- BOKU

- Dwolla

- Intuit

- Square Inc

- PayPal

- Prosper Marketplace

- Movencorp Inc

- SynapseFI

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2021, with a focus on Canada, the UK, and Australia, Dwolla raised USD 21 million in funding. The company plans to use this money to hire more staff, start the process of expanding its rails to more markets outside of the US, and enhance the functionality of its service, especially in terms of how it integrates and responds better to card payments.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Banking-As-A-Service Market based on the below-mentioned segments:

United States Banking-As-A-Service Market, By Deployment

- Cloud-Based

- On-Premises

United States Banking-As-A-Service Market, By Offering

- Products

- Services

United States Banking-As-A-Service Market, By Providers

- Traditional Banks

- Fintech Companies/NBFC

Need help to buy this report?