United States Betaine Market Size, Share, and COVID-19 Impact Analysis, By Forms (Betaine Anhydrous, Betaine Monohydrate, Betaine HCI, Cocamidopropyl Betaine, and Other Forms), By Types (Synthetic Betaine and Natural Betaine), By Applications (Food, Beverages, and Dietary Supplements, Animal Feed, Personal Care, Detergent, and Other), and United States Betaine Market Insights Forecasts 2022 – 2032

Industry: Chemicals & MaterialsUnited States Betaine Market Insights Forecasts to 2032

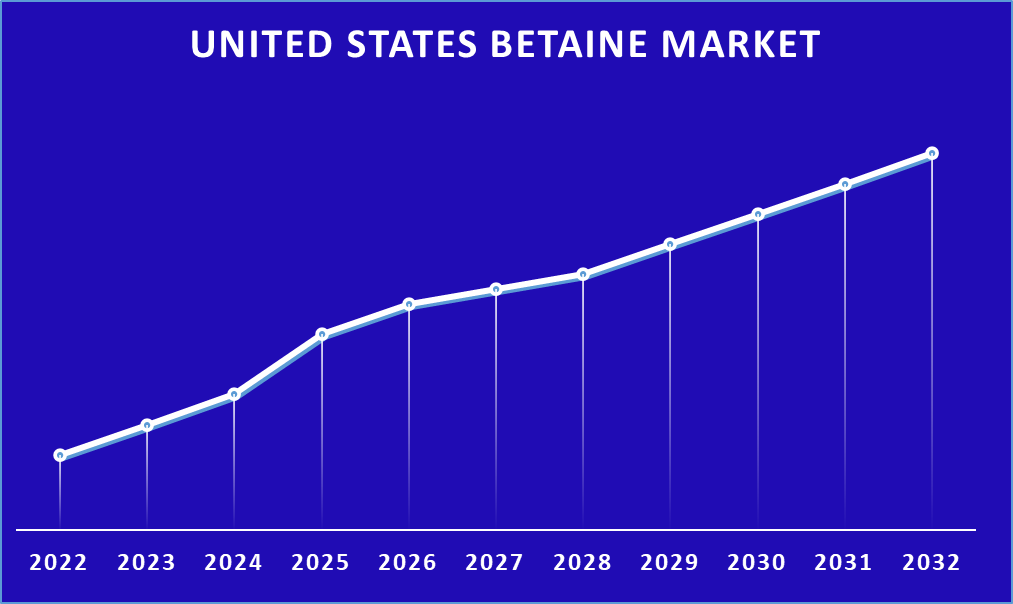

- The Market Size is Growing at a CAGR of 4.4% from 2022 to 2032.

- The United States Betaine Market Size is Expected to Hold a Significant Share by 2032.

Get more details on this report -

The United States Betaine Market Size is Expected to Hold a Significant Share by 2032, at a CAGR of 4.4% during the forecast period 2022 to 2032.

Market Overview

Betaine is a chemical compound with three methyl groups. The methyl group acts as a donor in many metabolic pathways. It is used to treat an inherited condition in which the body is unable to break down the protein, resulting in elevated blood homocysteine levels. This chemical compound is used to create a thick lather, such as in foaming products. In hair conditioner, it softens the hair and acts as an anti-static agent. When consumed directly by mouth, betaine has no significant side effects; however, betaine anhydrous can cause minor side effects such as nausea, stomach upset, and diarrhea. Furthermore, the food and beverage industry is projected to grow rapidly due to an increase in the production of ready-to-eat foods and processed foods.

Report Coverage

This research report categorizes the market for the United States betaine market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States betaine market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States betaine market.

United States Betaine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.4% |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Forms, By Types, By Applications |

| Companies covered:: | American Crystal Sugar Company, AMINO GmbH, DuPont, Esprix Technologies, Evonik Industries AG, Kao Corporation, Merck KGaA, Solvay, Stepan Company, Trouw Nutrition (Selko) and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rising demand for energy and sports drinks is expected to boost the market's scope, and increasing consumption of products that improve physical performance and immune systems may drive market growth. Additionally, energy supplements and protein powders can create lucrative opportunities as consumer awareness about betaine usage in healthy products grows. Furthermore, the expanding tourism and hotel industries necessitate a large number of frozen food materials and ingredients, which can provide lucrative opportunities for market participants.

Restraining Factors

Unexpected skin and hair reactions caused by betaine use can hinder market growth. The outbreak of COVID-19 caused a halt in betaine production, affecting a variety of industries due to supply chain disruption, stifling market growth.

Market Segment

- In 2022, the betaine anhydrous segment accounted for the largest revenue share over the forecast period.

Based on the forms, the United States betaine market is segmented into betaine anhydrous, betaine monohydrate, betaine HCI, Cocamidopropyl betaine, and other forms. Among these, the betaine anhydrous segment has the largest revenue share over the forecast period. The presence of amino acids in betaine anhydrous improves metabolism. Betaine anhydrous aids the body's processing of a chemical known as homocysteine. Homocysteine helps many different parts of the body function normally, including blood, bones, eyes, heart, muscles, nerves, and the brain. Betaine anhydrous helps to keep homocysteine levels in the blood low.

- In 2022, the natural betaine segment accounted for the largest revenue share over the forecast period.

Based on types, the United States betaine market is segmented into synthetic betaine and natural betaine. Among these, the natural betaine segment accounted for the largest revenue share over the forecast period. Natural Betaine is expected to gain prominence over its synthetic counterpart due to superior qualities such as improved lean development, resistance to heat stress, and decreased energy requirements. Supplements item are expected to gain popularity in sports drinks and diets due to increased strength and power while protecting cells from stress-induced harm.

- In 2022, the personal care segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States betaine market is segmented into food, beverages, dietary supplements, animal feed, personal care, detergent, and others. Among these, the personal care segment has the largest revenue share over the forecast period. Betaine is increasingly being used as an alternative to sulfur-based surfactants. As a result of its water retention and saturating properties, as well as its irritation-reducing properties, it is a widely used raw material in the personal care and cosmetic industries. Furthermore, it is widely used as a surfactant, emulsifier, and emollient in a variety of personal care products such as moisturizers and shampoos. As a result, these factors are likely to drive betaine demand across the personal care and cosmetic segment in the United States, fueling market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States betaine market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- American Crystal Sugar Company

- AMINO GmbH

- DuPont

- Esprix Technologies

- Evonik Industries AG

- Kao Corporation

- Merck KGaA

- Solvay

- Stepan Company

- Trouw Nutrition (Selko)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2021, Kao Corporation, a Japanese personal care conglomerate, launched the Essential hair care line.

- In July 2021, Solvay completed its purchase of Bayer's global coatings business. According to the terms of the agreement, the former company will have facilities in Méréville, France, as well as tolling operations in the United States and Brazil.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the United States Betaine Market based on the below-mentioned segments:

United States Betaine Market, By Forms

- Betaine Anhydrous

- Betaine Monohydrate

- Betaine HCI

- Cocamidopropyl Betaine

- Other Forms

United States Betaine Market, By Types

- Synthetic Betaine

- Natural Betaine

United States Betaine Market, By Application

- Food

- Beverages

- Dietary Supplements

- Animal Feed

- Personal Care

- Detergent

- Other United

Need help to buy this report?