United States Beverage Contract Bottling and Filling Market Size, Share, and COVID-19 Impact Analysis, By Type (Beer, Carbonates Drinks & Fruit Based Beverages, Bottles Water, and Others (Sport Drinks)), and United States Beverage Contract Bottling and Filling Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited States Beverage Contract Bottling and Filling Market Insights Forecasts to 2033

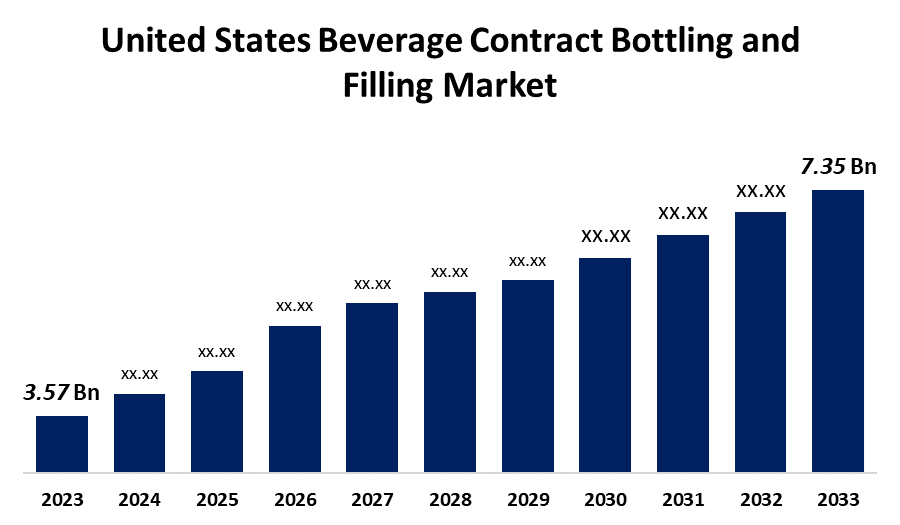

- The U.S. Beverage Contract Bottling and Filling Market Size was valued at USD 3.57 Billion in 2023.

- The Market is growing at a CAGR of 7.49% from 2023 to 2033

- The U.S. Beverage Contract Bottling and Filling Market Size is expected to reach USD 7.35 Billion by 2033

Get more details on this report -

The United States Beverage Contract Bottling and Filling Market is anticipated to exceed USD 7.35 Billion by 2033, growing at a CAGR of 7.49% from 2023 to 2033. The growing demand from new-age drinks and craft beer segment, CapEx benefits offered by contract bottlers for small-scale beverage manufacturers, and gradual change in the business model of contact packagers are driving the growth of the beverage contract bottling and filling market in the US.

Market Overview

A beverage contract bottling and filling industry provides specialised services to beverage firms looking for cost-effective production and distribution solutions in the beverage industry. By offering a variety of services like bottling, filling, packaging, and frequently distribution, contract bottlers and fillers free up beverage brands to concentrate on marketing and new product development while outsourcing manufacturing logistics. Contract bottlers are increasingly adopting advanced technology, like robotic systems, automated filling lines, and Internet of Things (IoT) sensors, to improve total production throughput, consistency in product quality, and operational efficiency. Using state-of-the-art technologies increases production efficiency and makes data analytics and real-time monitoring easier for the entire production line. By lowering material waste and energy consumption, technological developments in packaging materials and equipment support sustainability goals and are in line with market trends in the beverage sector towards eco-friendly practices.

Report Coverage

This research report categorizes the market for the US beverage contract bottling and filling market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States beverage contract bottling and filling market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US beverage contract bottling and filling market.

United States Beverage Contract Bottling and Filling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.57 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 7.49% |

| 2033 Value Projection: | USD 7.35 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type and COVID-19 Impact Analysis |

| Companies covered:: | Brooklyn Bottling Group, G3 Enterprises Inc., Southeast Bottling & Beverages, CSD Co-Packers Inc., Western Innovations Inc., Niagara Bottling LLC, and others Key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand from the new-age drinks and craft beer segment, along with the integration of a variety of new products and technologies is driving market growth. CapEx benefits offered by contract bottlers for small-scale beverage manufacturers, mediates sustainability and expansion of business, are escalating market growth. Furthermore, the gradual change in the business model of contact packagers is propelling the US beverage contract bottling and filling market.

Restraining Factors

The lack of flexibility and agility in manufacturing processes and dynamic nature regulations is hampering market growth for beverage contract bottling and fillings.

Market Segmentation

The United States Beverage Contract Bottling and Filling Market share is classified into beverage type.

- The beer segment is expected to hold the largest market share during the forecast period.

The United States beverage contract bottling and filling market is segmented by beverage type into beer, carbonates drinks & fruit based beverages, bottles water, and others (sport drinks). Among these, the beer segment is expected to hold the largest market share during the forecast period. In the US, beer is the most popular alcoholic beverage. While different filling machines can handle varying liquid viscosities, the filling needs for beer vary based on its viscosity and packaging.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. beverage contract bottling and filling market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Brooklyn Bottling Group

- G3 Enterprises Inc.

- Southeast Bottling & Beverages

- CSD Co-Packers Inc.

- Western Innovations Inc.

- Niagara Bottling LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Refresco, a leading independent beverage solutions provider for major brands and retailers globally, announced the completion of its acquisition of VBC Bottling Company, a US-based contract manufacturer of premium beverages.

- In January 2024, Novelis Inc., a leading sustainable aluminum solutions provider and the world leader in aluminum rolling and recycling, announced that it has signed a new contract with Ardagh Metal Packaging USA Corp., a global supplier in sustainable aluminum beverage packaging solutions. Under the contract, Novelis would supply aluminum beverage packaging sheets to Ardagh's metal production facilities in North America.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Beverage Contract Bottling and Filling Market based on the below-mentioned segments:

US Beverage Contract Bottling and Filling Market, By Type

- Beer

- Carbonates Drinks & Fruit Based Beverages

- Bottles Water

- Others (Sport Drinks)

Need help to buy this report?