United States Biguanide Market Size, Share, and COVID-19 Impact Analysis, By Drug Type (Branded and Generic), Distribution Channel (Hospital, Retail, and Online Pharmacies), and United States Biguanide Market Insights Forecasts to 2033

Industry: HealthcareUnited States Biguanide Market Insights Forecasts to 2033

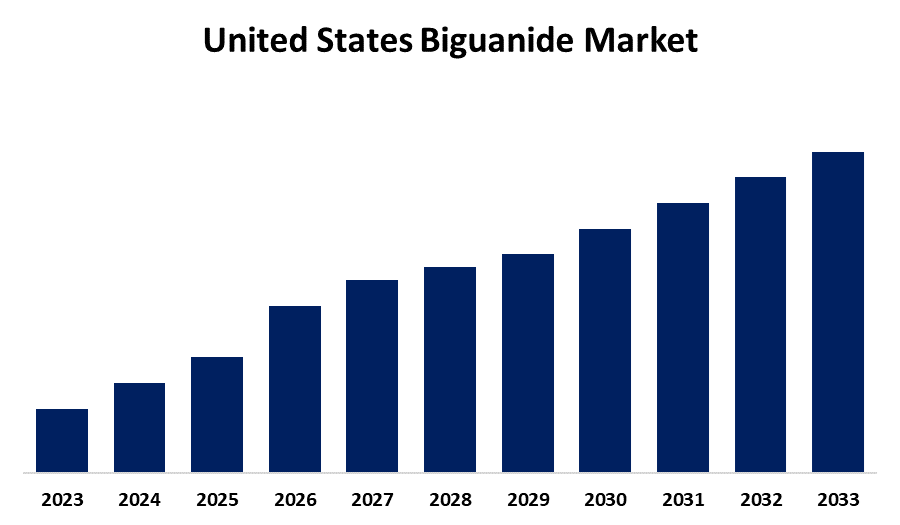

- The Market is growing at a CAGR of 3.1% from 2023 to 2033

- The US Biguanide Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The US Biguanide Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 3.1% from 2023 to 2033.

Market Overview

Biguanides are an organic class of compounds mainly used as antimicrobial agents in various applications. The most important biguanide compound is chlorhexidine, which is usually applied in health care on surfaces for disinfection, as an antiseptic for treating wounds or cuts, and as a preservative in medical equipment. They also have applications in water treatment in the production of cosmetics and in agricultural industries because of their efficacy in controlling microbial growth. Steady growth in the United States biguanide market has been primarily facilitated due to a continuously increasing demand for antiseptics and disinfectants in advanced healthcare settings. The rise in healthcare-associated infections along with continued focus on prevention of infection significantly contributes to the growth in demand. Rising awareness about hygiene and sanitation in food processing, and water treatment, among other industries, further fuels demand for the product. Government policies, such as the CDC-recommended infection control and prevention guidelines, are playing an influential role in the growth of the market. The U.S. Food and Drug Administration also promotes the use of biguanide compounds in controlled environments, as they have safety standards along with effectiveness. Moreover, further research on the antimicrobial properties and applications of biguanides is expected to thrust this market further shortly.

Report Coverage

This research report categorizes the market for the United States biguanide based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States biguanide market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each United States biguanide market sub-segment.

United States Biguanide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.1% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Drug Type, Distribution Channel, and COVID-19 Impact Analysis |

| Companies covered:: | Johnson & Johnson, Becton Dickinson and Company (BD), Hygiena LLC, Procter & Gamble (P&G), Purdue Pharma L.P., Colgate-Palmolive Company, Medline Industries, Inc., Sanofi-Aventis U.S. LLC, 3M Company, Crest Oral-B (Procter & Gamble) and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The US biguanide market has been driven by several factors. For instance, an increased rate of HAIs has necessitated the need for good antiseptics and disinfectants. Biguanides, specifically chlorhexidine, perform significant functions in controlling infections in the medical and healthcare sectors. Attainment of hygiene and sanitation awareness in food processing, agriculture, and water treatment has remained relatively high, and these further drive growth in the market. Government regulations and guidelines, such as those from the Centers for Disease Control and Prevention, promote the use of biguanide-based products with safety and effectiveness. Development and continuous research improve the suitability of these products for application in various industries.

Restraining Factors

This growth of the United States biguanide market is further inhibited by factors such as skin irritation/toxicity in some applications, regulatory hurdles, and competition through alternative disinfectants and antiseptics with more extensive consumer acceptance.

Market Segment

The U.S. biguanide market share is classified into drug type and distribution channel.

- The branded segment is expected to hold the largest market share through the forecast period.

The US biguanide market is by drug type into branded and generic. Among these, the branded segment is expected to hold the largest market share through the forecast period. This is attributed to the branded biguanide drugs, such as chlorhexidine-based products, are of great and strong brand value and very effective in medicinal and healthcare uses, and therefore of high demand in infection prevention and wound care applications. Their superior brand along with higher-priced chemo-synthetic contributed to a more dominating share of the company in this segment.

- The hospital segment is expected to hold the largest market share through the forecast period.

The US biguanide market is segmented distribution channel into hospital, retail, and online pharmacies. Among these, the hospital segment is expected to hold the largest market share through the forecast period. This is attributed to the wide use of biguanide-based preparations, such as chlorhexidine, in medical and hospital premises for infection control, surgical procedures, and wound care. Hospital facilities are superior places for most medical treatments and infection control. As a result, hospitals are the biggest consumers of antiseptics and disinfectants.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States biguanide market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Johnson & Johnson

- Becton Dickinson and Company (BD)

- Hygiena LLC

- Procter & Gamble (P&G)

- Purdue Pharma L.P.

- Colgate-Palmolive Company

- Medline Industries, Inc.

- Sanofi-Aventis U.S. LLC

- 3M Company

- Crest Oral-B (Procter & Gamble)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2023, Dr Reddy's Laboratories is pleased to announce the launch and distribution of Saxagliptin and Metformin Hydrochloride Extended-Release Tablets in the U.S. It helps in the enhancement of glycemic control in adults with type 2 diabetes mellitus.

Market Segment

This study forecasts regional and country revenue from 2022 to 2033. Spherical Insights has segmented the United States biguanide market based on the below-mentioned segments:

United States Biguanide Market, By Drug Type

- Branded

- Generic

United States Biguanide Market, By Distribution Channel

- Hospital

- Retail

- Online Pharmacies

Need help to buy this report?