United States Bioanalytical Testing Services Market Size, Share, and COVID-19 Impact Analysis, By Molecule (Small Molecule, Large Molecule, and Others), By Test (ADME, Pharmacokinetics (PK), Bioequivalence, Bioavailability, Pharmacodynamics (PD), Biomarker Testing, Virology Testing, Cell-based Assay, and Others), By End Use (CDMO, CRO, Pharma & BioPharma Companies, and Others), and U.S. Bioanalytical Testing Services Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Bioanalytical Testing Services Market Insights Forecasts to 2033

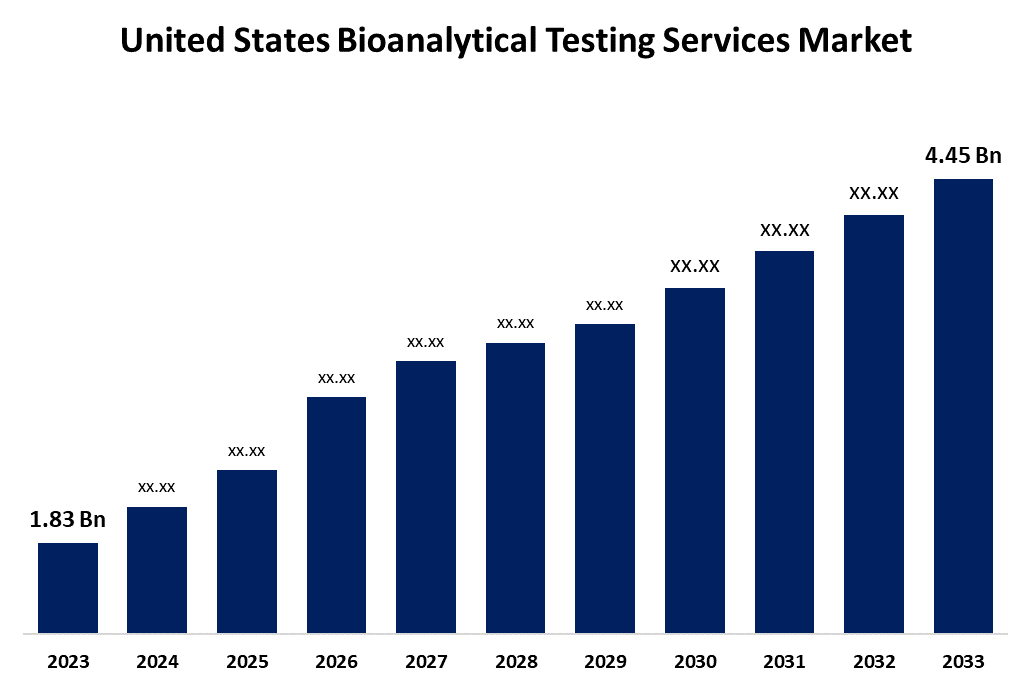

- The United States Bioanalytical Testing Services Market Size Was Estimated at USD 1.83 Billion in 2023.

- The Market Size is Growing at a CAGR of 9.29% from 2023 to 2033

- The USA Bioanalytical Testing Services Market Size is Expected to Reach USD 4.45 Billion by 2033

Get more details on this report -

The United States Bioanalytical Testing Services Market Size is Expected to reach USD 4.45 billion by 2033, Growing at a CAGR of 9.29% from 2023 to 2033.

Market Overview

The market for bioanalytical testing services in the United States is the market within the pharmaceutical and healthcare sectors that offers specialized testing services for biological sample analysis. The need for bioanalytical testing services in the US is being driven in large part by the increasing incidence of chronic illnesses like diabetes, cancer, and cardiovascular conditions. The increasing demand for biologics, biosimilars, and gene treatments, the lengthening of drug development and approval processes, and the expanding outsourcing of testing services are some of the reasons propelling the expansion of the bioanalytical testing services sector in the United States. In addition, regulatory agencies such as the European Medicines Agency (EMA) and the US Food and Drug Administration (FDA) are putting tight rules on how drugs should be developed and approved. Pharmaceutical companies are becoming more dependent on bioanalytical testing services since they are essential to guaranteeing adherence to these regulations. Furthermore, pharmaceutical research and development (R&D) is expanding steadily, which is providing a positive market outlook. The need for precise and trustworthy testing is being driven by pharmaceutical companies' significant investments in the creation of novel medications and treatments.

Report Coverage

This research report categorizes the market for the U.S. bioanalytical testing services market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US bioanalytical testing services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA bioanalytical testing services market.

United States Bioanalytical Testing Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1.83 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.29% |

| 2033 Value Projection: | USD 4.45 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Molecule, By Test, By End Use |

| Companies covered:: | ICON plc, Charles River Laboratories International, Inc., Laboratory Corporation of America Holdings., IQVIA Inc., Syneos Health, SGS SA, Intertek Group Plc, Pace Analytical Services, LLC, Medpace Holdings, Inc., North America Science Associates Inc. (NAMSA), Thermo Fisher Scientific, Inc., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The United States vodka market is expanding due to the need for bioanalytical testing services being driven by the public's growing awareness of environmental issues and the necessity of determining pollution levels. In addition, the growing trend toward personalized therapy has contributed to the nation's market expansion. Additionally, bioanalytical testing services are becoming more capable due to ongoing improvements in analytical tools and methods. These services are becoming more sensitive, accurate, and efficient because of advancements in automation technology, liquid chromatography systems, and high-performance mass spectrometers. Furthermore, demand for bioanalytical testing services is being driven by the increased emphasis on biomarker discovery and validation. US pharmaceutical companies are outsourcing to specialized laboratories for cost-effective solutions and expertise.

Restraining Factors

The market for bioanalytical testing services in the United States is confronted with obstacles such as the high expense of sophisticated testing equipment, strict regulations, and a shortage of qualified personnel. Furthermore, market expansion and operational effectiveness may be hampered by the intricacy of bioanalytical techniques and the requirement for ongoing innovation to satisfy changing pharmaceutical needs.

Market Segmentation

The U.S. bioanalytical testing services market share is classified into molecule, test, and end use.

- The small molecule segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the molecule, the U.S. bioanalytical testing services market is divided into small molecule, large molecule, and others. Among these, the small molecule segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing due to pharmaceutical development frequently using small molecules, such as medications with low molecular weights. Compared to large molecules like biologics, which are complex and demand sophisticated testing methods, these molecules are comparatively easy to define and analyze.

- The bioavailability segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the test, the U.S. bioanalytical testing services market is classified into ADME, pharmacokinetics (PK), bioequivalence, bioavailability, pharmacodynamics (PD), biomarker testing, virology testing, cell-based assay, and others. Among these, the bioavailability segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. The growing demand for generics and biosimilars, improved precision in drug absorption analysis, stricter FDA restrictions, and technology improvements are the main drivers of this segment's growth. These investigations help ensure consistent therapeutic effects across formulations by determining medication efficacy and bioequivalence for regulatory approval.

- The pharma & biopharma segment accounted for the largest market share in 2023 and is expected to grow at the fastest CAGR during the forecast period.

Based on the end use the U.S. bioanalytical testing services market is divided into CDMO, CRO, pharma & biopharma companies, and others. Among these, the pharma & biopharma segment accounted for the largest market share in 2023 and is expected to grow at the fastest CAGR during the forecast period. The need for bioanalytical testing services is rising as pharmaceutical and biopharmaceutical businesses concentrate on creating life-saving medications for a range of illnesses. Thus, the market for bioanalytical testing services is crucial for pharmaceutical and biopharmaceutical businesses to produce individualized medicine and patient care.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. bioanalytical testing services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ICON plc

- Charles River Laboratories International, Inc.

- Laboratory Corporation of America Holdings.

- IQVIA Inc.

- Syneos Health

- SGS SA

- Intertek Group Plc

- Pace Analytical Services, LLC

- Medpace Holdings, Inc.

- North America Science Associates Inc. (NAMSA)

- Thermo Fisher Scientific, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2024, new specialized bioanalytical testing services have been introduced by SGS to the pharmaceutical and biopharmaceutical businesses in North America.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. bioanalytical testing services market based on the below-mentioned segments:

U.S. Bioanalytical Testing Services Market, By Molecule

- Small Molecule

- Large Molecule

- Others

U.S. Bioanalytical Testing Services Market, By Test

- ADME

- Pharmacokinetics (PK)

- Bioequivalence

- Bioavailability

- Pharmacodynamics (PD)

- Biomarker Testing

- Virology Testing

- Cell-based Assay

- Others

U.S. Bioanalytical Testing Services Market, By End Use

- CDMO

- CRO

- Pharma & BioPharma Companies

- Others

Need help to buy this report?