United States Biosimilars Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Filgrastim & Pegfilgrastim, Monoclonal Antibodies, and Others), By Disease Indication (Cancer, Autoimmune Diseases, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and United States Biosimilars Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Biosimilars Market Insights Forecasts to 2033

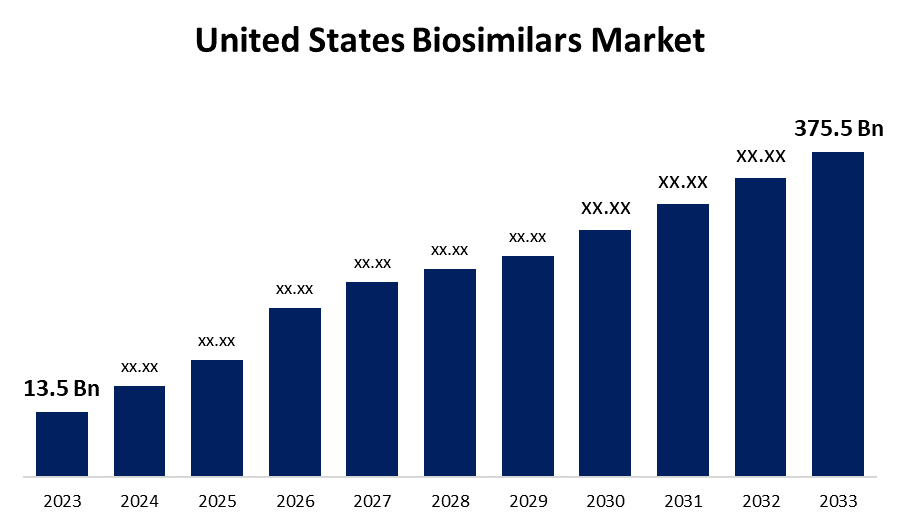

- The U.S. Biosimilars Market Size was valued at USD 13.5 Billion in 2023.

- The Market Size is Growing at a CAGR of 39.45% from 2023 to 2033

- The U.S. Biosimilars Market Size is expected to reach USD 375.5 Billion by 2033

Get more details on this report -

The United States Biosimilars Market is anticipated to exceed USD 375.5 Billion by 2033, growing at a CAGR of 39.45% from 2023 to 2033. The growing incidence of cancer, the geriatric population, and the favorable environment are driving the growth of the biosimilars market in the US.

Market Overview

Biosimilars are biological medical products that are similar to other biological medicines that are already approved. In terms of potency, safety, and purity, biosimilars are quite comparable to the reference product; nevertheless, there may be slight variations in the therapeutically inert ingredients. The FDA may demand that manufacturers carry out a clinical trial (or studies) sufficient to demonstrate safety, purity, or potency in one or more uses for which the reference product is licensed and for which the biosimilar applies for licensure before approving biosimilars. The increasing awareness among patients and healthcare professionals about therapeutic agents leads to accelerating the adoption and usage of biosimilars by biosimilar manufacturers and regulators. The primary trend in the market is the growing amount of funds that pharmaceutical companies are spending on research and development (R&D) to improve biosimilar pipelines. Strategic alliances and collaborations to quicken market entry are notably on the rise.

Report Coverage

This research report categorizes the market for the US biosimilars market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States biosimilars market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US biosimilars market.

United States Biosimilars Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 13.5 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 39.45% |

| 023 – 2033 Value Projection: | USD 375.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Drug Class, By Disease Indication, By Distribution Channel |

| Companies covered:: | Amgen Inc., Pfizer Inc., Viatris Inc., Coherus BioSciences, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

Biosimilars are used to treat a variety of chronic conditions, including rheumatoid arthritis, anemia, leukopenia, inflammatory bowel disease, psoriasis, and various cancers. As per the US Department of Health and Human Services, an estimated 129 million Americans suffer from at least one serious chronic illness (heart disease, cancer, diabetes, obesity, or hypertension). Thus, the growing incidence of chronic diseases especially cancer in the US is responsible for driving the market demand. Further, the growing geriatric population in the country is also responsible for driving the market growth. In addition, the increased spending on biosimilars is contributing to driving the US biosimilar market.

Restraining Factors

The increased development cost of biosimilars and the complexities in manufacturing are restraining the market for biosimilars.

Market Segmentation

The United States Biosimilars Market share is classified into drug class, disease indication, and distribution channel.

- The monoclonal antibodies segment dominated the US biosimilars market during the forecast period.

The United States biosimilars market is segmented by drug class into filgrastim & pegfilgrastim, monoclonal antibodies, and others. Among these, the monoclonal antibodies segment dominated the US biosimilars market during the forecast period. Monoclonal antibodies are therapeutic proteins that are extensively employed in the treatment of a wide range of illnesses, such as autoimmune diseases and cancer. The market participants' significant R&D investments and the patent expiration of numerous reference biologics are anticipated to drive the market.

- The cancer segment dominates the market with the largest market share in 2023.

The United States biosimilars market is segmented by disease indication into cancer, autoimmune diseases, and others. Among these, the cancer segment dominates the market with the largest market share in 2023. By 2028, cancer is predicted to rank as the second most common disease indicator. In the United States, there are currently 21 biosimilars that are marketed for use, 17 of which are used to treat cancer.

- The hospital pharmacies segment accounted for the largest market share during the forecast period.

Based on the distribution channel, the U.S. biosimilars market is divided into hospital pharmacies, retail pharmacies, and online pharmacies. Among these, the hospital pharmacies segment accounted for the largest market share during the forecast period. The drugs' easy accessibility as well as the fact that hospital pharmacies employ them to treat important diseases with better treatment choices are responsible for driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. biosimilars market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amgen Inc.

- Pfizer Inc.

- Viatris Inc.

- Coherus BioSciences

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Biocon Biologics Ltd (BBL), a fully integrated global biosimilars company and subsidiary of Biocon Ltd, announced that the U.S. Food and Drug Administration (US FDA) has approved the Company's first-to-file application for Yesafili (aflibercept-jbvf), an interchangeable biosimilar aflibercept.

- In April 2024, The FDA approved ustekinumab-aekn (Selarsdi; Teva Pharmaceuticals, Alvotech) injection for subcutaneous use as a biosimilar to ustekinumab (Stelara; Janssen Immunology) for treatment of moderate to severe plaque psoriasis and active psoriatic arthritis in adults and pediatric individuals aged 6 years and older.

- In February 2024, The US Food and Drug Administration approved the first interchangeable, high-concentration, citrate-free adalimumab biosimilar, adalimumab-ryvk (Simlandi).

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Biosimilars Market based on the below-mentioned segments:

US Biosimilars Market, By Drug Class

- Filgrastim & Pegfilgrastim

- Monoclonal Antibodies

- Others

US Biosimilars Market, By Disease Indication

- Cancer

- Autoimmune Diseases

- Others

US Biosimilars Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Need help to buy this report?